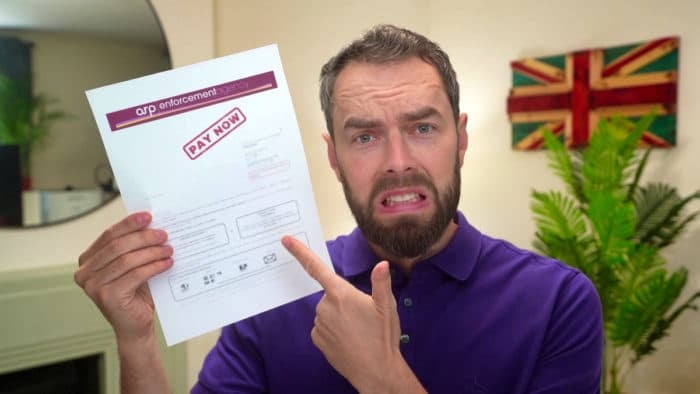

ARP Enforcement Agency Ltd – Should you Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Having a letter from ARP Enforcement Agency Ltd might make you feel worried and unsure. You might be asking yourself, “Do I need to pay this? Is it even my debt?”

Don’t worry; you’re not alone. Each month, more than 170,000 people visit our website for help with debt problems.

In this article, we’ll help you:

- Understand what the ARP Enforcement Agency is.

- Learn about the types of debt they collect.

- Work out if the debt they say you owe is really yours.

- Know your options for repayment or writing off some of the debt.

- Find out how to make a complaint if you need to.

Our team has dealt with debt collectors too. We know it’s not easy, but we’re here to guide you through it. So, let’s find out more about how to handle this situation with ARP Enforcement Agency Ltd.

What is an ARP Enforcement Letter?

An ARP Enforcement Letter is an enforcement notice that the bailiffs will send before coming to visit you at your home. This gives you an opportunity to pay the debt or contact them and discuss a payment arrangement. By sending the letter, ARP Enforcement immediately add a charge of £75 to your debt.

If you do not get in touch, they will come out to your property to request payment or seize control of goods, which incurs further costs!

You can read about all the ARP Enforcement charges at each stage of the debt recovery process on this page of their website.

Should you pay ARP Enforcement?

You should pay the money requested by ARP Enforcement Agency if you know you owe the debt and have previously received a court order asking you to pay. Your local council are only allowed to use bailiffs if a court order has been issued asking you to pay the debt.

If you have not received a court order or have no knowledge of being taken to court, you should challenge the payment request instead.

What is an ARP Enforcement Controlled Goods Agreement?

A Controlled Goods Agreement is a document that states the bailiffs are accepting a payment arrangement from you but have the right to seize specific assets should you stop making payments. It’s used as a type of guarantee that you’ll stick to the agreement.

Do I have to let ARP Enforcement bailiffs in my house?

You don’t have to let ARP Enforcement Agency bailiffs into your home. They cannot enter a locked home, but they can enter unlocked and open doors. However, they are still allowed to seize assets you own outside of your property, such as a car parked on your driveway.

Even if you don’t want to let ARP Enforcement bailiffs into your house, you should still try to engage with them to discuss the debt or a payment plan if required. You could do this from a second-floor window or through your letterbox.

But can bailiffs enter your home when you’re not there? No, they can only enter your property if someone is home. If you share your house with other people, make sure that they know not to let them in.

Generally, bailiffs can’t enter your home unless a non-vulnerable adult lets them in.

Negotiating with ARP Enforcement Agency might be possible. Just be realistic with your expectations!

If ARP Enforcement bailiffs leave empty-handed, they will try to come back and you’ll be charged further fees.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What happens if ARP Enforcement takes my assets?

If ARP Enforcement bailiffs seize possession of some of your goods and assets, it’s likely that they will be placed into storage. You may be charged fees for keeping the goods in storage. You have a further period to pay the debt or the goods are taken out of storage and sold at an auction to clear the debt.

Some valuables cannot be taken by ARP Enforcement bailiffs, such as tools you might need to do your job.

Only the debt plus fees will need to be repaid. So you might get some assets back if the total owed has been realised through the sale of other goods.

“I need to pay ARP Enforcement, but I can’t!”

If you have received a letter from ARP Enforcement asking you to pay but are experiencing financial hardship preventing you from doing so, you should contact them.

On the ARP Enforcement Agency website, they state that they will try to come up with alternative payment arrangements for those in financial difficulty.

However, ARP Enforcement doesn’t have to accept your proposed payment plan. They can instead visit your home and take possession of your valuables to clear the debt.

“I can’t keep up with my ARP Enforcement payment plan”

You might have agreed on a payment plan and signed a Controlled Goods Agreement, but since then your finances have declined and you can’t keep up with payments. Instead of ignoring the problem, it is best to call ARP Enforcement Agency Ltd and tell them what’s happening.

They state on their website that they may rearrange your payment plan so they don’t have to seize your valuables.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How do I complain about ARP Enforcement?

If you think that ARP Enforcement have behaved unreasonably or inappropriately, you can make a complaint against them.

You should first follow the ARP Enforcement Agency complaint process so that they have the opportunity to sort out your issue. If you get no response or think that their response was inadequate or unreasonable, you might be able to escalate matters.

The Financial Ombudsman Service (FOS) might be willing to hear your secondary complaint. You might also be able to make a complaint to the council that has instructed ARP to chase you.

The complaints procedure for your local council will be different to other councils, so I recommend talking to an organisation like Citizens Advice. They will be able to walk you through your options and next steps.

ARP Enforcement Agency Ltd Contact Information

| Website: | https://www.arpenforcementagency.co.uk/ |

| Email: | [email protected] |

| Telephone: | 01842 756440 (Enforcement Team) 01842 756510 (Automated Payment Line) |

| Post: | ARP enforcement agency, PO Box 268, Thetford, IP24 9AY |