Darcey Quigley Debt – Should You Pay

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’ve received a letter about a debt from Darcey Quigley and aren’t sure what to do, don’t worry, you’re in the right place for answers. This guide will help you understand who Darcey Quigley & Co Ltd are, what they can do, and how you can respond.

Every month, over 170,000 people turn to us for advice on debt matters, so remember, you’re not alone. In this friendly guide, we’ll explain:

- Who Darcey Quigley & Co Ltd are and who they collect debt for.

- How to beat Darcey Quigley debt collectors and stop them chasing you.

- How to check if the debt is really yours.

- What to do if you can’t afford to pay the debt.

- How you could possibly write off some of your Darcey Quigley debt.

We know how worrying it can be to get a letter from a debt collector, as some of our team have been in the same boat – we understand how you feel. Let’s dive in to learn more about Darcey Quigley and the options available to you.

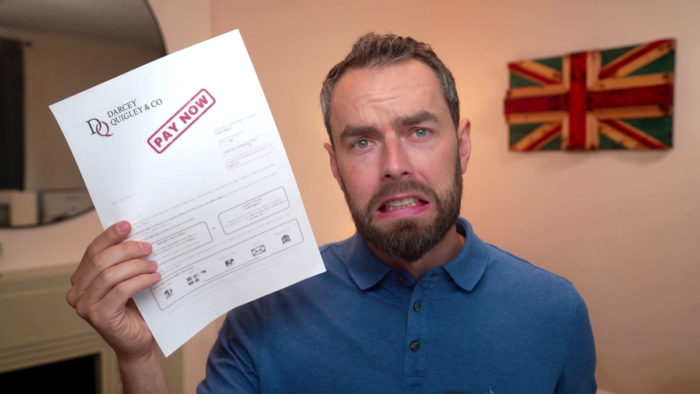

Darcey Quigley & Co debt letters

You are likely to receive a Darcey Quigley debt letter, which is really called a Letter Before Action (LBA). The LBA tells you that legal action will be taken if you don’t pay in full by a deadline. It’s designed to make you pay quickly to avoid future legal action.

However, there is no way of knowing whether the threat of legal action is real or empty. Some debt collection agencies will threaten court action even when the client has no intention to go to court. This is to scare you into paying. Yet, it’s a risk to assume no legal action will be taken.

Sending a prove the debt letter

MoneyNerd has made creating a prove-it letter easier than ever. Download our prove the debt template and add your own details easily. This will save you time and worry when asking Darcey Quigley Debt Collection to prove the debt.

Before you ask for proof do this!

Before you write a prove-the-debt letter, you should check if another loophole could get you out of having to pay. This other loophole is called statute barred debt. Many UK debts that are at least six years old don’t have to be paid. The courts don’t deal with these older debts, and therefore, you can never be forced to pay.

Read more about debts that become too old to be collected and see if yours qualifies!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What can Darcey Quigley & Co do?

Darcey Quigley & Co can make contact with you and ask you to make the payment. They may do this by calling, texting, emailing and via letters. They must never discuss your debt with someone else.

If you think Darcey Quigley & Co are contacting you too frequently or at unsociable hours, you should make a complaint to them. You can even tell them your preferred contact methods and times. If they persist in harassing you, you should tell the Financial Ombudsman Service about their collection tactics.

» TAKE ACTION NOW: Fill out the short debt form

Are Darcey Quigley & Co bailiffs?

Darcey Quigley & Co are not bailiffs. They are a debt collection agency only, which means they try to chase unpaid debts before their client takes legal action, or until they become statute-barred.

Once a judge asks a debtor to pay, they must do so or face debt enforcement action. One method of enforcing the judge’s decision is to use bailiffs, who will come to your home and seize goods. Darcey Quigley & Co cannot come to your home, force entry or take your possessions. They’re not allowed to suggest they can do these things to intimidate you.

Will They Give Up Chasing?

After all that you might be wondering whether you can just wait it out and hope they stop chasing you.

Sadly, that’s probably not going to happen. Most debt collectors are persistent.

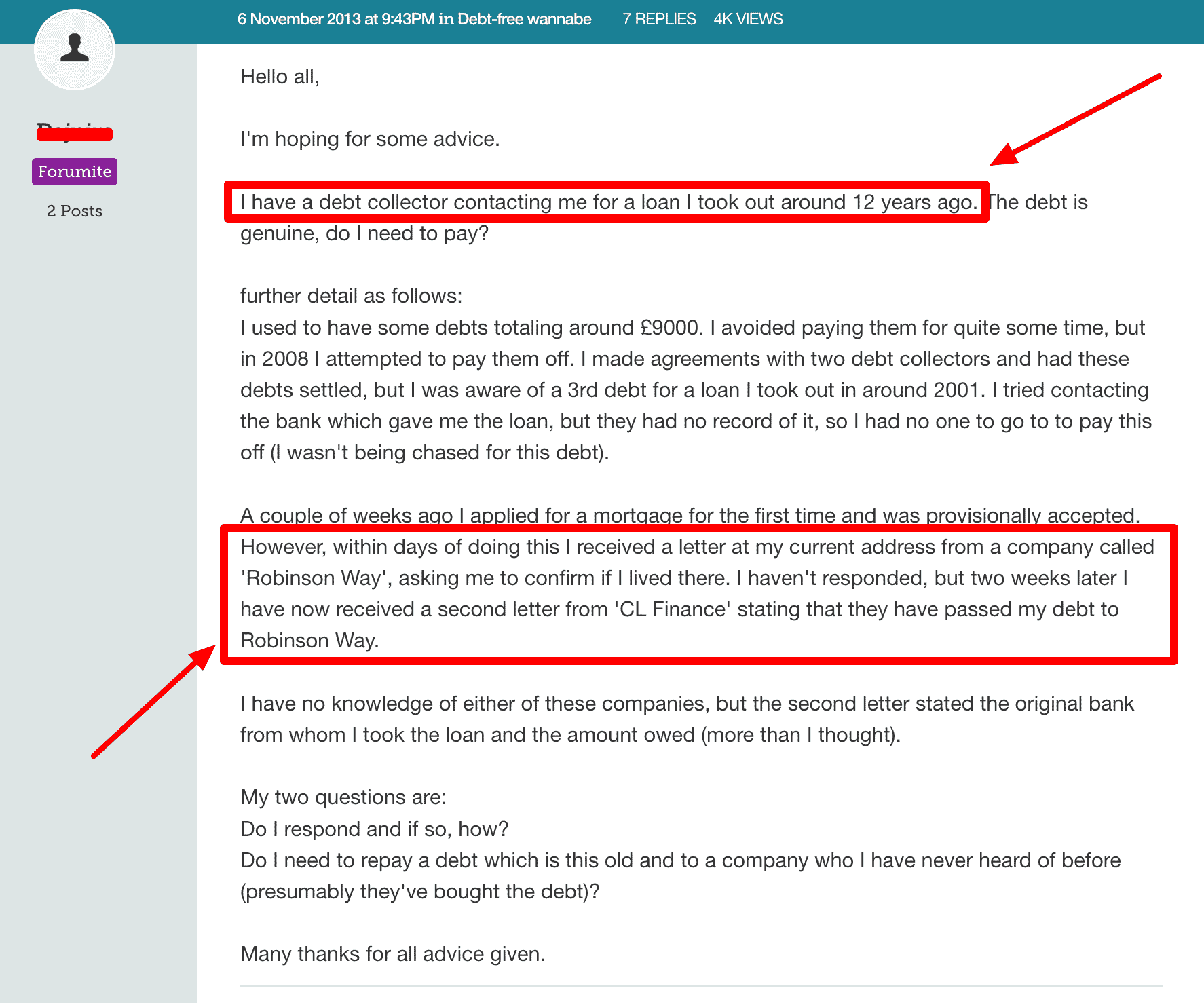

Source: Moneysavingexpert

As you can see Robinson Way starting to chase a debtor mere days after their mortgage application and a full 12 years after the debt was originally chased.

Other agencies like Lowell Group, Portfolio Recovery and Cabot Financial are constantly being accused of buying Statute Barred debts and then chasing people for payment.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Darcey Quigley & Co Contact Information

| Address: | International House, Stanley Boulevard, Hamilton Technology Park, Glasgow, G72 0BN |

| Phone: | +44 (0)1698 821 468 |

| Email: | [email protected] |

| Website: | https://www.darceyquigley.co.uk/ |