Can’t Pay Back Your Loan – What Can You Do?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried because you can’t pay back your loan? Don’t worry; you’re not alone. Every month, more than 170,000 people visit this website seeking advice on debt matters.

In this article, we’ll cover:

- What to do when you can’t pay back your loan

- Interest and additional fees

- The potential impact of missed payments on your credit score

We understand that dealing with loans can be challenging; some of us have been in your shoes. With our experience, we’ll help you figure things out.

Let’s dive in!

What You Should Do When You Can’t Pay Back Your loan

When you have a loan you can’t repay, it can be very stressful. Don’t panic, there are a few things you can do to sort it out. To help, I’ll go through the things you need to do when you’ve got a loan you can’t pay.

Speak to your loan company

You first need to talk to the loan company about the situation and explain why you can’t repay. Your lender should tell you where to go for debt advice by law. Then, they should stop asking you to pay temporarily.

This short break from repayments gives you time to manage your debt and determine how to repay the loan. A loan adviser will offer sound advice about how you can pay the loan back. Lenders can freeze interest and charges while you sort things out.

They are also banned from constantly bothering you for repayments, and they have to accept the amount you can pay – even if it is just a small amount each month.

Ensure you keep copies of all communications, including emails, letters and text messages. If they phone you, make sure you note down what was said. Doing so can prove there has been communication between you and the company.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Interest and additional fees

From my experience, it is easy for your debt to snowball after missing a loan payment. Interest can accumulate quickly during the period of non-payment, and you might be hit with additional fees for late or missed payments. The key is to stay calm and act fast.

Potential impact of missed payments on credit score

Companies calculate credit scores differently, using credit history, application form details, and any other personal details they may have on record. A late payment will stay on your credit report for six years.

A borrower’s credit score reflects how reliable they are with money and affects how much credit they can get. Some lenders see missed or late payments as a sign that borrowers have difficulty managing their finances. Thus, you may fail to meet the lending criteria of some companies if you miss loan payments regularly.

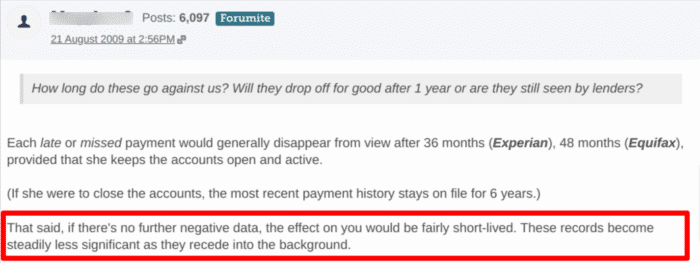

As this MoneySavingExpert forum user rightly states, although a late payment will stay on file for six years, the impact reduces with age. Your credit score should improve over time if you keep up with repayments.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Make sure you don’t roll your loan over

When you talk to the loan company, they’ll want to offer to roll over your loan. This means that they’ll put it back to the next month. Make sure this doesn’t happen, as you’ll still have to pay interest on that month. One way to avoid worsening your financial situation is by setting up a temporary arrangement.

Repayment plans

Negotiating with your lender and agreeing on a Loan Temporary Repayment Plan can help you get out of debt in a manageable way. If your lender agrees, you can pay less temporarily, giving you enough cash for your living essentials. In turn, you will be less likely to spiral into debt.

You must make payments on time. Otherwise, it may lead to default.