Bankruptcy Payment Plans – Complete Review

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about paying off your debt? You’re not alone. Each month, over 170,000 people visit our website seeking guidance on debt solutions.

In this article, we’ll provide a complete review for 2023 on bankruptcy payment plans. This can help you understand how to manage your debt in a structured way. Here’s what we’ll cover:

- What is bankruptcy?

- How much does it cost to go bankrupt?

- Payment plans and instalments.

- The pros and cons of bankruptcy.

- The impact of bankruptcy on your credit score.

We understand that dealing with debt can be stressful and confusing; some of us have been in the same boat. But don’t worry; this review will help you understand if bankruptcy is the best option for you and how it works.

Payment Plans & Instalments

If you’re struggling to get the full bankruptcy application fee, you can choose to pay in instalments. The minimum instalment payment amount is £5, so this could take you some time to amass the full £680. Note, you have to pay the full £680 before you can submit the application, so there’s no benefit of paying using the payment plan other than it helps you save.

How Much Does it Cost to Go Bankrupt?

Bankruptcy charges change contingent on where you live in the UK.

In England and Wales, you pay a sum of £680, comprising a £130 expense to the adjudicator and £550 to the official collector.

In Northern Ireland, the complete expense is £676 consisting of a £151 court charge and £525 bankruptcy. Specialist’s expenses are around £7.

There are many alternatives to bankruptcy in the UK, and I recommend checking out all of your options before making a final decision.

Advantages and Disadvantages of Bankruptcy

When looking at any debt relief solution in the UK it’s always worth looking at the pros and cons associated with both. Bankruptcy can be a great option for those with large amounts of unaffordable debt. However, bankruptcy isn’t for everyone, so I recommend checking out both sides of the equation before making a decision.

» TAKE ACTION NOW: Fill out the short debt form

Criteria for Bankruptcy

Make sure you visit a registered office in the UK, generally take a citizen’s advice or visit an official Government Website for well-rounded debt advice on if bankruptcy is suited for you or not.

However, I have compiled some factors that may help you in your decision such as if

- If you possess a home or have a negative equity

- If you have any accessible resources or even some capital

- You have debts which creditors won’t write off

- Your current state of living expenses and financial hardship

- Your earned, spare income per month as well as your annual taxable income

- If you can afford the bankruptcy fees in the first place

- If you intend to regularly make payments

- All of your unsecured debts and your credit ratings

- The current status of your debt management plan

Other conditions that made bankruptcy an option for you such as not being able to agree on a payment arrangement, repayment plan, not agreeing with debt solutions of excessive debts and other fees are needed to be checked as well.

Bankruptcy Petition

On the off chance that you need to announce yourself bankrupt, you need to begin the cycle by documenting a Bankruptcy Petition. In the event that you file for bankruptcy yourself, the bankruptcy appeal is known as the Debtor’s Petition.

On the off chance that you need to file for bankruptcy, you should contact your neighbourhood court. For this, they may ask you to present your

- Phone number

- Name

- Email address

- Information on credit card and debt

On the off chance that you are being compelled to be bankrupt by your creditors, at that point they will file the Bankruptcy Petition. This is known as a Creditor’s Petition and it must be filed by individuals to whom you owe more than £5000.

At the point when you file the request for bankruptcy you will likewise need to pay:

- an adjudicator expense fee of £130

- an amount of £550

This implies you’ll have the option to pay an amount of £680 in the event that you need to go bankrupt. In the event that you decide to pay online, you can pick to pay by portion. The base online instalment sum is £5 and can be paid in the same number of portions as you require.

Do know that documenting a bankruptcy request doesn’t keep your creditors from reaching or attempting to sue you.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Hearing of the Bankruptcy Petition

Whenever you have filed your bankruptcy appeal, a court date will be set for the underlying hearing. This court action is known as the Hearing of the Bankruptcy Petition. At this conference one of the accompanying things will occur:

- The bankruptcy procedures will be deferred on the grounds that more data is required for the court to have the option to conclude whether to give a Bankruptcy Order.

- The Bankruptcy Petition that has been filed will be excused.

- An Insolvency Practitioner will be delegated to set up an Individual Voluntary Arrangement all things considered.

- A Bankruptcy Order will be made. You will be proclaimed bankrupt the second that this request has been made.

Bankruptcy Order

When a Bankruptcy Order has been made, an Official Receiver is selected to take care of your situation.

The Official Receiver is a government worker and an official of the Court. In the event that you need to proclaim yourself bankrupt, you will be approached to go to an underlying gathering with the Official Receiver.

During that gathering, you will talk about the reasons why you are declaring financial insolvency and the Official Receiver will survey your resources and liabilities. The trustee then proceeds with plan payments and the bankruptcy process.

After this, any unsecured debt that you owed your creditors will be lawfully struck out and they will be prohibited from attempting to gather any more cash from you.

You will be consequently released from bankruptcy typically 12 months from the date of the Bankruptcy Order.

What are the Legal Implications of Bankruptcy?

Once made bankrupt, you will have to live under certain conditions that may affect your day-to-day life, such as:

- You can’t take out a loan over £500 without telling the lender you’re bankrupt. The Official Receiver must also be notified of your application.

- You cannot work in certain jobs. If you work in finance, you may lose your job.

- You can’t start your own business or continue operating your own business without court permission.

- Travelling may be restricted. The Official Receiver can place restrictions on travelling abroad, but domestic travel is not typically affected.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Are there any other options?

Deciding how to tackle your debt is a very personal decision and you certainly can’t get the answer through a simple blog post.

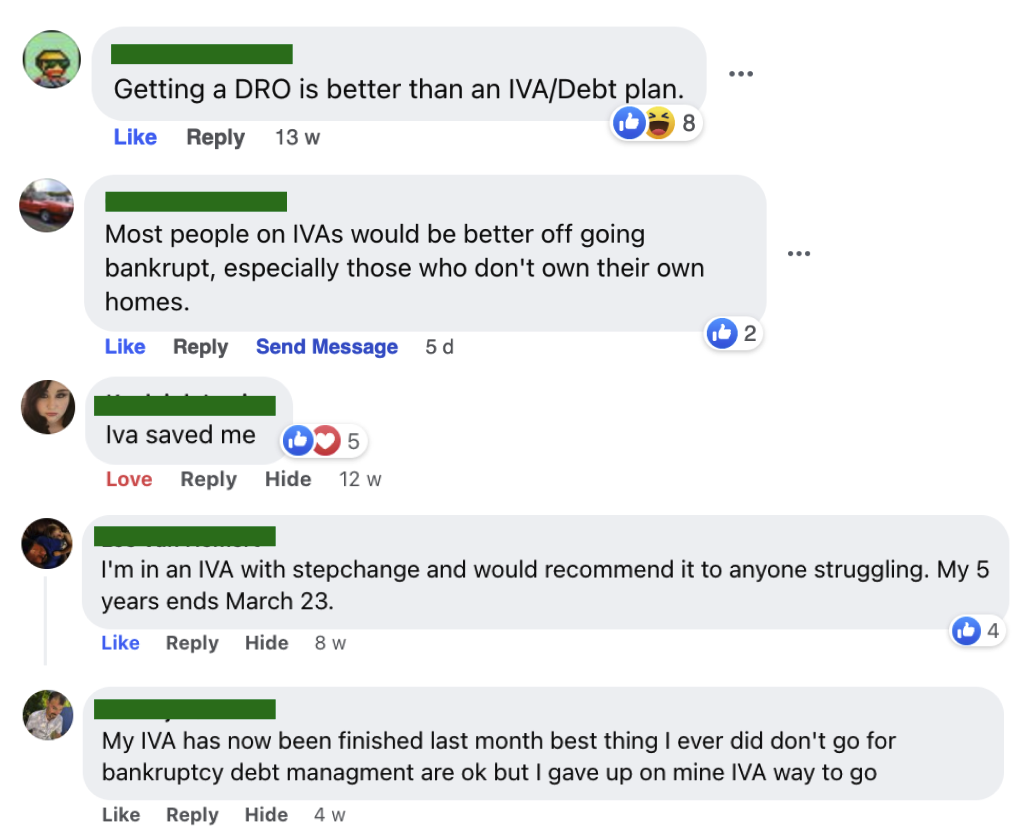

It’s made worse by the strong opinions you’ll often find online.

The best option is to get help from a debt expert to find out all your options and see which is right for you.

I’ve partnered with The Debt Advice Service and you can access their expert support by filling out the short form below.

Get help from The Debt Advice Service.