Consolidate Credit Cards – Complete Guide

Is your head spinning with many credit card bills? Wondering if you could combine them? This article will tell you about how to do just that. It’s called credit card consolidation.

Our website offers guidance to over 170,000 people each month regarding their debt issues. We know it can be tough when you’re worried about unpaid debt, but you’re not alone. We’re here to help you.

In this article, we’ll explain:

- What credit card consolidation is.

- The trends of consumer debt in the UK.

- How much credit card debt is normal in the UK.

- The risks of a bad debt consolidation loan.

- How to get a free debt consolidation loan quote.

We understand that debt can be scary, but there’s no need to panic. There are ways to manage debt, and we’re here to guide you through them. Let’s take the first step and learn about credit card consolidation.

Average Credit Card Debt in the UK

Unsurprisingly, more people are going online to find out how to consolidate all credit cards into one to make their debt repayments easier. The average UK credit card debt is currently above £2,000.

Of course, credit card consolidation is not the only method to get out of credit card debt, but it is a popular choice for some suitable debtors. But first, what really is credit card consolidation?

Consolidate Credit Cards… Why?

Debt consolidation can be done in lots of ways. It involves making multiple debts turn into fewer, more considerable debts with better repayment terms that work in your favour.

You can consolidate debts with loans too, and there is a MoneyNerd payday loan consolidation post if you want to learn more about this topic!

When debt restructuring, you need to reduce the number of credit card debts and make repayment terms more favourable. For example, you might have three credit card debts of £500 each. By consolidating these three credit cards into one credit card, you will have one debt of £1,500.

There are other considerations, but we are keeping it simple for now.

This process of reducing the number of your credit card debts is only worth it if the new single credit card debt has a lower monthly repayment than the previous three credit cards combined.

It may have other beneficial terms, such as an initial repayment holiday where you have to make no repayments for several months. However, this should not be the only reason you consolidate credit cards!

The potential benefits of consolidating credit cards are more affordable monthly repayments. However, you might have to pay back for longer and have more to pay back overall.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.99% |

£218.73 |

£26,247.92 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 6.95% |

£220.40 |

£26,447.92 |

| Selina | 7.5% |

£221.35 |

£26,562.50 |

| Equifinance | 7.7% |

£221.70 |

£26,604.17 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

What If You Can’t Consolidate Credit Cards?

Don’t panic if you cannot consolidate your credit cards because of bad credit. Alternative debt solutions are available. These include:

-

Individual Voluntary Arrangements – a way to consolidate your debts and make monthly repayments for five years with the bonus of wiping all unpaid debt afterwards. An IVA can cost from £1,000 to £2,220.

An IVA is a legally-binding solution, and you must include at least 75% of your existing debts. It is important to note that not all debts can be included (such as child support, fines and student loans). Those living in Scotland cannot get an IVA but can check if they meet the eligibility criteria for a Protected Trust Deed instead.

-

Debt Relief Orders – a legal order to stop all creditors from asking for money for one year. All debt on the DRO is wiped after a year if your finances have not improved. Furthermore, the process is straightforward, and you won’t need to go to court. It costs £90 to apply for this debt solution.

A DRO is only an option for people with less than £20,000 worth of debt and less than £50 disposable income per month. As with IVAs, not all debts can be considered, and homeowners cannot apply for DROs.

-

Debt Management Plans – a common debt solution that allows you to consolidate debts and make monthly repayments until they are paid off. Debt charities, such as StepChange, offer this debt solution for free.

Although Debt Management Plans can help you manage your debt and avoid formal insolvency, it is not legally binding, and you risk creditor rejection. As with other debt solutions, you will also experience an initial dip in your credit score too (but if you can make your payments on time, it can actually be beneficial for your credit score in the long run!)

-

Bankruptcy – filing for bankruptcy is the last resort for people in a severe financial situation. It enables you to write off a lot of unsecured loans. Once in action, it will stop creditors from contacting you, and legal action will stop too.

Declaring bankruptcy costs £680, it has a negative impact on credit rating, and you may have to liquidate or sell your non-essential assets. Furthermore, it could make it challenging to gain employment, especially if you want to become a company director or if you want to work in finance or law.

All debt solutions can have significant implications, so you should seriously consider your options before making a choice. I’ve put together a debt options article to give you more information to help you make an informed decision that’s right for your situation.

How to Consolidate Credit Cards

If you are struggling to meet the repayments due on your credit cards, debt consolidation is one of the financial tools and strategies to explore. But how do you consolidate credit cards? The answer lies in something called a credit card balance transfer.

What Is a Balance Transfer?

A credit card balance transfer is a way to consolidate credit cards by opening another credit card specifically for this purpose. This is called a balance transfer card, allowing you to transfer the balance of other credit cards to this card.

Not all lenders offer this type of card. Always double-check the terms and conditions before signing up for anything.

What Else to Watch Out For?

These balance transfer credit cards usually come with an interest-free period at the beginning of the contract. This period could be as long as six months. This means the balance you transfer will not increase during these months, which could help you pay off more debt in the immediate future.

However, before you sign up for a balance transfer credit card, you need to do the following:

- Check the balance transfer fee

- Look at how much interest you’ll be charged after the initial interest holiday period

Only by working out the balance transfer fee (typically 1-3% of the balance you transfer over) and the interest payments after any interest-free period, will you know if consolidating credit cards will be worth it.

From my experience, credit card debt management and understanding credit card terms isn’t easy. Consult a reputable debt charity if you need assistance.

Debt consolidations loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking for a better interest rate?

- Stuck with the confusion of multiple repayment plans?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

Who Should Use a Credit Card Balance Transfer?

Credit card consolidation is not for everyone. It is most suitable for people struggling with their finances but have not fallen behind just yet. Getting a credit card balance transfer is an early intervention debt prevention technique.

Other options are available if you are already behind on repayments and receiving debt letters.

Can Anyone Complete a Credit Card Balance Transfer?

Not everyone can use a balance transfer credit card. To access one of these cards, you must make an application, and like any other credit application, getting approved will depend on your credit file.

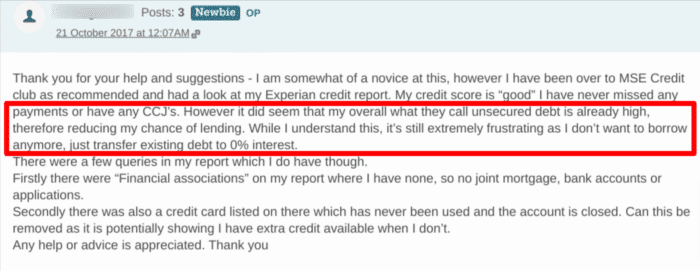

You can get a balance transfer credit card if you aren’t in debt and have a decent credit score. Despite having a good credit score, the MoneySavingExpert forum user above could not get a 0% balance transfer credit card because they had too much unsecured debt.

If you are already in a lot of debt or have a bad credit history, managing multiple credit card debts using this solution may not be possible for you.

I Still Don’t Know What to Do…

If you are still struggling with credit card debt, it is a good idea to consult a top UK debt charity for financial advice and consultation. StepChange, National Debtline and Citizens Advice all offer free impartial debt advice tailored to individual circumstances.