Crystal Collections Debt Collectors – Do You Have to Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Dealing with Crystal Collections Debt Collectors can make you feel worried. You might be asking yourself, “Do I really need to pay?” or “What happens if I can’t?” You’re not alone. Every month, over 170,000 people come to our site looking for information about their debt worries.

In this article, we will help you understand:

- Who Crystal Collections Ltd are and what they do.

- How to know if the debt they are asking for is really yours.

- Ways to stop them from chasing you so much.

- Options to set up a plan to pay them back or even write off your debt.

- Your rights and what action Crystal Collections can take against you.

Our team knows how you feel. Some of us have dealt with debt collectors too. It can be scary, but we’re here to help you understand your options and find a way forward.

Let’s take the first step together to deal with Crystal Collections Debt Collectors.

How to deal with Crystal Collections Limited

Now we have the basics down as to who Crystal Collections Ltd are, what they do, and why they might be contacting you, let’s work out your next steps. Let’s focus on what to do if they’ve been in touch with you. Following these guidelines will let you know where you stand, and what action you should take.

They keep on sending me letters and calling me

Persistence and debt collection agencies go hand-in-hand – they’re almost legendary for their continued persistence in getting you to pay the debt. There is a fine line between persistence and harassment, and debt collection agencies are not allowed to harass you. Crystal Collection Debt Collectors are members and affiliates of some of the best known and respected financial governing bodies, so they will be expected to adhere to the rules.

In a nutshell, you should not ignore them, nor should you ignore any other debt collection agencies. It’s rare that a company such as Crystal Collection Ltd contact you in error, and even if they have, ignoring them won’t stop their letters. They can also escalate matters against you if you continue to ignore them.

What you can do though is dictate how you want to be contacted. For instance, you can ask that they only contact you in writing. This can be a good option, as it gives you physical proof of their correspondence if trouble arises down the line.

Ignoring the matter won’t get rid of them, so it will save you a headache by dealing with the matter head-on.

Should I just pay Crystal Collections Debt Collectors?

At the end of the day, we all have to pay the debts we make at some point. There can be a few different conditions that might affect how you go about this. For instance, if you are able to prove that the debt isn’t yours, or that the debt was issued to you illegally, then you can contest it. To do this, you need to make sure you have as much information as possible.

If you are certain that the debt is yours, and if you are capable of repaying it in full, then this is absolutely what you should do. One trick that could mean you have to pay slightly less is contacting the original creditor and seeing if repayment can be made to them rather than Crystal Collections Ltd.

» TAKE ACTION NOW: Fill out the short debt form

Can I stop Crystal Collections Ltd from visiting my home?

It’s rare that regular debt collection agencies will actually visit your home, as it’s often a last resort for them if they see no further progress can be made from sending you letters and phoning you up. However, they are obliged to give you a warning letter declaring their home visit, which is usually sent with at least seven days’ notice.

As Crystal Collections Debt Collectors primarily work within the asset repossession sphere, there’s more likelihood of them visiting your home, especially if you ignore their correspondence and don’t reach out to them yourself. Their primary concern is rectifying the debt for their client, so they will go to great lengths to reconnect you with the client who is owed the debt.

Financial and Legal Matters

It’s essential to know and understand your rights when dealing with companies like Crystal Collections Debt Collectors, as you have more rights and options than you might realise. That being said, they also have rights and options, so it’s important to know these too. While most companies have to adhere to rules laid out by their governing bodies, there have been some examples of companies breaching these rules.

Can they take action against me?

Other than writing letters to you and calling you, they can also potentially visit your home. If you fail to get in touch with them, they are permitted to escalate matters. On the Crystal Collections Ltd website, you can see that they pride themselves on their ‘empathetic, sensitive, and professional approach’. This doesn’t mean that they’ll let you get away with it though! They can legally get the court involved if it seems like there’s no other way to go. Here are some of the actions they might take:

So, you obviously don’t want to have any of these happen. Not only will they cause you stress and worry in the short term, but they can also have long term implications. Your credit rating could end up being damaged in the process.

Do I have any rights?

Crystal Collections Debt Collectors are members of the Credit Services Association (CSA) as well as the Financial Conduct Authority (FCA), which means there is a code of conduct that they are expected to follow, and rules that they must adhere to. These include, but aren’t limited to:

Knowing and understanding these rights is so important, as if there is any evidence of Crystal Collections Ltd disobeying these rules, it can make your debt null and void. Keep track of all your correspondence with them to ensure that they’re obeying the rules.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

I can’t afford to pay Crystal Collections Debt Collectors – what can I do?

One of the hardest things in life is realising that you can’t make a payment for an outstanding debt. It can be both overwhelming and embarrassing, but remember that you’re not the first and you won’t be the last. There are also a series of initiatives that can help you cope with the matter at hand.

Firstly, it would be worth contacting Crystal Collections Debt Collectors to explain your situation in full and acknowledge their correspondence. This will most likely put you on a good footing with them, and Crystal Collections Ltd could be likely to accept a repayment plan as a result of this. This means that instead of paying the amount in full, you make a series of installments towards the full amount.

There are also initiatives in place to help you pay these debts. Debt management plans and debt consolidation loans are both options that you can choose to help you pay off the debts you might have accrued.

Can I complain about them? How do I do that?

If you don’t think that Crystal Collections Ltd have behaved in an appropriate manner, you have every right to make a complaint about them. After all, they are bound by the fairly strict rules laid out in their governing bodies. You can find a dedicated complaints policy document on their website, which takes you through the whole process.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Crystal Collections Debt Contact Information

Staying On Top Of Your Debts

One of the hardest parts about being in debt is that the industry isn’t at all transparent.

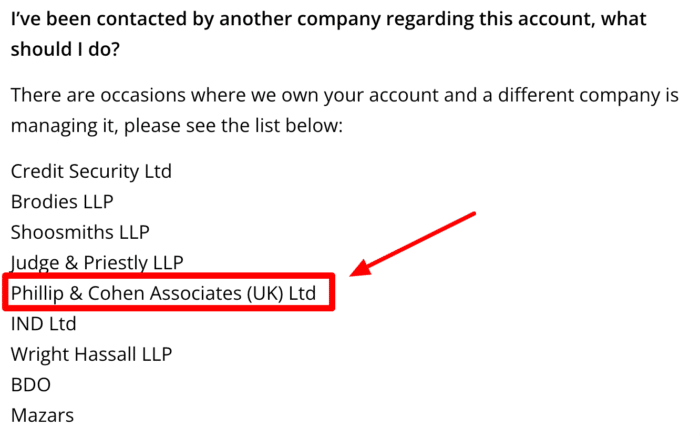

One common tactic used by Debt Collectors is contacting you under multiple names and addresses.

Sometimes, it’s for practical reasons, but even then it can be confusing and intimidating. So it’s important to try to keep a level head and research what’s going on.

Some of the biggest debt collectors in the UK operate under multiple names.

- Robinson Way will sometimes contact you under the name Hoist Finance.

- Cabot Financial Group recently bought Wescot Credit Services

- Credit Style communicate as both Credit Style and CST Law.

- Lowell Financial also owns Overdales and collects debts under both names.

In fact, in the case of PRA Group, they’ve been known to use multiple company names. As you can see in the image below.

If you’ve been contacted by a debt collector recently, it’s worth going through your post and emails to check that you haven’t missed anything, just in case they’ve started writing to you under a different name.

Final Thoughts

That’s just about everything you might need to know about Crystal Collections Debt Collectors, and how you might go about dealing with them. It can be confusing, overwhelming and stressful, but if you follow these tips, you should be able to get through it without too much pain or hassle.