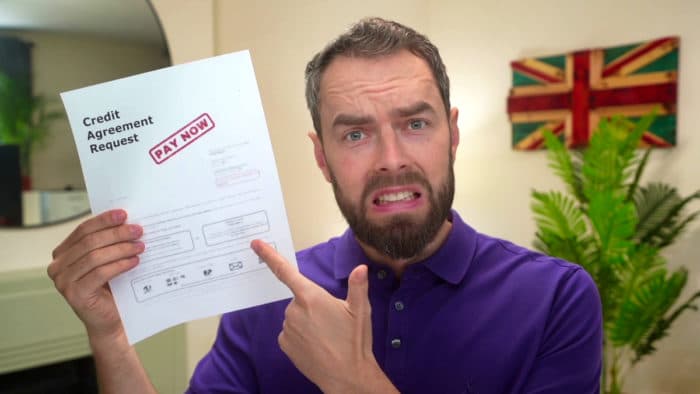

Credit Agreement Request Letter Template

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you looking for help to write a credit agreement request letter? You’re in the right place! Every month, over 170,000 people visit our website for help with debt problems.

In this article, you’ll find:

- A free letter template to make your request easy and worry-free.

- Clear information about your rights under the Consumer Credit Act.

- Detailed steps on what to do if your creditor doesn’t reply to your request.

- Advice on dealing with unaffordable debt.

- Tips on how to write off debt legally.

We know that dealing with debt-related problems can feel overwhelming. But don’t worry, we’re here to help.

Downloadable Resource

The download links below take you to a Google document template where you can make a copy or save in any document format you like. Note, you may have to login to your Google account.

Download – Single (for one person)

Download – Joint (for couples)

Am I allowed to ask for my credit agreement?

You are allowed to ask for your credit agreement because of the Consumer Credit Act. You only have this right if you still owe the creditor money. So, if you are part-way through paying back your creditor, you are legally allowed to ask and receive your credit agreement. However, if you have finished paying back your credit, you may not have the right to access your credit agreement anymore.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What is the Consumer Credit Act?

In a nutshell, the Consumer Credit Act is a piece of legislation that governs how credit agreements are advertised and managed. It was brought into law in 1974 but has since been amended in 2006. The Consumer Credit Act provides protection and assurances for people who take out credit.

You can request a copy of your credit agreement with any company under sections 77, 78 and 79 of the Consumer Credit Act.

How much does it cost to use the Consumer Credit Act?

If you request your credit agreement from a lender using this legislation, you will need to pay a fee of £1. You should include £1 within your letter to request access or your creditor could write back to ask for it or deny your request. It’s best to include the £1 fee in your request to prevent delays.

Note, if you use the Consumer Credit Act to ask for a statement of your account, you will not need to pay the £1 fee as stated in section 77b.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What information will I get back?

Once you have sent your request for your credit agreement and paid the £1 fee, you should receive a true copy of the agreement in good time. The copy of the agreement must include all terms and conditions that were in the original agreement when you signed it, and it must also state any changes to these terms (if applicable). The copy should be clear to read without difficulty.

The copy does not have to include your signature or date of signature.

My creditor didn’t reply to my request for information

Your creditor should provide a copy of the credit agreement within 12 days. During this time they cannot take you to court for the debt. If they do not respond to your request, they can not take legal action against your debt until they respond.