Debt Consolidation Loans with No Guarantor – Top Options

In this article, we aim to help you understand debt consolidation loans. Our focus is on options that don’t need a guarantor, especially for those with bad credit. We know that managing debt can be tough and cause worry. You’re not alone, and we’re here to help.

Every month, we guide over 170,000 people to find answers to their money worries. We’ve got plenty of useful advice to share. In this piece, we’ll discuss:

- The meaning of a debt consolidation loan.

- The real cost of a bad debt consolidation loan.

- Ways to improve your credit score.

- The good and bad points of debt consolidation.

- Other ways to deal with debt.

We understand the worry of unpaid debt. Yet, there are many ways to handle debt. Let’s start by learning more about debt consolidation loans without a guarantor.

What are debt consolidation guarantor loans?

Debt consolidation guarantor loans are the same as other debt consolidation loans but the applicant must apply with a guarantor. The guarantor is someone who agrees to be responsible for the monthly repayments if the applicant fails to make the monthly repayment on time and in full. This provides extra security to the lender and could get a lower APR offer as a result.

They’re usually used by people with a poor credit rating because they cannot get one of these loans on their own, and some lenders even demand that applicants apply for their loans with a guarantor. The guarantor may need to meet certain criteria, such as having a good credit score, being of a certain age or even owning their own UK home.

What is a bad credit no guarantor consolidation loan?

A bad credit no guarantor debt consolidation loan is a type of consolidation loan for people with a poor credit score – but without the need for a guarantor listed within the application.

These types of loans are in demand among people who cannot find someone to act as their guarantor. Or by people who do not wish to ask someone to be their guarantor due to embarrassment, or having to reveal their personal money problems.

Consolidation loans for poor credit without a guarantor are available, it just means assessing your situation and speaking to an authorised provider.

This is understandable, but you never have to go through your money worries alone. A UK debt charity can provide personal finance advice that is always confidential.

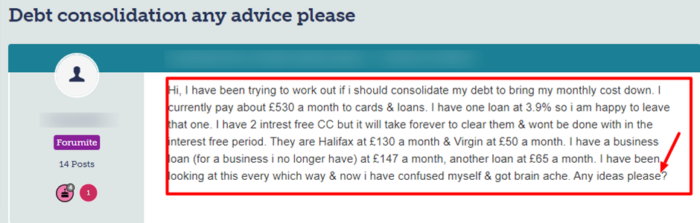

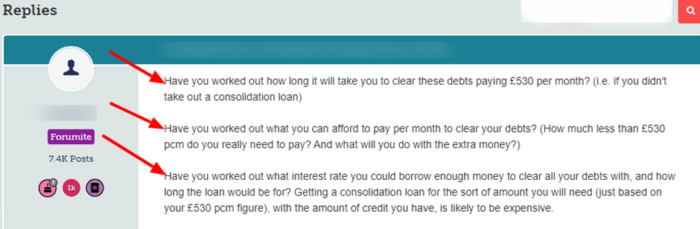

A lot of people ask questions about debt consolidation loans, once of which I’ve listed here.

Source: Moneysavingexpert

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

Can I get a debt consolidation loan with bad credit?

Accessing any type of credit, including a debt consolidation loan, is more difficult if you have a bad credit score.

Your credit score helps lenders determine the risk of you not repaying the money, so if you have a poor credit rating, it’s less likely your application will be approved.

Bad credit and debt consolidation loan eligibility does exist. There are some bad credit loans advertised for those without a good credit history, which can be used to consolidate debts.

It’s still important to only apply for one of these loans from a lender that is authorised and regulated by the Financial Conduct Authority. Plus, you should seek advice from a professional first.

Because the risk of lending to you is deemed to be greater, the rate of interest is likely to be higher. If the interest rate is too high, it may not be worthwhile consolidating your debts with the loan.

Another option is to use debt consolidation guarantor loans instead…

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.99% |

£218.73 |

£26,247.92 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 6.95% |

£220.40 |

£26,447.92 |

| Selina | 7.5% |

£221.35 |

£26,562.50 |

| Equifinance | 7.7% |

£221.70 |

£26,604.17 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

Debt consolidation loans with no guarantor

Most consolidation loans on the UK market do not require the applicant to have a guarantor. It’s the exception rather than the rule overall when not focusing on bad credit consolidation loans only.

If you’re simply looking for a no guarantor consolidation loan, then you will find them at:

- HSBC

- Santander

- Lloyds

- Natwest

- TSB

- Tesco

- Virgin Money

- Halifax

- NatWest

- Royal Bank of Scotland

This list is not exhaustive and there are plenty of other places to apply for a consolidation loan without a guarantor, including with online lenders (see below!).

No guarantor debt consolidation loans for bad credit

But if you’re looking for a bad credit consolidation loan with no guarantor, you will have a much smaller selection of potential places to borrow from. But there are some firms offering bad credit consolidation loans without the need for a guarantor, such as:

#1: Likely Loans

Likely Loans is an online loan provider for people with a less than satisfactory credit history. They advertise unsecured loans that do not require a guarantor when applying. At the time of writing, you could borrow up to £5,000 over a maximum repayment period of three years. The representative APR is 59.9%.

#2: Ocean Finance

Ocean Finance is a well-known loan provider in the UK and you may recognise their brand from TV adverts. They offer no guarantor consolidation loans with a 69.9% APR for personal unsecured loans. They also offer secured loans if you are a homeowner and want to borrow more than £15,000.

#3: Bamboo Loans

Bamboo Loans is another online lender offering consolidation loans to the UK market without the need for a guarantor. Their loans are available between £1,000 and £8,000 at a representative APR of 26.9%. They also publish the maximum APR they will offer anyone who is approved, namely 89.9% APR.

#4: Solution

Solution offers both guarantor and no guarantor loans for people with bad credit. They openly state that repayments will include higher APR if you do not have a guarantor or agree to list an asset within the agreement, which would make it a secured loan. You can borrow up to £25,000 in either case.

#5: Shawbrook Bank

Debtors over 25 who have lived in the UK for at least three years will be able to apply for a no guarantor consolidation loan with Shawbrook Bank, an online UK bank. With a minimum income of at least £15,000, you could access one of their loans between £1,000 and £30,000 with a representative APR of 14.9%.

These are here as examples only and may not be the best option for you. Always do your own research and get free debt help for support.

Debt consolidations loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking for a better interest rate?

- Stuck with the confusion of multiple repayment plans?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

Are there any debt consolidation loans bad credit no guarantor direct lenders?

There are no guaranteed debt consolidation loans with assured approval, either directly from a lender or when using a credit broker.

Everyone who applies for credit in the UK will need to have their personal finances assessed to ensure they can meet monthly repayments. Thus, there are no guaranteed debt consolidation loans.

You can improve your chances by using a guarantor loan or by improving your credit score. One of the quickest and most effective ways of improving your credit rating is to look for mistakes on your file and have them removed by the lender that recorded the mistake.

If the lender refuses, you can ask the applicable credit reference agency to remove it instead.

Support with debt consolidation loans with no guarantor

If you are considering applying for a consolidation loan without a guarantor, make sure you’re making the most effective move by seeking professional advice.

Help with debt consolidation loans without a guarantor is possible with the right research and advice.

Free and confidential advice is available through charities like Step Change and National Debtline. Get in touch now before starting your no guarantor consolidation loan application.

Glossary of terms

DMP – Debt Management Plan

FCA – Financial Conduct Authority

APR – Annual Percentage Rate