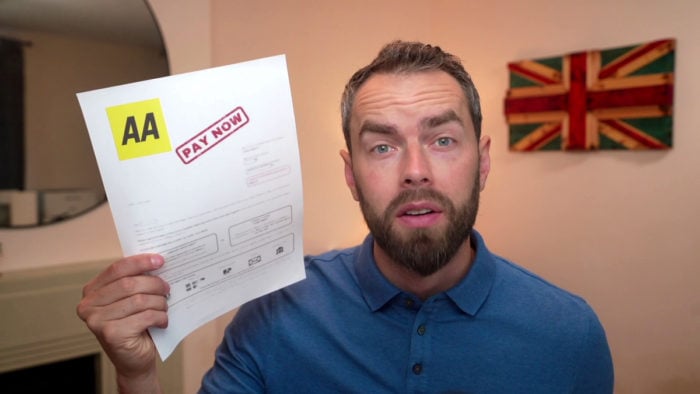

AA Missed Payment – Here’s What To Do

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried because you’ve missed an AA car finance payment? You’re not alone. Every month, over 170,000 people visit our website seeking advice on debt solutions.

In this article, we’re going to explain:

- A little bit about the AA

- How you can spread your AA payments over several months

- The possible legal repercussions of not paying AA

- How the AA deals with missed payments

- The impact of missed car payments on your credit score

StepChange stress the need for professional debt advice, noting that 60% of adults in financial trouble hesitate to seek help.1

Missing a car finance payment can be a cause for concern — you might be afraid your car could be taken away or feel confused by your car finance contract. But don’t worry; we’re here to guide you through your options and find a solution that works for you.

Are there legal repercussions for not paying AA?

If you realise that you can’t afford to pay your AA loan anymore, you should tell them immediately. In some situations, you might be able to negotiate an alternative payment plan.

You may even be able to voluntarily surrender your car, depending on the type of contract that you have. If you are unsure, you can read your contract or contact your car finance company to find out.

If you do nothing, you run the risk of your car being repossessed.

You will get a reminder after you miss the first payment. You may get a second reminder if you miss another payment or you can be sent a notice of arrears. This arrears notice will tell you how much you owe and when you need to pay it.

If you do nothing and stay in arrears, your car finance company can send a default notice which will give you 14 days to pay off all the debt in full. If you don’t pay off the balance, your car agreement can be ended and your car repossessed.

The car finance company has the legal right to repossess your car if you don’t pay them back.

What to do if you can’t meet an AA payment

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How the AA deals with missed payments

What late fees does the AA charge?

Can I delay my AA payments?

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can I change my AA payment frequency?

Will missed car payments affect my credit score?

Yes, missed car payments will affect your credit score.

This is because companies use your credit file to see if you are a ‘high-risk’ customer – someone who might have difficulty paying their bills on time. A history of missed payments will suggest to any potential creditor that you could have difficulty paying your debt off in the future.

You will look even less favourable to potential lenders if you have a repossession on your credit history. A repossession shows that you had such difficulty paying back your debt that someone had to go to court about it. Or that you had issues covering your bills so quickly that your car financer could just take it away.

Understandably, companies are going to be reluctant to give you credit!

After 6 years, it is no longer visible on your credit report, and you should find it easier to get credit again.

» TAKE ACTION NOW: Fill out the short debt form