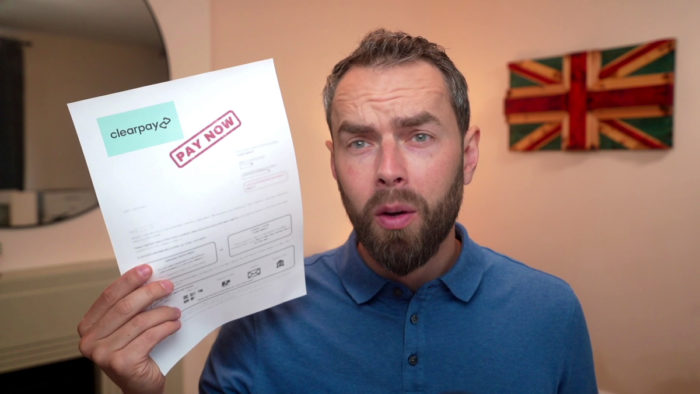

Clearpay Debt Collection – Should you Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you facing a tough time with Clearpay debt collection? Don’t worry; you’ve come to the right place for help. Each month, over 170,000 people visit our website looking for guidance on debt problems.

This simple guide will help you understand:

- What Clearpay is and how it works.

- The steps to take if a Clearpay debt collection agency contacts you.

- The laws and rules related to Clearpay debt in the UK.

- How you can possibly write off some of your Clearpay debt.

- How not to panic and find the right solutions for your Clearpay debt.

StepChange stress the need for professional debt advice, noting that 60% of adults in financial trouble hesitate to seek help.1 We know how hard it can be to deal with late or missed payments on Buy Now Pay Later schemes. But you’re not alone; we’re here to offer help and guidance.

Let’s take the first step towards sorting out your Clearpay debt.

What Should I Do When a Clearpay Debt Collection Agency Contacts Me?

The main thing is to remain calm and communicate. Having a debt collector contact you makes an anxious situation even worse. Never ignore any correspondence, and be as open about your situation as possible.

First, make sure the debt they are chasing is actually yours. If it is, you can share information with the collection agency, but never before. Being transparent is the best option when confronted with a debt collector. They could be more understanding and may even give you some leeway.

There are solutions when you can’t pay off a Clearpay debt, and they have instructed a debt collection agency. Many debt management companies and charities are there to offer help, support and advice on a debt payment plan. Independent charities provide their services for free; this includes Payplan.

I always recommend you cooperate as much as possible with the debt collector. However, you should also explore all options to resolve the debt.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

I’ll Just Ignore the Clearpay Debt Collection Agency.

Ignoring and not communicating with a Clearpay debt collection agency will not disappear the problem. Sticking your head in the sand will only make matters worse. The reason? Debt collectors are persistent because when they succeed, they get paid.

Moreover, debt collectors report you to credit agencies and do so repeatedly. The result? Your creditworthiness is seriously and negatively impacted for all to see. Other things include:

· Interest is added to the original Clearpay debt making it harder for you to settle

· You may miss out on writing off your debt completely!

» TAKE ACTION NOW: Fill out the short debt form

Don’t Panic. There are Clearpay Debt Collection Solutions Out There

Chances are you fell behind with payments through no fault of your own. When you don’t have the money to pay, options are open. This includes:

- Working with an independent charity (they don’t charge) can help you work out a debt management plan that Clearpay will accept and that you can afford

- Consider a Debt Relief Order (DRO), which is a solution if you are on a low income and your debt is relatively low.

There are many more debt solutions available out there. To learn more about them, please take a look at the table below.

| Debt Solution | Description | Formality | Debt Type | Debt Range | Legally Binding | Impact on Credit Score | Asset Risk | Monthly Payment | Duration | Creditor Agreement Required |

|---|---|---|---|---|---|---|---|---|---|---|

| Debt Management Plan (DMP) | Agreement to pay back non-priority debts in one monthly payment. | Informal | Non-priority debts | Any amount |

No | Yes | No | Varies | Varies (until debt is paid) | No (but creditors must be informed) |

| Individual Voluntary Arrangement (IVA) | Agreement to pay back all or part of your debts over a set period. | Formal | All or part of debts | Usually over £10,000 | Yes | Yes | Possible | Fixed | Fixed period, usually 5-6 years | Yes (75% by debt value must agree) |

| Debt Relief Order (DRO) | Freezes debt for a year and be potentially written off. | Formal | Non-priority debts | <£20,000 debt | Yes | Yes | No | None during freeze | 12 months | No (court approval needed) |

| Bankruptcy | Legal status for those who cannot repay debts, potentially writes off debts. | Formal | Unmanageable debts | Any amount, typically high debt | Yes | Yes | High | None during bankruptcy | Usually 12 months, then discharge | No (court process) |

| Consolidation Loan | Taking out a new loan to pay off all existing debts. | – | Multiple debts | Based on loan amount | Varies | Yes | Depends on loan type | Fixed | Depends on loan terms | No |

| Payment Holiday | Temporary relief or reduced payments offered by creditors. | – |

short-term financial difficulties | Any | No | Yes | Low | Reduced or paused payments | Break of up to 6 or 12 months, depending on circumstances, payment history, and creditor’s policy. | No |

| Informal Negotiation | Direct negotiation with creditors for reduced payments or extended terms. | – | All debts | Any | No | Possible | No | Negotiable | Until agreement terms are met | No |

| Statutory Debt Repayment Plan (SDRP) | Plan to repay debts over a reasonable time, with protections from creditor action. | Formal | All debts | Varies | Yes | Yes | No | Fixed | Varies, based on ability to pay | Yes |

| Equity Release | Homeowners release equity from their home to pay off debts. | – |

Debts of homeowners, typically older individuals aged 55+ | Varies and depends on property value | Yes | Yes | Asset (home) is used as collateral | Varies | 8-10 weeks timeframe from application to fund disbursement. Lifetime; repaid on house sale/death. | No |

If you don’t communicate and refuse to be transparent about your situation, you may be given a CCJ if Clearpay or their debt agencies take you to court. You have to pay this; otherwise, bailiffs could seize your possessions.

A county court judgement also stays on your credit file for six years. This impact on your credit file will make it difficult to take out any form of credit, get a mortgage or even rent a property. You could have the debt repayments taken directly from your wages, which I advise you to avoid at all costs!

Independent debt agencies can discuss various debt relief options with you, such as a debt relief order or IVA, to help you get out of debt.

Can Clearpay Debt Collection Agencies Harass Me For Payment?

No, a debt collection agency cannot harass you for payment. By law, they cannot do any of the following under debt collector restrictions:

- Call you several times a day

- Chase you on social platforms

- Pressure you to do anything.

- Have more than one collector chase you at a time

- Use anything that looks like a court form

- Threaten you in any way

- Attempt to embarrass you in a public place

- Tell another person about your debt

- Claim they work on behalf of a court or bailiff (Sheriff Officer in Scotland)

- Tell you there are legal proceedings when there are not

- Tell you that it is a criminal offence to be in debt

- Ignore you when you tell them the debt isn’t yours

Knowing the difference between an enforcement agent – a bailiff – and a debt collector is important. If you are experiencing debt collection agency harassment, speak to Citizens Advice.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What Clearpay Says About Their Debt Collection Policies

According to a Clearpay spokesman, the company never uses bailiffs or enforcement agents. As a last resort, they sometimes use a debt collection agency.

The spokesman went on to say the FCA regulates debt collectors. Thus customers must be fairly treated when contacted. The representative also claimed that Clearpay never uses ‘aggressive doorstep’ collectors.

When you apply for a Clearpay account, you should always keep on top of your spending. Sounds easy, but life can throw a few ‘wasn’t expecting that’ things at you. You may find your finances stretched and can’t meet a payment.

In short, your circumstances might change. Knowing what to do when a debt collector calls makes coping easier. Understanding your rights and the laws governing debt collectors is part of the solution.

Clearpay Contact Details

| Website: | https://www.clearpay.co.uk/en-GB |

| Email: | [email protected] |

| Help Center: | Get in touch |

| Mail: | Clearpay Customer Service, Clearpay Finance Limited, Jactin House, 24 Hood Street, Ancoats, Manchester, M4 6WX |