Aktiv Kapital Debt Collectors – Do You Need to Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Why do Aktiv Kapital Debt Collectors keep contacting you?

Is it your debt?

What Happens If I Don’t Pay My Debts?

We’ve all wondered – what exactly will happen if you stop paying off your debts? Well, the answer is a whole lot of bother.

- Your creditor will send you reminders and then demand to get you to pay any missed payments.

- If you don’t pay, your account will default.

- If you still don’t pay your debts, your creditor can choose to sell your debt to a debt collection agency or employ an agency to chase you for the missed payments. This is where Aktiv Kapital will come in.

- If you don’t pay the collectors, your creditor or the collection agency might be able to take legal action against you to get their money back. Legal action usually starts with a CCJ.

Keep in mind that a lot of these stressful stages can be avoided altogether if you communicate with your creditors or debt collectors. Agreeing on an alternative payment plan is much cheaper for them than taking you to court – good communication can mean you avoid legal action completely.

» TAKE ACTION NOW: Fill out the short debt form

What if you can’t pay?

Do you have too much debt?

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can you ever get rid of your debt?

There are several different debt solutions available in the UK, so I recommend speaking to a debt charity as soon as possible. Their advisors will be able to look at your finances in detail and help you work out which debt solution will work best for you.

I have linked a few charities that offer these advisory services for free below.

Debt Management Plan (DMP)

A DMP is an informal debt solution that lets you pay off your debts via a single monthly payment.

Because it is informal, it is not legally binding so you are not tied into a DMP for a minimum number of payments.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.

If you have little income and no valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How do I make a complaint against Aktiv Kapital Debt Recovery?

If you think that Aktiv Kaptial has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Make your first complaint to Aktiv Kapital so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, Aktiv Kapital may be fined. You could even be owed compensation.

Aktiv Kapital Debt Recovery Contact Details

Will They Give Up Chasing?

After all that you might be wondering whether you can just wait it out and hope they stop chasing you.

Sadly, that’s probably not going to happen. Most debt collectors are persistent.

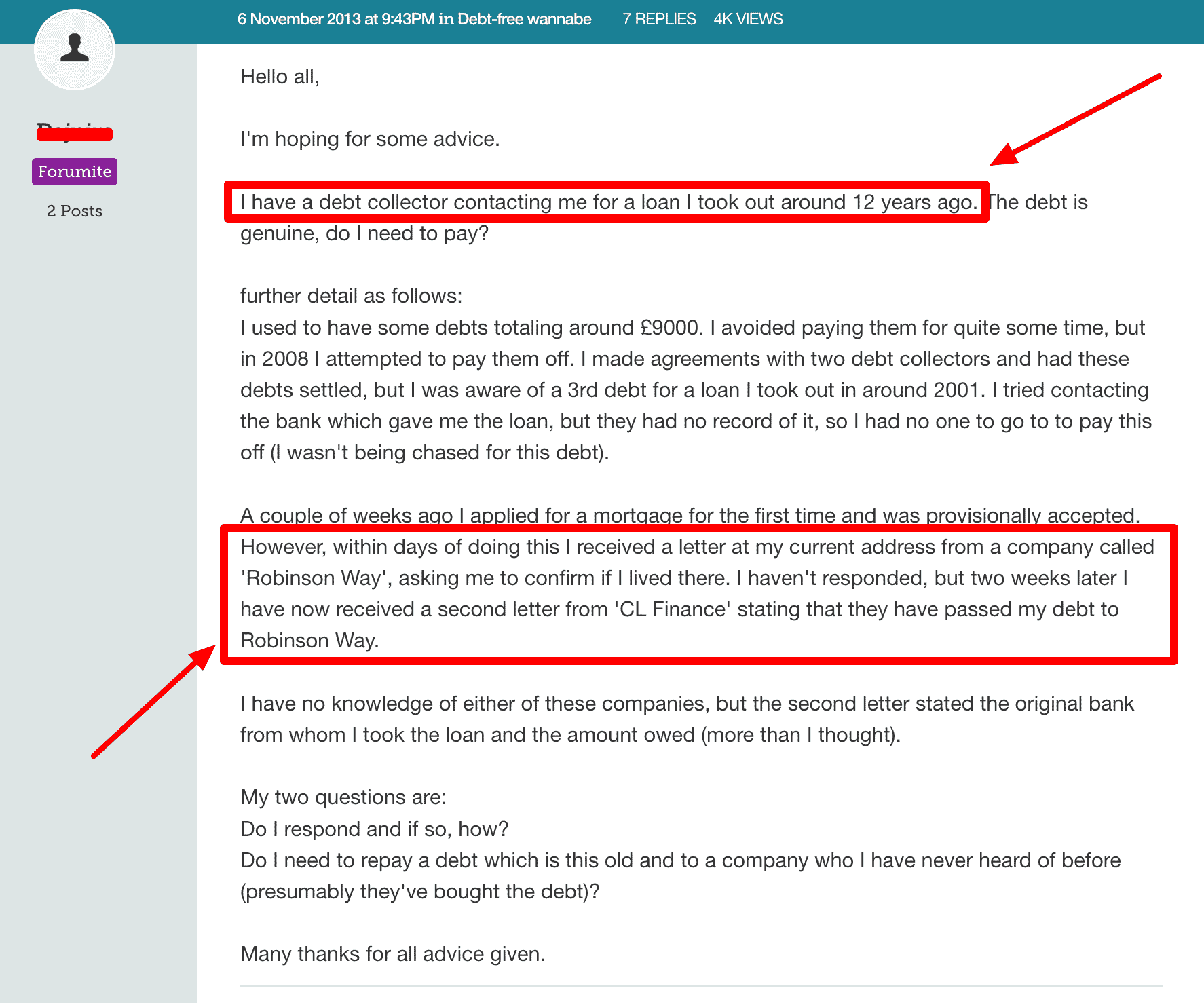

Source: Moneysavingexpert

As you can see Robinson Way starting to chase a debtor mere days after their mortgage application and a full 12 years after the debt was originally chased.

Other agencies like Lowell Group, Portfolio Recovery and Cabot Financial are constantly being accused of buying Statute Barred debts and then chasing people for payment.