Consequences of Debt – What You Need to Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

When you’re in debt, it can feel scary. You might be concerned about what could happen, but don’t worry! You’re not alone in this – each month, over 170,000 people come to our website for guidance on their debt problems. In this article, we’ll talk about:

- Why being in debt can be bad.

- What to do if you have debt.

- The worst things that might happen because of debt.

- How you could write off some of your debt.

- What debt can do to a person’s life.

Our team understands debt. We know how it feels because some of us have been in debt too. We’re ready to give you the facts and help you understand your debt better. So, let’s start learning more about the consequences of debt and what you need to know.

What’s the Worst that Can Happen When You’re In Debt?

There are different reasons that can explain how people get into debt. But how far can your money problems go? Well, the worst that debt can do to you is to severely limit your ability to enjoy life.

One of the most dangerous effects of debt is that too much of it lowers your credit rating, which means that not only will companies be less willing to give you loans in the future, you’ll get those loans at much higher interest and much stricter conditions.

A low credit rating means that you’ll avail of many services and facilities at a much higher price than you would otherwise, such as auto insurance.

Other than that, there’s the crippling stress of being hounded by your creditors and debt collectors and facing possible court action.

All in all, you’re seen as financially weak and untrustworthy when it comes to money, so be prepared to see your financial freedom slip away from your grasp.

Eventually, the stress can take a toll on your family life, your mental health, and your motivation.

You may be denied several lucrative opportunities, such as a chance to own a home, all because you are in debt.

The worst thing that can happen if you fail to pay your debt is creditors/debt collectors can take legal action against you. This can potentially lead to county court judgements, asset seizures, and a negative impact on your credit rating.

Can You Go to Prison Because of Debt?

As per UK law, you cannot go to prison just because you’re unable to pay your debts. If any creditor or collection agency tells you so, it’s completely false.

However, if you’ve committed fraud related to the debt, and if it can be proven in court, you may very well go to prison!

Under normal circumstances, you cannot be convicted for being unable to pay your debt.

This doesn’t absolve you of all debt consequences, though. If bad comes to worse, even though you may not go to prison, you will have to face ugly situations, such as bankruptcy proceedings.

If you don’t see a way out, consider contacting an insolvency service and trying out one of their insolvency solutions.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What are the Impacts & Effects of Debt on a Person?

In this section, I’ll cover the various financial, physical, and mental impacts of unpaid loans on people.

Let’s get right into it.

Impacts of Unmanageable Debt

Too many loans can eventually throw you into a deep pit of financial issues.

First, you’re repaying more than you borrowed because of interest. That alone is enough to upset budgets in most middle-class homes. You’re giving up a substantial amount of your income away instead of utilising it or investing it somewhere.

Secondly, debt often comes with severe financial limitations. For instance, if you declare bankruptcy, you may be unable to take loans over a certain amount or may even lose control of where your money and assets go.

Lastly, unmanageable loans can be a cause for lots of stress, regardless of whether you’re a working professional or a college student.

Mental Health Problems & Debt

The American Psychological Association has spoken consistently on how debt and money problems can be very problematic for mental health.

Most people don’t realise how much worry money problems can cause them, to the point where they’re stressed all the time, anxious, have deteriorating relationships with friends and family and even have trouble getting a good night’s sleep.

Studies have revealed that 46% of people with loan problems also have mental health issues.

Also, there’s a two-way causation between debts and cognitive health. Poor cognitive health is linked to more debts, and debts are linked to poorer cognitive health.

Financial Effects

As I’ve mentioned before, debts may have seriously damaging financial effects on people. Interest is a silent financial menace.

When it comes to credit card debt, it slowly builds up the amount you owe, even in small purchases, so you pay back much more than what you get.

Other than that, debts make it harder to plan for your future. When you’re spending huge amounts on things now, you’ve fallen into the vicious cycle of immediate gratification. The problem is that this gratification isn’t painless.

Debt is a trap that seems alluring but isn’t. Once you learn of the financial torment and stress that comes with taking loans, you’ll think of it as a lose-lose situation.

Credit Report

A credit file basically records your credit activity and your loan history. Based on this information, lenders then decide if they should loan you money or not. And if they should, what interest rates should they offer you?

When you’re in debt, for instance, credit card debt, it’s mentioned on your report. That’s why it’s a bad idea to take too many loans and take too long to repay them.

If creditors see too many loans or irregular repayment history on your report, they won’t want to lend you money. Debts obviously cause issues for you in that regard.

Self Esteem

The final impact I’ll be discussing is on self-esteem.

In today’s hyper-paced economy, money is everything. It determines your respect in the corporate world, the opportunities you get, and even how you feel about yourself—your self-image.

With that in mind, debt is an indicator of a lack of financial security, which can seriously hurt your self-image.

I know that many individuals who face debt fall into pits of self-doubt—doubts about their ability, talent, worth, and how they perceive themselves.

Trust me when I tell you that being in debt does not make you a lesser human being! It is just one of life’s difficult obstacles that you have to overcome and move forward.

Financial Effects of Debt

When it comes to the financial effects of debt, the most obvious problem one can point to is the fact that it restricts the amount of money you can spend every month.

This is because if you’ve entered into any sort of debt repayment plan with your creditors, then most (if not all) of your surplus income will be going towards your debts.

This means that you’d only have money for essential costs to run your household. Any other money will go towards debt payments.

Furthermore, if your debts have high interest rates and other additional charges, then you may end up paying back a lot more money than the amount you initially borrowed.

This is especially troublesome, which is why you should always think twice before taking out a loan with a high interest rate. You should only do so in cases of emergencies and never for luxury/unnecessary purchases.

If you choose to enter into a formal debt solution such as an IVA, it could mean that you have to release equity from your home in your final year.

If you don’t have a home and choose to enter into an IVA, then its duration could be extended by another year.

Being in debt can mean that you have to stick to a very restrictive budget for an extremely long time (several years).

Furthermore, if you make a mistake or your income drops, and you fail to make a monthly payment towards your debt, that could lead to your entire debt solution failing.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Debt and Stress

Of course, being in debt can definitely be a great cause of anxiety.

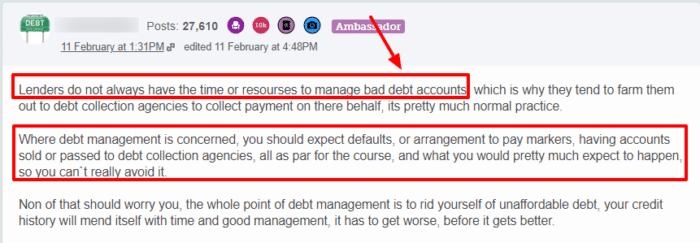

In addition to that, being hounded by creditors and debt collection agencies can exacerbate your stress levels even more.

If this is left unaddressed, it can lead to further complications with both your mental as well as physical health.

Stress has been known to cause several health issues, such as insomnia, severe anxiety, muscle tension, chest pain, high blood pressure, etc.

Being in debt can also cause a tremendous amount of mental health problems.

A study conducted by the Citizens Advice Bureau suggested that individuals with unmanageable debt were 24% more likely to have a mental health score in the bottom quarter of the total population.

Furthermore, when they looked at people with lower-than-average mental health scores, they found that:

- More than a fifth of them are more likely to be in debt

- They are twice as likely to be behind on paying a utility bill

- They are nearly 66% more likely to be behind on their council tax

From this, it can be seen that debt and mental health issues go hand-in-hand.

Poor mental health can be the effect of debt issues, but at the same time, underlying mental issues can also be the cause of debt.

Debt and Relationships

One in four people say that being in debt has had an adverse effect on their relationships.

I’ve explained above how debt can cause stress levels to rise. This can cause other problems, such as irritability.

When you’re stressed out all the time, you’re not going to be able to communicate your needs and wants effectively to your partner.

This can cause increased arguments between you and your partner. In more extreme cases, it can even lead to the relationship ending.

On one hand, debt such as this can cause increased resentment between you and your partner due to a lack of communication and growing distrust.

On the other hand, some people often choose to hide their debt from their partners. Keeping things bottled up inside themselves like this can cause devastating feelings of guilt and shame.

Hence, in this way, debt causes increased mental health issues in such individuals.

Debt and Behaviour

Going back to the Citizens Advice Bureau study I mentioned earlier, another great impact of debt that is often overseen is how it can affect a person’s behaviour.

By behaviour, what’s being referred to here is the fact that being in debt often discourages a person from making major life decisions that could be good for them.

This can cause their lives to become stagnant.

The study conducted showed that people who had unmanageable debt were:

- 49% less likely to start a business of their own. (Compared to 33% without debt)

- 41% less likely to study or retrain (Compared to 27% without debt)

- 34% less likely to move to somewhere else (compared to 25% without debt)

- 28% less likely to change jobs (compared to 19% without debt)

Many people tend not to make these major decisions by saying that they’ll consider them once they have paid back the money they owe.

In this way, debt holds back the potential of many individuals who would have made decisions to make their lives better otherwise.

It is always best to get support from an independent debt charity. They can guide you to a debt-free life again.

You can get free advice by contacting organisations such as: