Debt and Revenue Services Debt Collection – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about a letter you’ve received from Debt and Revenue Services Debt Collection? Unsure if you should pay or even if this is a real debt? Don’t worry; you’re in the right place for answers. Each month, our website gives helpful advice to over 170,000 people regarding their debt questions.

In this article, we will help you understand:

- Who Debt and Revenue Services are.

- How to know if you really owe this money.

- What happens if you don’t pay them.

- Ways to stop them from writing to you.

- How to maybe make the debt smaller or even go away.

We know how scary it is to get a letter like this as some of our team members have had letters from debt collectors too. We understand how you feel.

Here’s how you can deal with Debt and Revenue Services Debt Collection.

Those Scary Debt and Revenue Services Letters

Make Debt and Revenue Services Prove Your Debt

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Do Not Ignore Debt and Revenue Services

» TAKE ACTION NOW: Fill out the short debt form

Can Debt and Revenue Services Come to My Home?

Debt Solutions Are at Hand!

How to Complain about Debt and Revenue Services

Mitigate Debt and Revenue Services Calls

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

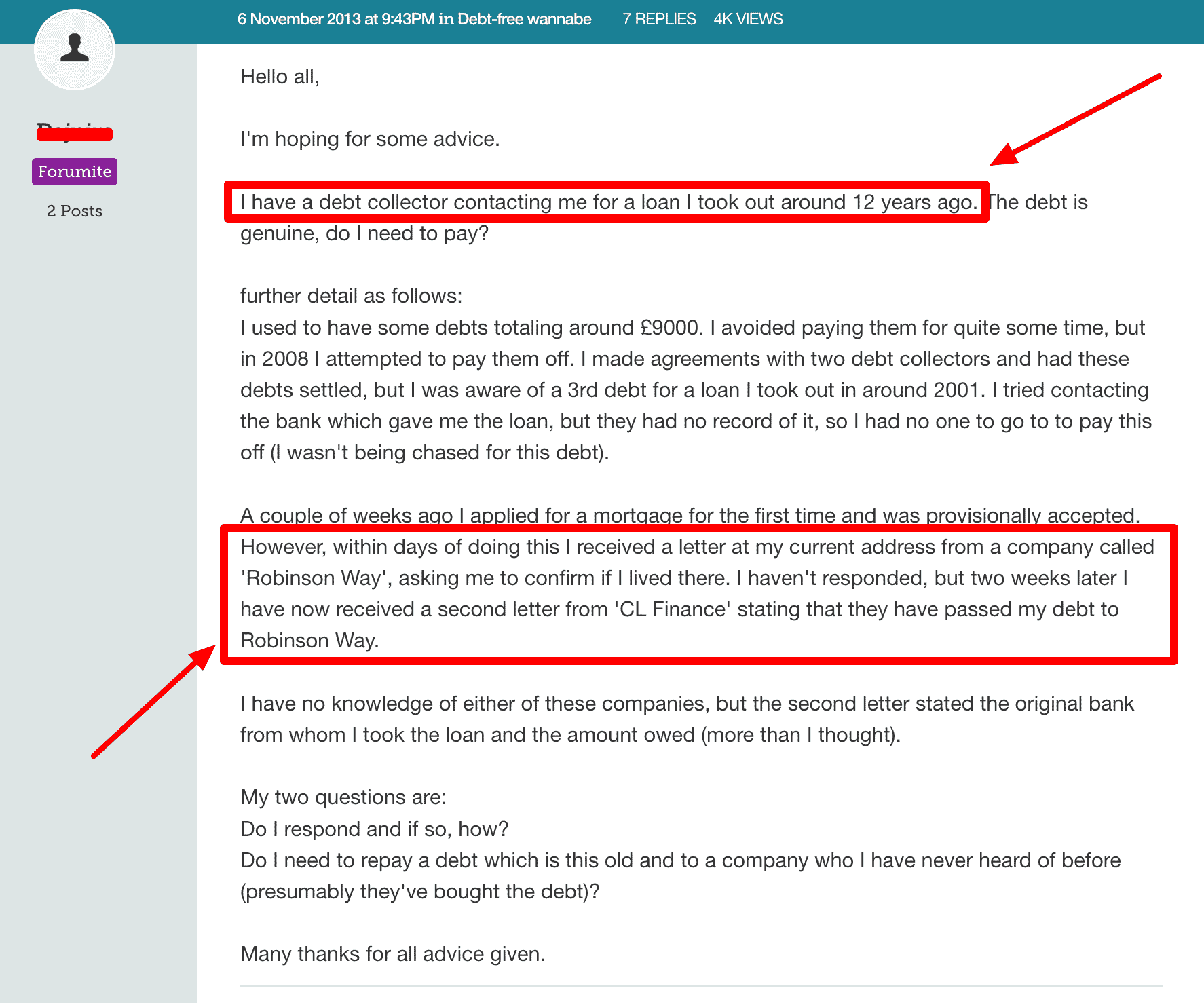

Will They Give Up Chasing?

After all that you might be wondering whether you can just wait it out and hope they stop chasing you.

Sadly, that’s probably not going to happen. Most debt collectors are persistent.

Source: Moneysavingexpert

As you can see Robinson Way starting to chase a debtor mere days after their mortgage application and a full 12 years after the debt was originally chased.

Other agencies like Lowell Group, Portfolio Recovery and Cabot Financial are constantly being accused of buying Statute Barred debts and then chasing people for payment.