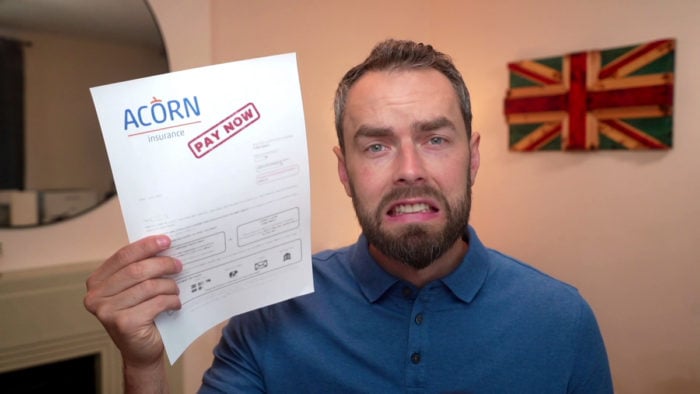

Acorn Missed Payment – Here’s What To Do

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’ve missed an Acorn payment and are unsure of what to do, this article is here to help.

We understand that it can be worrying when you miss a payment — you might be concerned about not being able to pay the debt or fear the consequences of a missed payment.

Don’t worry; you’re not alone. Every month, over 170,000 people visit our website seeking advice on matters like this.

In this article, we’ll cover:

- What happens if you ignore reminders from Acorn

- How Acorn deals with missed payments

- Options for staying in touch with Acorn

- Ways to write off some debt

- What to do if you can’t pay your Acorn instalment

Our team has experience dealing with similar situations, so we know how stressful it can be. We aim to provide clear, useful advice to help you handle any missed payments with Acorn.

Missed an Acorn payment. Here’s what to do

From experience, pay a missed instalment as soon as possible if you have the money to do so. But if you don’t have the funds, Acorn lets you spread the cost over 2 to 3 weeks.

When you choose to pay a missed instalment in two equal weekly payments, the first one is payable that day. The second payment must be paid 7 days after this.

You’ll have to pay the first instalment online by credit or debit card. Then, the provider uses these payment details to take the second instalment seven days later.

When you choose to pay a missed Acorn payment in three equal weekly payments, the first instalment is due that day. After this, the second instalment is taken 7 days later, and the third instalment 7 days after that.

If the second and third instalments fail, Acorn will try again two days later. But if this attempt fails, the provider cancels your policy for non-payment!

The key is to contact their support before the payment is due. However, don’t wait too long before making the call.

The support team can offer you essential advice on how to resolve the problem. This could include changing a payment date!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

The consequences of an Acorn missed payment!

Missing a scheduled payment can happen. Whether by mistake or because you’re struggling financially. My advice is to call Acorn support and tell them. You may find they provide a solution.

Suppose you don’t contact the insurance provider, or you don’t reply to calls and correspondence. In that case, the matter can get more serious.

I suggest you do the following when you have a missed payment:

- First, check the amount was not paid by contacting Acorn support

- Next, if you have online banking, see if the money left your account

If you missed the payment on the due date, the consequences could be harsh. You may:

- Incur extra charges, which include administration costs

- Have your policy cancelled, which means you won’t be insured

- Be taken to court to recover any unpaid premium

Moreover, a missed insurance payment will appear on your credit history for 6 years and affect your credit score. Borrowing money, getting credit, a loan or a mortgage will be hard.

Granite charges £25 for a default!

My Direct Debit to Acorn will fail. What can I do?

Contact Acorn support before the Direct Debit is due.

When you don’t have enough money to pay an instalment, don’t wait till after the due date to contact Acorn. They could arrange for you to make the payment in instalments that are more manageable.

Always keep in touch with Acorn support when you know a Direct Debit will fail. If you don’t, it could get expensive. You’ll incur bank charges on top of everything else!

I can’t pay my Acorn instalment. What should I do?

Contact Acorn immediately! They may arrange a new payment date. One that makes it easier for you to pay. Their support could arrange for you to pay the missed payment in instalments over two or three weeks!

However, if you are offered an arrangement, you must stick to it. When you don’t, the insurance provider will cancel your insurance policy. Then, they could send your details for debt collection!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Will Acorn send my details to a debt collection agency?

Yes, if you default on your payment to Acorn, they will pass your details to a debt collection agency.

My advice? Don’t let this happen! Instead, contact Acorn support and try to sort things out before it gets to this stage.

When you are struggling financially, the last thing you need is a debt collector to send you letters. It’s better to arrange a payment plan with the insurance provider than to have a debt collector hassle you!

In addition, contact a non-profit debt advice organisation when you’re struggling to make an Acorn payment. There’s lots of help and support out there. The trick is to get in touch with an adviser sooner rather than later.

First, contact Acorn support. Let them know about the problem and try to resolve it. Next, contact a debt charity for free, impartial advice.

The best debt charities to contact are:

Never ignore an Acorn missed payment because it could lead to more hassle!

Acorn Contact Details

| Post: | Acorn Insurance Services Limited, The Lighthouse, 98 Liverpool Road, Formby, Liverpool, Merseyside, L37 6BS |

| Contact us: | https://www.acorninsure.co.uk/contact-us/ |

| Website: | https://www.acorninsure.co.uk |