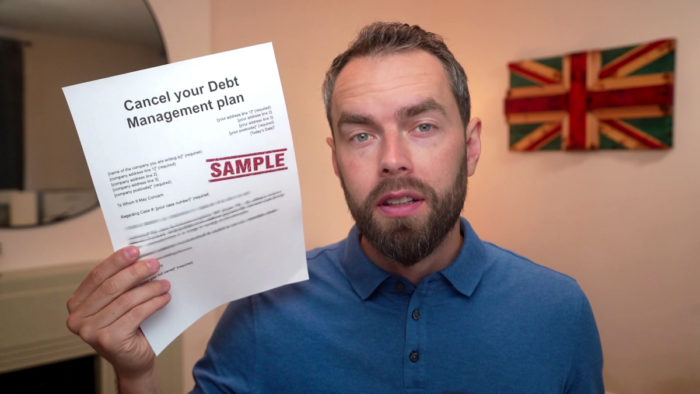

Cancel your Debt Management plan – Sample Letter Template

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you thinking, ‘Can I cancel my debt management plan?’ You’re in the right place. Each month, over 170,000 people visit our website for guidance on solving their debt problems.

In this article, we’ll give you clear steps on:

- How to cancel your debt management plan.

- Writing a good letter to make this happen.

- Possible costs when stopping your plan.

- Asking for some money back from your debt plan.

- How to say if you’re not happy with your debt plan provider.

We understand that dealing with debt can be hard. You might be worried about writing a formal letter, or maybe you’re unsure of what will happen next. That’s why we’ve also got a letter template to help you along.

Ready to take control of your debt? Let’s get started!

Letter Template

To Whom It May Concern

Regarding Case #: [your case number]* (required

I have been exploring several options which allows me to run a debt management plan free of charge, enabling all of my available income to be distributed to my creditors. I am therefore writing to inform you that I no longer require your services and wish to cancel my plan with immediate effect.

Please provide a full breakdown of my account with you since it began, outlining all payments I have made, all creditor distributions and to whom they have been made. Please send this within 14 days of the date of this letter.

I also request a full refund of my [deposit/first payment to you]* (required) of £[enter the amount you want refunded]* (required) which I made by [cheque/direct debit]* (required) on [date the payment was made]* (required).

[I am making this request as i feel that you have not provided the services that the financial conduct authority’s consumer credit sourcebook says you should. This includes the following: failing to inform me of the outcome of the negotiations with my creditors; you did not inform me of the total cost of the agreement and the amount to be repaid]* (required)

Please send the payment to me at the address provided above, within 14 days of the date of this letter.

I look forward to hearing from you.

Yours sincerely

Downloadable Resource

The download links below take you to a Google document template where you can make a copy or save in any document format you like. Note, you may have to login to your Google account.

Download – Single (for one person)

Download – Joint (for couples)

» TAKE ACTION NOW: Fill out the short debt form

Can I cancel my Debt Management Plan?

Debt Management Plans are not legally binding debt solutions, which means either party can cancel the plan at any time. They are not like IVAs where the debt solution has legal weight and cannot be cancelled or deferred without serious repercussions. If you want to cancel your DMP for a particular reason, then you are free to do so.

However, if you are cancelling because the DMP has become unaffordable for you, you may prefer to renegotiate the plan rather than exiting it altogether. Ultimately, you need another plan in place to get out of debt. Cancelling the DMP without lining up a different DMP provider (such as a debt charity) or another debt solution could be a bad idea.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Who should cancel their DMP?

There are different situations that would make someone want to cancel their Debt Management Plan. The most common scenario is when a debtor has signed up to a DMP that comes with fees, but then realised they could get a DMP service with another provider at a lower cost or lower monthly fees. Some charities won’t even charge for setting up a DMP on your behalf.

Other reasons to cancel a DMP are generally not being happy with the service provided, switching to a different debt solution, or you may have come into some money and are able to pay off your debts completely, maybe with a settlement offer.

Be aware of any DMP cancellation fees!

Some DMP service providers will have included cancellation fees within the terms and conditions of the agreement. Others will not have included these fees. The only way to know if you will be subject to cancellation fees is to check the terms of your DMP agreement.

If they have included cancellation fees, these charges must be reasonable. If they are excessive and unfair, they could be breaking the law.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Will I get a refund on my debt management plan?

Again, the chances of getting a refund on your DMP will depend on the terms and conditions in the DMP agreement. However, most DMPs today are agreed on the internet or over the phone, which gives you more rights. When a DMP is finalised in this way, it is known as a distance sale and gives you a right to cancel within 30 days and also recover any fees or charges you paid within the same timeframe.

Can I complain about a DMP provider?

If you believe a DMP provider misled you to get you to agree to their service, you should make a complaint directly to the DMP provider. If they do not respond in a way you would hope, such as agreeing to refund any fees, you could then take your complaint to the Financial Conduct Authority and the Financial Ombudsman Service.