Cheap Secured Loans – Best Options, Tips & More

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

If you have a secured loan, or you’re thinking about getting one, you might want to know more about how they work.

You are not alone in this. Each month, more than 6,900 people visit our website seeking advice on secured loans.

In this simple guide, we’ll explain:

- What a secured loan is.

- How a secured loan works.

- The difference between a secured and an unsecured loan.

- The true cost of a bad secured loan.

- How to compare secured loans and find cheap deals in the UK.

We understand that you may feel worried about the risks of a secured loan. We will help you understand these risks and how to manage them.

Ready to find the best and cheapest secured loans in the UK? Let’s dive in!

Secured loans in a nutshell

A secured loan may refer to one of many different types of loans that use an asset as collateral in the loan agreement.

What does this mean? It means that the lender has a right to repossess and sell the listed asset if the borrower stops making monthly repayments in full and on time, as stated in the loan agreement. For example, your home may be repossessed if you secure a loan with a property and stop repaying.

Only consider getting any type of secured loan from a provider that is authorised and regulated by the Financial Conduct Authority.

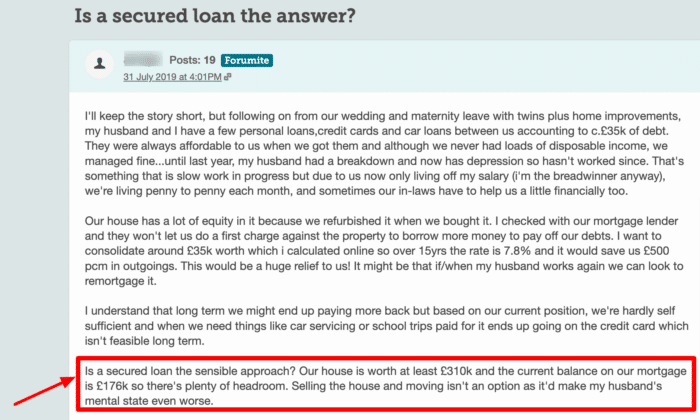

This forum user on MoneySavingExpert is looking for advice on secured loans and whether it is the right thing for them.

What is a cheap secured loan?

A cheap secured loan is simply a secured loan that has a low interest rate.

You should also consider any other fees and charges in the loan to determine if it is still a cheap loan. For example, are the early repayment fees low? And does the loan have cheap closing costs that are due to repay the loan at the end of the repayment term?

Also, consider application fees, brokerage fees and other potential admin costs as part of the process.

Sometimes, a secured loan may look cheap because of its low interest rate, but it includes other charges that are significantly higher than the rest of the market. When you compare secured loans, make sure to look at more than just interest rates.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 6.34% |

£219.34 |

£26,320.83 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 7.99% |

£222.20 |

£26,664.58 |

| Selina | 8.45% |

£223.00 |

£26,760.42 |

| Equifinance | 9.95% |

£225.61 |

£27,072.92 |

| Evolution | 10.2% |

£226.04 |

£27,125.00 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

Where can I get a secured loan?

Secured loans are advertised widely online. They are typically offered by UK banks, some building societies, supermarkets, the Post Office and online loan providers.

Some types of secured loans, such as second-charge mortgages, are available through specialist mortgage lenders. Only consider companies that are authorised and regulated by the Financial Conduct Authority (FCA).

What is the Financial Conduct Authority?

The Financial Conduct Authority regulates financial services firms and financial markets in the UK. Its aim is to protect consumers, keep the industry stable, and promote healthy competition between financial service providers.

Are secured loans cheaper?

Secured loans often have a lower interest rate than unsecured credit, such as credit cards and unsecured loans. By using an asset as collateral, the lender may view you as less of a lending risk and be able to offer a lower interest rate than unsecured credit.

If you take out a secured loan against a property or the equity in your home, you have a better chance of getting a cheaper loan. However, there is also the risk of losing your home if you cannot meet all of your monthly payments.

Secured loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking to fund a home improvement project?

- Dreaming of finally taking the once-in-a-lifetime trip?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

How do I get a cheap secured loan?

To get a cheap secured loan, you need to find the lenders offering the lowest interest rates and low loan costs (if applicable).

However, because securing the lowest interest rate relies on your personal finances and credit score, you might need to improve your finances by paying off other debts and increasing your credit score to get one of the cheapest secured loans.

If not, you could find the cheapest lenders but then be offered an interest rate that is much higher than the representative example and not so cheap.

Are secured loans cheaper than personal loans?

One reason someone may choose to get a secured loan over an unsecured personal loan is that the rate of interest within monthly repayments is generally lower. However, the interest rate you are offered depends on individual circumstances, and it might only be lower than the rate you would be offered through an unsecured loan.

Someone with a better credit score than you could get a lower rate using unsecured loans than you get using a secured loan.

What are the interest rates on a cheap secured loan?

The average interest rates on the best secured loans are around 2-10%, depending on the loan amount you are borrowing. Thus, cheap secured loans have an interest rate at the lower end of this spectrum. To get approved for one of the cheapest secured loans, you’ll need to have good finances and an excellent credit score.

Cheap secured loans – examples

Below are two examples of cheap secured loans in the UK at the time of writing. They are not necessarily the cheapest secured loan available and are provided as examples only. If you want to find a secured loan with low interest rates, you should complete your own up-to-date research.

Norton Finance is a reputable and legal online loan provider offering secured loans from £3,000 to £100,000 to be repaid over 1-30 years. This lender’s representative rate starts at 2.99% but changes based on your loan amount.

Ocean Finance offers secured loans from £10,000 to £100,000 to be repaid over a repayment term of 5-25 years. This lender’s representative rate begins at 9.6% and also changes based on the specifics of the loan. Ocean Finance is not a direct lender, meaning they source loans from other companies on your behalf.

Who can help me find a cheap secured loan?

It can be difficult and stressful to compare secured loans online. You can outsource the job to trained professionals instead, such as a credit broker or financial advisor. Their services cost an initial fee and possibly commission, but using them could still save you time and even money.

But nothing is guaranteed, and you may make your secured loan cheaper by doing it yourself. Each situation can be different.

How to compare secured loans

You can compare secured loans using the representative interest rates advertised by each lender. Note that the representative rate changes based on the amount you want to borrow and is not accurate for everyone. The rate shown is what 51% of applicants received, and the cost of the loan you are offered may be much higher, especially if you have a poor credit rating.

Make sure to look and compare any other applicable fees included in the loan, such as early repayment charges and closing costs.

You may choose to use a loan calculator to get a clearer picture of forecasted loan repayments based on your needs. But as these calculators use the representative rate only, they are not personalised to you and may not be accurate.