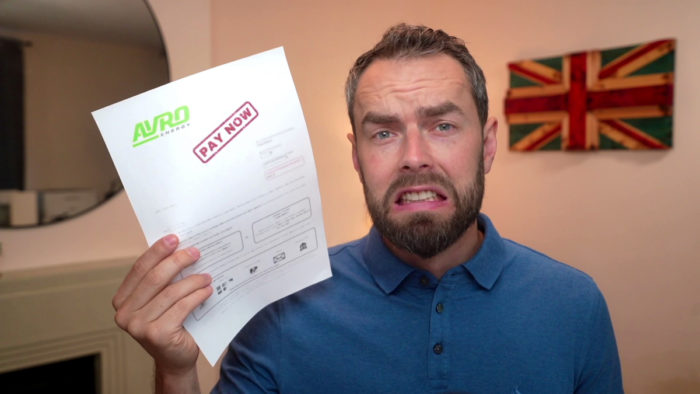

Avro Energy Debt – Pay or Ignore?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re grappling with Avro Energy debt, you’re in the right place to find answers. We understand your worries about paying energy bills and the fear of owing money.

Every month, we offer guidance to over 170,000 people on debt solutions. Be assured that we have helpful tips and advice to share with you.

In this guide, we will explore:

- What Avro Energy was and what happened to its accounts when they went bust.

- How you can handle your Avro Energy debt and the steps to take if you can’t pay.

- The possibility of writing off some Avro debt and what happens to debt if a company goes bust.

- The process of dealing with debt collection agencies and how to ensure they are legitimate.

- The support and advice available to you if you are struggling with unaffordable debt.

We also provide insight into how to legally write off debt and how much debt is considered too much. We know it’s a hard time, but remember, you’re not alone.

Let’s dive in and discuss your options.

Avro Energy debt, do you have to pay?

If you know the debt is yours and you can afford to pay, I recommend you do so as soon as possible. Then, like this, you won’t receive any more threatening letters or nasty phone calls.

I can’t pay my Avro Energy debt. What should I do?

If you can’t pay your Avro Energy debt, just because the supplier went bust does not mean the debt goes away. So stay in touch with whoever is chasing you for the outstanding. But only when you are sure they are legitimate.

You may have been contacted by the administrators or an officially appointed debt collection agency. I strongly recommend you keep in touch to arrange an affordable repayment schedule.

» TAKE ACTION NOW: Fill out the short debt form

Don’t ignore any correspondence from debt collectors

Debt collectors are notorious for not giving up. In short, if you ignore them, they won’t go away. In fact, they may get more persistent and could visit your home.

Stay in touch with the debt collection agency to avoid extra stress, nasty calls and threatening letters!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can debt collectors force entry into my home?

No, they cannot. However, they can visit you at home but must first notify you they are coming in writing. A debt collector must show they are officially representing Avro Energy when they get in touch.

What support and advice can I get for my Avro debt?

You’ll find support and debt advice online from charities and independent organisations. Don’t try to deal with things on your own which could be more stressful. Struggling financially is always a worry.

Instead, contact any of the following charitable organisations that provide help and advice to people in debt:

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Avro Energy Contact Details

| Address: | Alvarez & Marsal Europe LLP, Suite 3 Regency House, 91 Western Road, Brighton, BN1 2NW |

| Telephone: | 0808 164 1088 Mon – Thu 9am – 5pm Fri 9am – 4pm |

| Email: | [email protected] |

| Website: | https://octopus.energy/ |

Can I complain about Avro?

Yes, everyone has the right to file a complaint against an energy supplier. In addition, you can reach out to the Ombudsman Service if you are unhappy with things.

Thanks for reading my post on Avro Energy debt. I hope the information helps you understand what’s happening with the supplier and the company that’s taken over from them.