For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re thinking about divorce but are concerned about the impact on your money, you’re in the right place.

Each month, over 8,700 people visit our website looking for guidance on this very topic; you’re not alone.

We understand that you may be worried about the cost of divorce and its effect on your financial health. That’s why, in this article, we’ll cover:

- How divorce works, including the latest rules for 2023

- Ways to keep your money safe during a divorce

- What you may be entitled to in a divorce settlement

- How to work out a fair split of money and assets

- Dealing with issues such as hidden assets and pension protection.

We know that this is a tough time for you; some of us have even been through it ourselves. But with the right support and advice, you can navigate this process and secure your financial future.

How to save money on divorce fees

How to save money on divorce fees

Divorces are hard to handle, but the financial repercussions can make a bad situation feel even worse.

The solution? Understanding your next steps and exactly how much they’ll cost.

For only £5, JustAnswer offers a trial chat with an experienced divorce solicitor. They can help you navigate the process and save you from costly face-to-face lawyer fees.

Chat below to get started with JustAnswer

In partnership with Just Answer.

How does divorce work? (Updated rules 2023!)

The divorce process was simplified in England and Wales on the 6th of April 2022. Legal changes were made, allowing couples to get divorced without one party having to place blame on the other, which is why the new process is known as a “no-fault divorce”.

Previous to no-fault divorces, one party would need to select a reason for the breakdown of the marriage. The respondent to the petition for divorce would then need to agree or contest the divorce. A contented divorce could create delays and further divorce costs. A detailed breakdown of divorce costs can be found via our main divorce page.

The new process however removes the blame game with the intention of making the divorce process more amicable with less opportunity for conflict. It also allows couples to apply for a divorce as a joint application, which wasn’t previously possible.

What am I entitled to in a divorce settlement?

A divorce settlement states the way in which money and assets will be split when the divorce is finalised.

Your entitlement to money and assets will be based on two principles which are sometimes in conflict with each other – fairness and equality.

There are two types of assets an individual could (jointly) own. There are matrimonial assets, which are assets that have been acquired or built up during the marriage. And there are non-matrimonial assets, which are those that were acquired before marriage.

Non-matrimonial assets could transfer into matrimonial assets. For example, you might receive an inheritance before getting married, but then use this money to buy a family car. Moreover, non-matrimonial assets are not always excluded from divorce settlements.

Does a man get half in a divorce?

Any ex-partner could be entitled to 50% of money and assets within a divorce, but this isn’t always the case. Sometimes it’s judged to be fairer to divide money and assets in a way that isn’t a 50/50 split.

Every marriage and divorce is unique, which means there aren’t fixed rules for everyone.

Who gets my share of the property if I divorce?

There is no standard rule to state how a property will be divided in a divorce. There is never a one-size-fits-all approach, so it’s best to come to an agreement.

Most often, one partner will buy out the other person’s share in the property if possible. However, it’s not that uncommon for the two individuals to continue living in the property together for a period of time when it’s amicable enough to do so.

Moreover, if both individuals own the property they both retain the right to enter and use the property. So you’re never forced to leave the property when you’re going through a divorce.

Does it matter if assets are in my spouse’s sole name?

The family matrimonial home can be divided between both parties even when it’s legally owned by just one person.

The sole owner of the property might claim that the property is a non-matrimonial asset. However, this argument doesn’t hold credence since you have both been living in the property as a married couple.

If you’re divorcing someone who has sole legal ownership of the family home, you might want to consider adding a Matrimonial Home Rights Notice to the property by contacting the Land Registry. This notice will prevent the property from being sold until after the divorce has been finalised.

Can you hide assets before divorce?

It’s illegal to hide assets from your ex-spouse to prevent the asset from being divided with your ex-spouse. This includes savings accounts, investments, antiques and more recently, cryptocurrency.

If you deliberately hide assets, the court can issue penalties and even change the way that assets and money are split within your divorce, so it’s not a good idea.

How do we separate our finances in a divorce?

Your finances will need to be divided as part of the divorce. This isn’t always split 50/50 – but it still could be.

To separate your money in a divorce, you should start by making a list of all your bank and savings accounts. You should try to decide how the finances should be fairly split between you.

Is my husband entitled to half my savings (UK)?

Your personal savings solely in your name are usually classified as a matrimonial asset because it’s likely that these savings will have built up over the course of the marriage.

Therefore, your ex-spouse may have a right to a portion of your personal savings, but this doesn’t necessarily mean a 50/50 split.

Can my spouse transfer money before our divorce?

Although your ex-partner might transfer money before a divorce is finalised, any money they transferred away can be considered an intended reduction of matrimonial assets.

You could then ask for a bigger share of the remaining assets than you would usually ask for to compensate for their outward transfers. If the matter goes to court, the court is likely to adjust the divide of money or assets to account for your partner transferring the money.

Worried About Divorce Finances?

Divorce can be complicated, especially when it comes to navigating the cost. One small error could lead to serious consequences.

But, the support of a good solicitor can help you to understand your next steps.

For a £5 trial, JustAnswer’s online divorce solicitors can help you understand your rights and guide you towards the best financial solution for you.

In partnership with Just Answer.

How can I protect my pension in a divorce?

You can protect your pension in a divorce by considering its value and negotiating to keep all of your pension in exchange for other finances and assets, known as pension offsetting.

You could even use a pension sharing order to make sure you still receive some of your pension in the future.

» TAKE ACTION NOW: Get legal support from JustAnswer

What is a financial settlement?

A financial settlement is an agreement on how your money and assets will be split as part of the divorce.

How much to ask for in a divorce settlement

When negotiating to split assets and money, you should ask for what you believe is a fair share. The default may be to ask for a 50% split, but this may not be fair to you or the other person.

You might find that there is a difference between what you believe is morally fair and what is legally fair.

It’s hoped that no-fault divorces without having to point the blame at the other person should make negotiations easier and more productive.

How do I prepare for a financial settlement?

The best way to prepare for a financial settlement is to list all of your money and assets and think about what you believe is a fair outcome for both people. This includes personal bank accounts, joint accounts and other financial assets.

The starting point of the split is always 50/50 and then adjusted based on the circumstances.

If your situation is complex or you suspect your ex-spouse won’t negotiate fairly, it might be better to speak to a family lawyer first. They can help you understand your legal position to influence how you will negotiate.

Can we draw up the settlement by ourselves?

You can create the financial settlement by yourselves – known as a DIY divorce – but it’s advisable to make the agreement legally binding.

If your divorce is straightforward and you agree, you can ask for a Consent Order, which is a legal document outlining the details. You and your ex-spouse will need to sign the document and send it to the court to approve it at a cost of £53 (subject to change!).

The Consent Order will need to be drafted by a legal professional to ensure it’s legally binding. Some couples have decided to use online low-cost services to do this.

In Scotland and Northern Ireland, the process differs. For example, in Scotland, a DIY divorce is termed a simplified divorce and can only be used by couples who meet strict criteria.

What if you cannot agree a divorce settlement?

If you cannot agree on a divorce settlement with your ex-spouse, you can use mediation services to try and reach an agreement. Failing that, you will need to go to court and let a judge decide.

Divorce mediation

Divorce mediation is provided by lawyers to try and help you both reach a fair agreement. This can be effective because lawyers can inform each client of how a judge may decide to split money and assets, providing clarity to negotiations. However, mediation services will come at a cost.

Court action

If mediation is unsuccessful, the couple will need to go to court for a judge to decide how assets and finances should be divided. They issue a Financial Order to do this.

You will need to prove that you used mediation services previously unless the divorce has come about through domestic abuse.

How much will it cost to go to court?

There is currently a court application fee of £275, which is subject to increases over time. You’ll also need to pay for legal representation during any court hearing, which can cost thousands of pounds depending on the solicitor and their experience.

This is why it’s best to agree on a financial settlement without going to court.

Who pays these legal fees?

The application fee can be paid by one person or both people. If one person pays but they want the other person to contribute, they can ask for this to be included within the Financial Order made by the judge.

How does the court decide what is a fair divorce settlement?

A judge will consider a number of factors to decide how finances and assets should be split. They may consider some or all of the following:

- Each person’s individual assets

- Financial and emotional contributions to the marriage

- Time spent unemployed

- Projected earning capacity of both people

- Living standards prior to the breakdown of the marriage

- Disability requirements

- Marriage length

- Your ages

How long does a divorce financial settlement take?

The timeframe to reach a financial settlement can differ significantly between couples. It’s much quicker if you and your partner agree on how to split assets and finances – and therefore avoid court action.

You’re more likely to agree on a financial settlement quicker if you don’t have complex assets and finances.

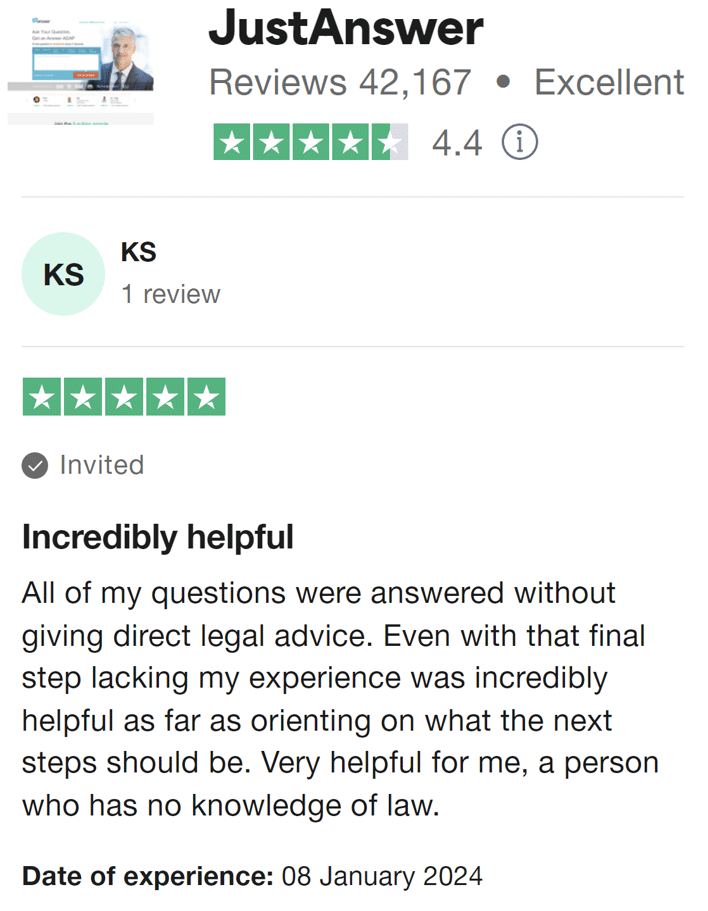

Join thousands of others who got legal help for a £5 trial

Getting the support of a Solicitor can take a huge weight off your mind.

Reviews shown are for JustAnswer.

What happens If my ex doesn’t pay up after divorce?

If your ex doesn’t pay you what is owed after the Financial Order has been issued, you can take action to enforce payment. You can:

- Ask the court for an Attachment of Earnings Order, which is an order for his or her employer to keep sending some of their wages to the court which is then passed to you.

- Ask the court to place a legal charge on a property owned by your ex. This will prevent them from selling the property without first repaying your debt.

Starting over after a divorce with little or no money can be stressful and difficult. So it’s good to know that there are options if your ex doesn’t cough up!

Can I transfer money before divorce?

Transferring assets before a divorce isn’t technically illegal, but this isn’t advisable if you’re only doing it to deplete the marital pot and prevent your ex from taking some of your money.

This type of deprivation of assets can be considered by your partner in negotiations and will be considered by a judge if the financial settlement escalates to court. So it’s likely to not work and could even make your situation worse.

Will the money I transfer to family members before divorce be considered by the court?

Yes, a court will consider any intentional deprivation of assets to stop your ex-partner from getting more out of the divorce.

Giving away money during a divorce is a popular topic, which MoneyNerd has already covered in detail.

Can I transfer assets before divorce?

Similarly, you shouldn’t transfer any sole assets to other people before a settlement has been reached. Even assets legally owned in your name alone can be considered marital assets.

Disposing of matrimonial assets will be considered by a court and influence the judge’s Financial Order.

Can I sell my assets before the divorce is filed?

You can legally sell or dispose of assets before the divorce process is initiated, but it could still be seen as a way to reduce your partner’s share of the divorce settlement. A court could then take this into account when making a Financial Order.

What happens if my spouse has a secret bank account that is not declared?

If you think your spouse hasn’t declared all of their bank accounts, you can ask your solicitor to complete searches or use a Non-Party Disclosure.

If they are found to have been deliberating concealing assets and finances, this can negatively affect them in regards to the outcome of the settlement in court.

Does getting a divorce cut my financial ties with my ex?

Although a divorce splits assets and finances, you may still have some financial ties with your ex in the short and long term.

In the short term, you might still need to pay bills and household expenses, including a mortgage. And in the long term, you might have child maintenance in place or be entitled to a share of your ex-partner’s pension in the future – or vice versa.

Can an ex-husband, wife or civil partner claim for property after a divorce?

Yes, it’s possible to claim money and assets after a divorce, although it’s quite rare.

One of the most notable cases of this was when one lady claimed money from her ex-husband 19 years after the divorce due to significant growth in his business.

The Supreme Court Judge presiding over the case stated that marriage was a life-long commitment, and as such, there is no time limit on seeking Financial Orders.

Are all the rules the same for a civil partnership?

Many of the rules discussed above are also applied to ending a heterosexual or same-sex civil partnership, namely a civil partnership dissolution. You may want to speak to a family lawyer for personalised advice.

Divorce FAQs

Divorce Doesn’t Mean Financial Ruin

Legal advice can make all the difference when navigating the financial aspects of divorce, and affordable help is within reach.

Normally, the cheapest solicitors in the UK will put you back at least £130 per hour.

But, for a £5 trial, a divorce solicitor from JustAnswer can review your situation and provide personalised guidance. It’s a no-brainer!

Try it below.

In partnership with Just Answer.