Commercial Domestic Investigations – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you puzzled by a surprising letter from Commercial Domestic Investigations? Don’t worry – you are in the right spot.

Each month, over 170,000 people come to our website for help with debt worries. This article will guide you through:

- Understanding who Commercial Domestic Investigations are and who they work for.

- Deciding if you need to pay Commercial Domestic Investigations.

- Finding out how to check if the debt is really yours.

- Learning what to do if Commercial Domestic Investigations contacts you.

- Exploring ways to possibly write off some of your debt.

We know this situation can be scary – our team is made up of people who have been in your shoes.

We’re here to help. So, join us as we answer your questions about Commercial Domestic Investigations and help you take control of your debt.

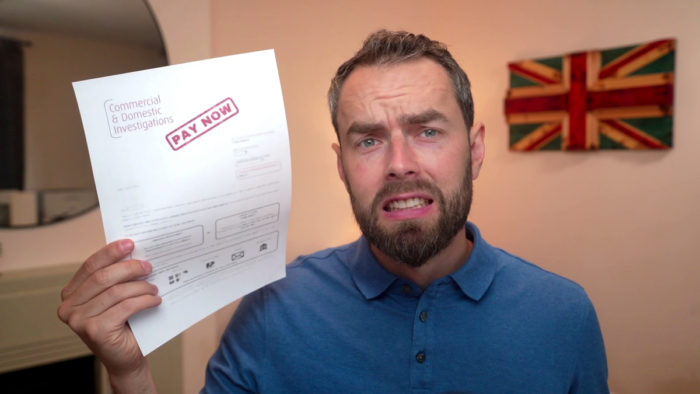

Have you received a Commercial Domestic Investigations letter?

Commercial & Domestic Investigations will start by sending you a letter informing you of how much you owe with a deadline to pay. They do have access to methods to track you and your contact details down, even if you have moved overseas.

They are likely to say that if you don’t pay by the deadline that they will consider court action. This makes the letter an official Letter Before Action (LBA) and is a necessary warning before being allowed to take you to court. Although, it will be their client who takes you to court rather than Commercial Domestic Investigations.

Sometimes these threats are serious, and at other times, they can be empty threats to try and scare you into paying quickly. For example:

“We now have our case file which contains events we were never informed about. They apparently threatened immediate legal action on our behalf, but was never followed through so made the debtor believe we were not serious.”

- Victoria E (Google Review)

This was a review from an angry business owner stating that they never knew what was going on with their case. The fact that Commercial Domestic Investigations threatened legal action on their behalf without the client ever knowing would suggest that they do sometimes use it as a scare tactic.

But don’t assume they’re always empty threats!

What to do after being contacted by Commercial Domestic Investigations

Don’t ignore their letter, but instead, send them a prove the debt letter in reply. This is a letter that requests they provide evidence that you owe the money. They cannot reply simply stating that you owe it and why. They must reply with evidence that you owe the money.

For example, if they were chasing an unpaid credit card debt for Barclaycard, they could need to send a copy of the signed credit agreement you made with Barclaycard. Until they provide evidence you don’t have to pay. And if they don’t send evidence and you get taken to court, you can tell the judge that they have failed to meet this obligation.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How do I verify Commercial Domestic Investigations debt?

If you have received debt letters from Commercial Domestic Investigations, but aren’t sure if they’re legit, what do you do?

From my experience, the best thing to do is ask for proof that the debt is yours. I have a free ‘prove it’ letter template that you can use to help you write to Commercial Domestic Investigations and request evidence that you are liable for the debt that they are chasing.

You are under no obligation to pay for a debt that can’t be proven to be yours.

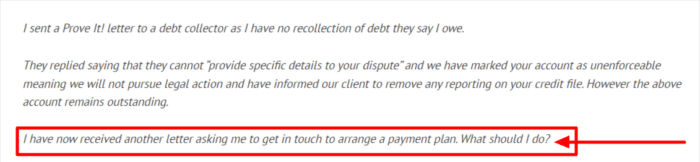

In this example, this forum user is being chased for a debt that they don’t have to pay. If you are in the same situation as this person – you are being asked to pay for a debt that you aren’t liable for – you can ignore additional letters or you might have a case for harassment.

You are well within your rights to ask for evidence or dispute debts that you don’t think you have to pay.

It is crucial that you respond to legitimate debt collectors quickly. Responding quickly will help you avoid any extra charges or fees. Not ignoring debt collectors also means that you are less likely to face legal action, such as a CCJ.

Commercial Domestic Investigations proves my debt – now what?

If Commercial Domestic Investigations does send you acceptable proof that you owe the debt, you should probably pay up. You might want to speak to them about a payment plan or consider other debt solutions if you have financial difficulty.

Ignoring their letters after they’ve provided the proof may or may not result in legal action against you, which could escalate to bailiffs if you lose in court.

What about old debts?

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window will be enforceable for the duration of the CCJ.

If your debt is statute-barred, you can use my free letter template to write to Commerical Domestic Services and explain the situation.

If you are unsure about the status of your debt, you can contact a debt charity for some advice. Their advisors will be able to look at the debt in question, determine its status, and advise you on your next steps.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can Commercial Domestic Investigations come to my home?

Consider Commercial and Domestic Investigations as an administration company. They have no right to come to your home, demand to enter and cannot take your possessions. They’re not enforcement officers working for the court!

Commercial Domestic Investigations contact information

| Address: | Commercial Domestic Investigations 3B Colima Avenue, Sunderland Enterprise Park, Sunderland, SR5 3XB |

| Phone: | 08444 159200 0191 5645876 |

| Email: | [email protected] |

| Website: | https://www.commercialdomesticinvestigations.co.uk/ |

You can call Commercial Domestic Investigations on 08444 159200. Lines are open on weekdays only between 9am and 5pm.

Other Debt Collectors to look for on your Credit Report

There are hundreds of debt collectors in the UK and they each collect for different companies.

It’s surprisingly easy to not notice that you’re in a debt collector’s crosshairs.

I’d suggest you spend time checking your credit report. If a debt collector purchases any of your debt, it will appear on your credit report.

Some of the biggest to look out for include Cabot, PRA Group, and Lowell.

So if you see anything relating to their names, then you’ll need to investigate further.