AXA Missed Payment – Here’s What To Do

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you missed an AXA payment and are unsure of what to do next? Don’t worry; you’re in the right place. This article will guide you through the steps to take if a payment to AXA has slipped your mind.

Each month, over 170,000 individuals visit our website for advice on topics such as this, so you’re not alone.

In this article, we’ll discuss:

- What to do if your Direct Debit to AXA fails

- The possibility of writing off some debt

- How AXA deals with missed payments

- What to do if a debt collector contacts you

- Ways to avoid missed payments in the future

Our team, many of whom have faced similar challenges, are well-equipped to provide advice and guidance. We understand that missing a payment can be a cause for worry, but rest assured, there are ways to address this issue.

Don’t panic when you miss an AXA payment

First, don’t panic. You’re not the only person to miss a scheduled payment to a company.

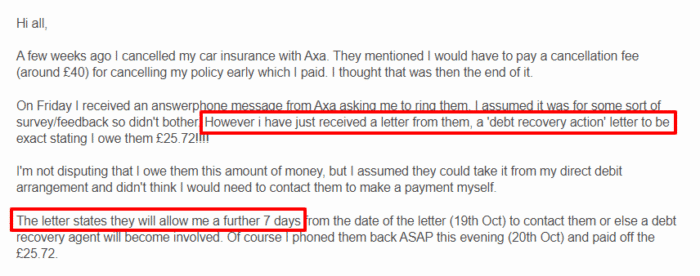

The AXA team will soon gets in touch with you either by letter or email. The provider will try to take the money a second time, usually within one week.

Next, you can make a payment by selecting the ‘Pay Missed Monthly Payment’ option on your account. But make sure the provider hasn’t already taken the amount from your bank account.

I advise you do this if you have the funds available. Contact the AXA support team and let them know if you can’t pay on the due date.

» TAKE ACTION NOW: Fill out the short debt form

My Direct Debit to AXA failed. What happens?

If the Direct Debit you set up with AXA fails, your bank might charge you. The fee can be anything from £5 to £25 each time the payment fails.

You can avoid these charges if you opt for the ‘retry process’, which gives you till 2pm to pay funds into your account.

Most banks let you know when a DD fails and provide you with time to pay money into your account.

As already mentioned, AXA tries to take the money from your account within a week of a failed DD payment.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Your monthly AXA insurance payments are binding

You must pay scheduled premium payments on time when you pay AXA insurance monthly.

If you don’t, the insurance provider could cancel your policy.

The consequences of a cancelled insurance policy are many. You may find:

- You’re not covered

- You’re not insured to drive

- Future premiums go up

- You could incur late fees and other charges. In some cases, interest can accrue on late payments, causing you to owe more over time.

When you know you can’t pay, contact their support team. They may reschedule the payment date. If you don’t contact them, the problem will get harder to resolve.

Their support team could arrange to take payments on another date. In addition, they may set alerts on when a scheduled payment is due.

If you default on your payments several times, there may be administration costs to pay.

Moreover, a missed payment appears on your credit report, and it stays there for up to 6 years. In addition, your credit history and rating are affected. You may have trouble getting credit, a loan or a mortgage.

It is against the law to drive without car insurance in the UK, so if your policy is cancelled, that’s it.

It’s also a breach of the Road Traffic Act. If caught, you might face not only fines but also prosecution.

You’re not allowed to drive on a public highway. The penalties are high when you drive without insurance. This includes a fine, points on your licence. You could lose your licence!

You must tell potential insurance providers about a cancelled policy. It’s your responsibility to do so!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Is AXA Insurance regulated?

Yes, AXA Insurance is regulated by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA).

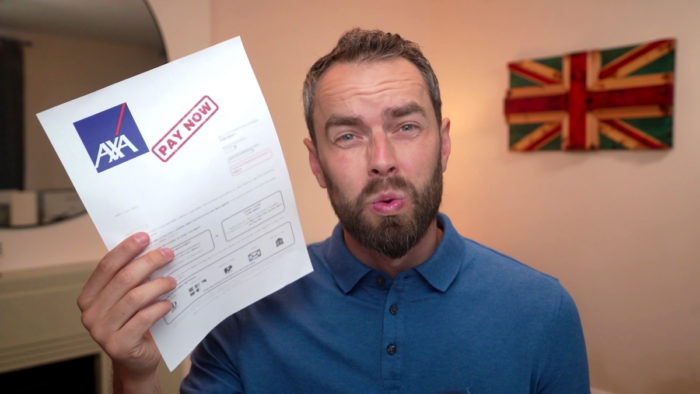

Will AXA use a debt collection agency if I don’t pay?

Yes, AXA may send your details to a debt collection agency to recover the amount you owe.

My advice, contact AXA support before this happens. It may stop them from sending in a very persistent debt collector. It’s how debt collection agencies earn their money!

The key to successfully dealing with an AXA missed payment is to stay in touch with the provider.

When they can’t get hold of you, or you don’t respond to their mail, the next stage is having to deal with a debt collection agency.

AXA missed payment due to financial hardship

Contact the provider if you struggle with money and can’t pay an AXA instalment on time. Their support team may be able to help you.

For example, they could reschedule your payment dates.

AXA Contact Details

| Contact us: | https://www.axa.co.uk/contact-us/ |

| Website: | https://www.axa.co.uk |