Bankruptcy Searches – What You Need To Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about paying off your debt and thinking about bankruptcy? It’s a common concern, and you’re not alone. In fact, over 170,000 people visit our website each month for guidance on debt solutions.

In this easy-to-understand guide, we’ll talk about:

- What bankruptcy means.

- How you can apply for bankruptcy.

- If bankruptcy is the best choice for you.

- The cost of applying for bankruptcy.

- How bankruptcy can affect your life and your credit score.

We know how you might be feeling right now; some of our team members have been through the same tough times. Remember, we’re here to help.

Ready to find out more about bankruptcy and whether it’s the right step for you? Let’s get started!

Bankruptcy Searches

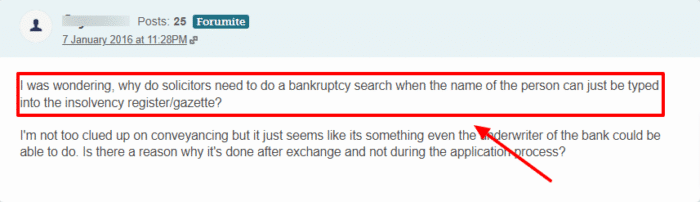

Before lending someone outside of England and Wales money, it is recommended that you carry out a bankruptcy search against their name. Bankruptcy searches are simply looking at the bankruptcy status of a certain individual before lending them money.

Bankruptcy searches are useful because they allow you to separate an insolvent beneficiary. You should avoid distribution to an insolvent beneficiary at all costs.

This is because the beneficiary isn’t likely to pay the money back, and this is partly the responsibility of the lenders later on instead of the borrowers. Paying any money to a bankrupt beneficiary even inside the UK is a bad idea, let alone outside the country.

By conducting bankruptcy searches, you can filter out the people who cannot repay your debt from people who can do so. It is important to only lend money to a beneficiary with a good credit score as these are usually the ones who don’t end up defaulting.

There are different services operational in the UK that help you in conducting a bankruptcy search. For a small price, they can run background checks on the potential borrowers for you.

Also, even in COVID-19 circumstances, you need to remember to run a small bankruptcy search to make sure that he’s reliable. I know it is harder to run checks over telephone lines, but you simply have no other choice.

There are other ways to verify financial stability such as performing credit checks, referencing checks, or even studying ones bank statements to understand their financial behaviour.

How Bankruptcy Affects Your Credit Score

Bankruptcy will, without question, affect your credit score, much like other debt solutions. Bankruptcy stays on your credit file for six years after completion, so you may find it difficult to borrow during this time – even for something as simple as a mobile phone contract.

Not only that, but bankruptcy can affect other areas of your life too, such as renting a new property or even employment.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

List of discharged bankrupts UK

You can use the bankruptcy and insolvency register to search for people in England and Wales who have gone bankrupt. You can also use the register to find out whether someone has signed an agreement to deal with their debts. However, the details of anyone who has been discharged from bankruptcy will be automatically removed from the register after three months.

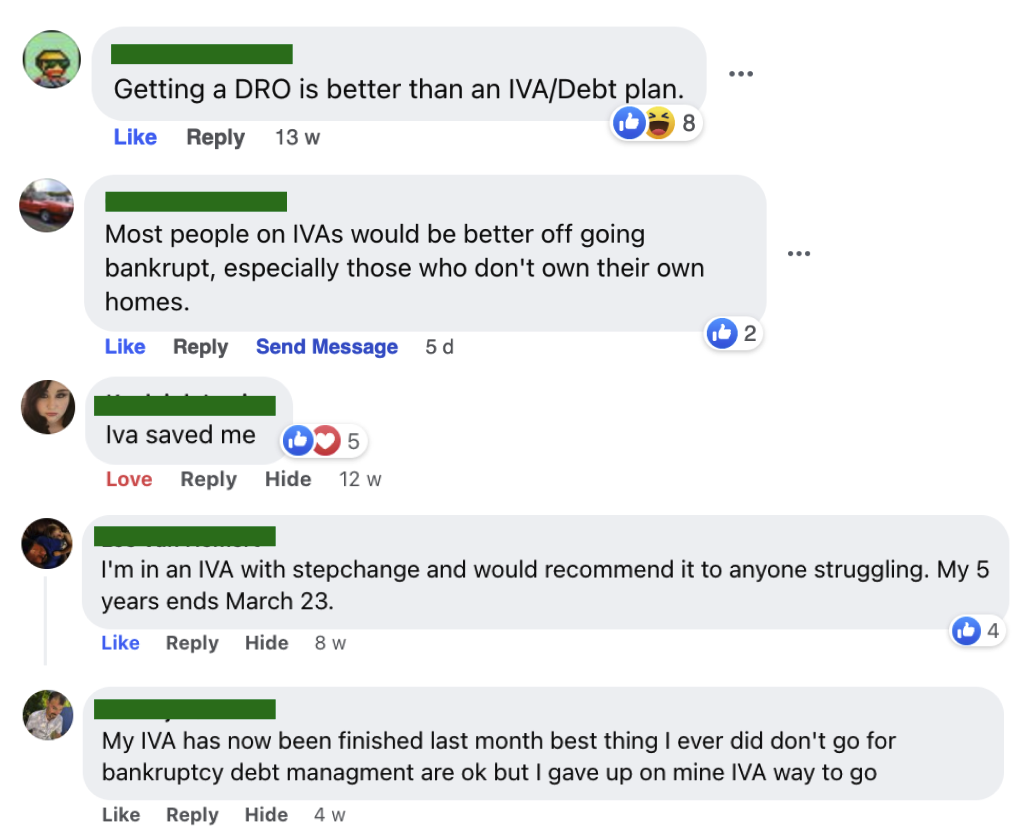

Are there any other options?

Deciding how to tackle your debt is a very personal decision and you certainly can’t get the answer through a simple blog post.

It’s made worse by the strong opinions you’ll often find online.

The best option is to get help from a debt expert to find out all your options and see which is right for you.

I’ve partnered with The Debt Advice Service and you can access their expert support by filling out the short form below.

Get help from The Debt Advice Service.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

FAQs

Bankruptcy isn’t something to be ashamed of.

Many celebrities are bankrupt, and most counsellors use this example to persuade people to opt for the option.

If you do choose bankruptcy as a debt solution, remember that it is possible to rebuild your financial reputation.

Just make sure that you are aware of your options before you make such a decision.