Brecon Debt Recovery – Must You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’ve got a surprise letter from Brecon Debt Recovery and you’re puzzled about where this debt has come from, don’t worry – this is the right place to find answers. We know it might feel scary, but you’re not on your own. Each month, over 170,000 people come to our website for advice on their debt problems.

In this article, we will help you:

- Learn about who Brecon Debt Recovery is.

- Understand why they might be getting in touch.

- Find out if the debt is really yours.

- Know your rights and what happens if you can’t pay.

- Learn about options to deal with the debt, even ways to write some of it off.

We get it. Some of us have also had to deal with debt collectors, so we understand how you feel and are here to help. Let’s work together to make sense of this and find the best way for you to handle it.

Let’s dive in.

Why is Brecon Debt Recovery getting in touch?

It can be upsetting to receive a letter or email notifying you of your debts, especially from a company you may not recognise. You may also ask yourself why they are contacting you at all. As the in-house debt collection agency for Next, it is likely that Brecon are getting in touch because of an amount owed on your Next Directory credit account. If you’ve failed to act on, mislaid, or misread letters from Next regarding your credit account, they will pass your information on to Brecon.

Brecon Debt Recovery UK is a debt collection agency – this means they specialise in recovering money owed to their clients by customers. Businesses often don’t have the necessary resources or skills to collect payments from people, so agencies such as Brecon are employed to act on their behalf. In this instance, Brecon are the dedicated debt collection agency for Next.

The debts that Brecon often deal with are known as Catalogue Debts. These fall under the bracket of non-priority debts, which means you can treat them in the same way as credit cards, loans or overdrafts. However, this doesn’t mean that they’re not serious.

There are some complex rules with regards to Catalogue Debts agreed upon or taken out before 6th April 2007. Debts regarding accounts from this date might not be enforceable if you did not sign a credit agreement. In these instances, it is recommended to contact a service such as National Debtline for further information.

Brecon has been known to contact via email, letter, and telephone, depending on how much personal information they have access to.

Sometimes, if you don’t respond to letters from Brecon, they will transfer the debt on to an external debt collection agency. In many cases, this is a company called Moorcroft.

» TAKE ACTION NOW: Fill out the short debt form

How do I Verify Brecon Debt Collectors debt?

If you have received debt letters from Brecon Debt Recovery, but aren’t sure if they’re legit, what do you do?

From my experience, the best thing to do is ask for proof that the debt is yours. I have a free ‘prove it’ letter template that you can use to help you write to Brecon Debt Recovery and request evidence that you are liable for the debt that they are chasing.

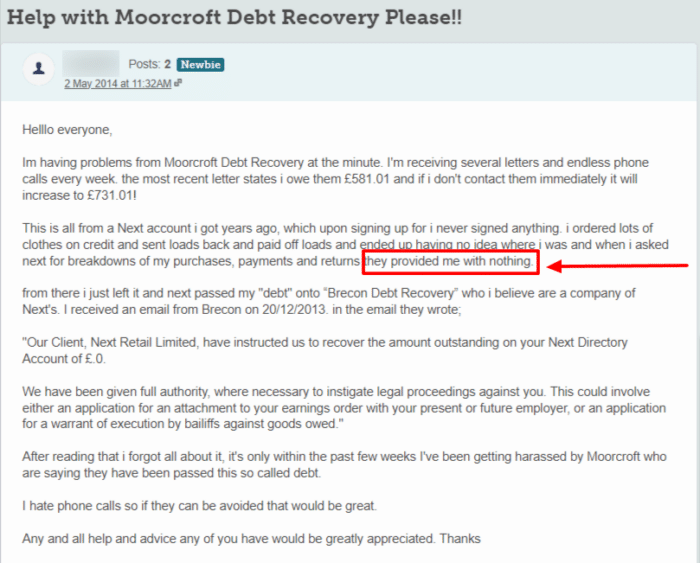

You are under no obligation to pay for a debt that can’t be proven to be yours. Take a look at this example.

This forum user should send a ‘prove it’ letter to Brecon Debt – or whoever is now chasing their debt – and ask for proof that the debt exists in the first place, and that they are liable.

From my experience, companies can make mistakes and might chase you for debts that don’t exist. This is why it’s so important to make sure that you are liable for the debt before you pay.

However, it is crucial that you respond to legitimate debt collectors quickly. Responding quickly will help you avoid any extra charges or fees. Not ignoring debt collectors also means that you are less likely to face legal action, such as a CCJ.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How to deal with Brecon Debt Recovery

Now that we’ve established who Brecon Debt Recovery is and who they represent, let’s look at what to do if they get in touch. Debt collection letters and emails can be really stressful and upsetting, so it’s really important to know what to do, and to know the options that are available to you. Here are some top tips about how to deal with them:

Don’t ignore them

Persistence is a by-word with debt collection agencies. No matter how much you ignore them, they’ll keep on sending letters or trying to contact you in other ways. You should take these letters seriously, as they are legally permitted to escalate matters if push comes to shove.

It is rare that a debt collection agency will contact you in error, so when you get a notice from Brecon, check all the relevant information you might have about the issue.

You do have some control over how they contact you. If you’re getting tired of them calling you up, you can say that you only want to be contacted in writing, and they will be legally obliged to obey this request.

To avoid their persistence, the best plan of action would be to reach out and contact them yourself. You might also want to ask Brecon for proof of the debt if you haven’t already.

Don’t panic

No one wants to get a letter from a debt collection agency – it can often feel like salt in the wound, and can be really stressful. However, it isn’t a cause for panic. It’s really important to know your rights as well as any legal action they might be able to take, as this can lead to a quick and painless resolution.

The first thing you want to do is confirm whether you do actually owe the money they say you owe. Gather as much information and correspondence to do with your Next Directory credit account as you can, and double–check. If letters or emails about your Next credit account have fallen by the wayside, it’s highly likely they will have passed the issue on to Brecon.

Be sure to check the information given in their letter with your own records. This will make it much easier for you to sort things out.

Know your rights

Next and Brecon Debt Recovery are both governed by the Financial Conduct Authority, which means they have to adhere to certain rules.

These rules say that they’re not allowed to harass you with excessive or unsociable calls, they can’t bully or threaten you into paying and they’re not allowed to pretend they have legal powers that they don’t actually have.

Knowing and understanding these rights is really important. You should also keep a diary marking all dates, correspondence instances, and anything else you think is relevant. If you feel like they are disobeying any of these rules, this can be vital.

Know their rights

Brecon Debt Recovery also has certain rights, and they can take appropriate action as they see fit. Besides calling you, emailing you and writing to you, they might:

- Add interest or charges to the amount owed

- Transfer your debt to an external debt collection agency

- Take actions to sue (in extreme cases)

- Threaten bankruptcy (again, in extreme cases)

It is worth noting that debt collection agencies are allowed to make home visits – though they rarely do so. It is worth knowing, however, that they are not legally permitted to enter your residence without either a court-issued warrant or the homeowners’ specific permission.

None of these are ideal situations to find yourself in, so the sooner you get on top of everything, the less likely they will be to pursue these options.

Pay your debt

If they have absolute proof of your debt, and you have the funds to pay it, then you will need to do exactly that. Brecon Debt Recovery offers several different ways of paying your debt. As well as using the Brecon Debt Recovery pay online option, you can:

- Pay via bank transfer (they offer a monthly standing order option as well)

- Via SelfServe (call 0800 587 7758 and tap in your SelfServe number, the amount and your card details)

- Via Next Gift Card

- In any mainland UK Next store using cash or card

- Via telephone on 0800 988 0068

What if you can’t pay Brecon Debt Recovery?

It can be really hard to face up to the fact that you may not be able to pay your debt, but it isn’t the end of the world. There are a few options in place that can help you deal with the situation at hand. It’s worth knowing that if you have kept up a good level of communication with the debt collection agency, it’s more likely they will understand your situation.

First and foremost, you should contact Brecon Debt Recovery to explain your current financial situation. This kind of transparency might lead them to accept a repayment plan, meaning that you slowly pay back the amount in several instalments. Brecon’s website states that this is a possibility – but it would be worthwhile confirming this with them.

But if any form of payment would put you in extreme financial difficulty, you might want to consider a debt solution.

There are several different debt solutions available in the UK, so I recommend speaking to a debt charity as soon as possible. Their advisors will be able to look at your finances in detail and help you work out which debt solution will work best for you.

I have linked a few charities that offer these advisory services for free below.

Debt Management Plan (DMP)

A DMP is an informal debt solution that lets you pay off your debts via a single monthly payment.

Because it is informal, it is not legally binding so you are not tied into a DMP for a minimum number of payments.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.

If you have little income and no valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Other Debt Collectors

You should check for more outstanding debts that you may have with other companies or debt collectors. Here are four steps you could take:

- Check your credit report for other defaults

- Check your email and post for reminders or overdue notices

- Check the court records for CCJs against you

- Check your bank statements for the names of other debt collectors

There are hundreds of debt collectors in the UK and each works with different companies to collect debts.

For example, Cabot Financial have been known to collect for the DVLA while Lowell Financial and PRA Group buy debts from various credit card companies like Barclaycard.

If you see a name on your bank statement that you don’t recognise then you can search MoneyNerd to see if they’re a debt collector.

Brecon Debt Recovery Contact Information

| Address: | Desford Road, Enderby, Leicester, United Kingdom, LE19 4AT |

| Phone Number: | 0800-988-0068 Mon-Fri 8am – 9pm | Sat-Sun 8am – 5pm |

| Email: | [email protected] |

| Website: | https://www.brecondebtrecovery.co.uk/ |

Final thoughts

If you have received a letter or an email from Brecon Debt Recovery, this article will help you with your next steps. It can be frightening, stressful, and unpleasant, but if you make sure you have all the right information, you can get it all sorted out relatively painlessly. Remember, you’re not alone in this process – many people get these letters, but now you know what to do, it shouldn’t be as much of a headache as it could have been.

One final thought – if Brecon Debt Recovery do not seem to be behaving in a respectful or rule-abiding manner, you have absolutely every right to make a complaint against them. There is a process to this, though. To start off, you should write a letter to Brecon directly, explaining the nature of your complaint. If they do not acknowledge the letter or take steps to try and resolve and appease you, then you are legally permitted to escalate the matter to the Financial Ombudsman Service.