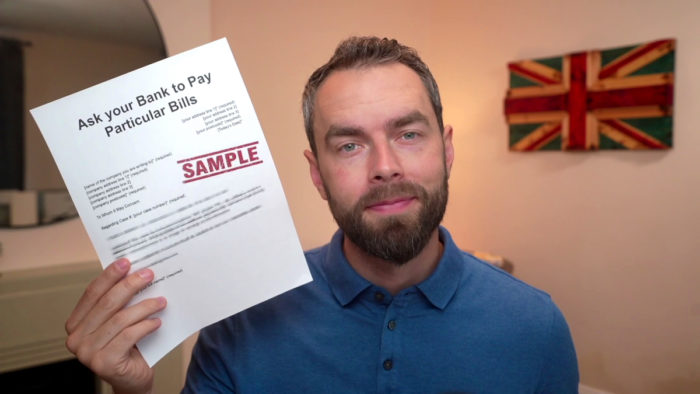

Ask your Bank to Pay Particular Bills – Letter Template

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you seeking help to write a bank payment request letter? You’re in the right place. Each month, over 170,000 people visit our website for guidance on solving debt solutions.

This article will guide you on:

- How to ask your bank to pay certain bills.

- The use of our letter template to make a bank payment request.

- Understanding the first right of appropriation.

- What happens if the bank rejects the first right of appropriation.

- Ways to legally write off debt.

Debt can be a big worry. That’s why we’ve created a letter template designed to assist you in asking your bank to pay certain bills directly from your account.

Let’s get started!

Letter Template

To Whom It May Concern

Letter exercising first right of appropriation

Name of account holder: [make sure you include the exact name of the person who has the account.]* (required)

Account # and Sort Code: [your account number and sort code]* (required)

I request that the following items be paid from the funds that are due to be deposited into the above account on [date]* (required) for the sum of £[enter the amount here.]* (required)

In doing this I am exercising my first right of appropriation over these funds and wish you to pay the following items. These are listed below:

[rent or mortgage:]* (required)

£[enter the amount here.]* (required)

[council tax:]* (required)

£[enter the amount here.]* (required)

[any other bills:]* (required)

£[enter the amounts here.]* (required)

I understand that any other items may be returned if there are insufficient funds available to pay them.

Please confirm that my request has been carried out.

I look forward to hearing from you.

Yours sincerely

Downloadable Resource

The download links below take you to a Google document template where you can make a copy or save in any document format you like. Note, you may have to login to your Google account.

Download – Single (for one person)

Download – Joint (for couples)

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Who should use our bank payment request letter template?

Our free bank payment request letter can be used by anyone. It will be most beneficial to those who have a bank account and are in financial difficulty with creditors or service providers, but also owe money to a bank.

For example, you might have money due to come into your account, but are also aware that the bank wants to take the money to reduce your overdraft. In this situation, you can request that the bank uses your money to pay your bills rather than allowing the bank to collect it for itself. This is known as exercising the first right of appropriation.

What is the first right of appropriation?

The first right of appropriation is your legal right to tell your bank what to do with the funds you add to your bank account. It is a legal right to tell the bank they must pay your bills, such as council tax, utility bills, mortgage payments etc.

The first right of appropriation does not give you the right to money you do not have. You can only instruct payments with money in your account at that time.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How to exercise the first right of appropriation?

To exercise your first right of appropriation you must write to the bank, which is why we have made our downloadable letter templates. You are unlikely to get the outcome you hope for if you call your bank or attend a branch. Always write to the bank if you want to make sure they pay your money to your creditors or utility providers.

Can a bank reject the first right of appropriation?

Every UK bank must respect your first right of appropriation and follow your instruction. This will help people prioritise their essential expenses and leave paying back bank overdrafts for later when things are more manageable. You can launch an official complaint to the bank if they do not accommodate your instruction.

You might be met with a blank face if you ask the local customer service agent at your branch. It is a niche legal right that a lot of people don’t know about. But that doesn’t give banks the right to reject your wishes.

That’s why you should download our free letter template and send it in the post instead.