Debt Consolidation vs Debt Settlement – Full Comparison

Debt consolidation vs debt settlement – how different are they, and which one should you choose?

I explain the differences between these two debt management strategies, providing clarity so you know which one is more suitable for your situation.

As always, if you need further help and support dealing with problem debt, speak with one of the reputable UK debt charities.

What is debt consolidation?

Debt consolidation is when someone reduces the many debts they have by taking out new credit and using the money to pay off multiple other debts.

For example, you might have three loans and take out a debt consolidation loan to pay off all three loans. In a nutshell, you lump all of your debt together.

The benefit of this is it makes keeping up with monthly repayments easier with less chance of overspending or missing frequent repayments. Moreover, finding credit with a better interest rate than you’re currently paying could save you money.

The four common ways to consolidate debt are:

- Using a debt consolidation loan

- Using a balance transfer credit card (to consolidate other credit card debts only)

- Debt Management Plans (DMPs)

- Remortgaging or getting a second charge loan and using the home equity to repay existing debts

What is debt settlement?

Debt settlement is when the debtor and the creditor agree to settle the debt early with one lumpsum payment. This usually involves the lender “forgiving” a percentage of the debt.

For example, if the debtor owes the creditor £1,000, they could make an offer to settle the debt for £800. The other £200 would then be written off and would not need to be paid.

It’s essential that you get any debt settlement agreement in writing before making a payment.

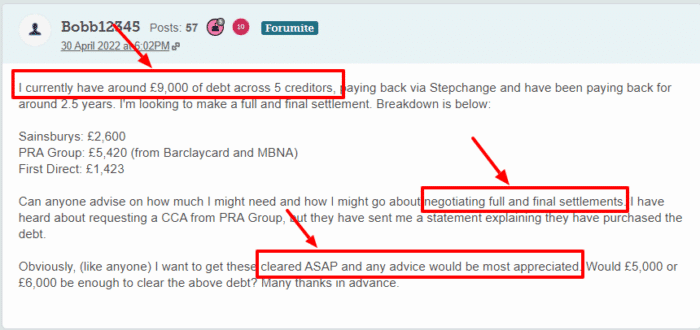

How to negotiate a debt settlement

If you decide to negotiate a debt settlement, you usually have three options:

- You can negotiate the debt settlement yourself

- You can ask a debt charity to help you negotiate

- You can use paid-for debt settlement companies

You should be wary of a debt settlement company claiming they can get a better deal than you would be able to negotiate. The end decision is down to the creditor, and it’s unlikely that a paid-for service will get a significantly better agreement – if at all.

I suggest starting your offer as low as 30% of the outstanding balance. However, most debt settlements are in the region of 70%, so expect counter offers as the negotiations progress.

If you manage to get any money wiped off the balance owed and you can afford it comfortably, you should see this as a victory.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 6.34% |

£219.34 |

£26,320.83 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 7.99% |

£222.20 |

£26,664.58 |

| Selina | 8.45% |

£223.00 |

£26,760.42 |

| Equifinance | 9.95% |

£225.61 |

£27,072.92 |

| Evolution | 10.2% |

£226.04 |

£27,125.00 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

Is debt consolidation the same as debt settlement?

Debt consolidation and debt settlement are two different debt management strategies. Whereas one tries to move all of the debt into one place while reducing interest payable, the other attempts to clear an individual debt while getting some of the balance written off.

However, there are some similarities between debt consolidation and debt settlement. They are both strategies that can reduce the debtor’s number of debts and the total amount of debt owed. And they are both typically used as an early intervention.

Debt consolidation vs debt settlement

Debt consolidation and debt settlement can both be beneficial. The difference between using debt consolidation and debt settlement comes down to personal circumstances.

Debt consolidation is a method used by people who want to get a grip on spiralling finances, or by those that just like to grab a cheaper deal.

On the other hand, debt settlement is usually used by people who have debts and have suddenly come into money, maybe through new employment or inheritance. It is used as a way to save while paying back what is owed.

However, a debt settlement has implications on your credit score, which we discuss further in this guide.

Let’s now look at the pros and cons of debt settlement and debt consolidation.

| Debt Consolidation | Debt Settlement |

|---|---|

| Has positive effect on your credit score if all debts are paid on time. Can hurt your rating if new loan is missed | Typically results in a significant negative impact |

| Interest rates typically reduced or fixed | No interest as the goal is to reduce the principal |

| Fees may apply for the new loan or service | Debt settlement companies might charge fees which can be a percentage of the debt or the amount saved |

| Creditors are paid the full amount owed | Creditors agree to accept less than the full amount |

| Fixed monthly payments in most cases | One-time settlement or a few payments over a short period |

| Might save on interest but principal remains the same | Could save on the principal amount |

| If secured against an asset (like a house), there’s a risk of losing it if not repaid | Creditors might not agree to settle, legal actions possible |

| Can improve financial situation if managed well | Debt is reduced, but credit score might be impacted for years |

Debt settlement is the fastest way to clear your debts and gain freedom. However, it can hurt your credit score since it is noted on your file that the account was settled for less than originally agreed. So you may want to consider debt settlement as a last option.

Debt consolidation and debt settlement at the same time

You might be wondering if you could use both at the same time.

For example, could you take out a debt consolidation loan to pay off multiple debts, and then try to reduce the amount you have to pay back on the individual debts to clear them?

This is possible. But you should get any debt settlement offers in writing before you apply for the debt consolidation loan or balance transfer credit card.

Don’t apply for a loan or credit card to consolidate debt in the hope that your creditors will allow you to settle for less. Doing so could cause financial difficulty and a worsening debt problem.

Debt consolidations loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking for a better interest rate?

- Stuck with the confusion of multiple repayment plans?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

How much does debt consolidation affect your credit score?

When you apply for a debt consolidation loan or a balance transfer credit card, the lender you apply to has to complete a hard search of your credit score.

This doesn’t substantially impact your credit score, but if you were to apply for lots of loans or credit cards in a short time, it would.

Debt consolidation will not negatively affect your credit file. You would damage your score if you didn’t keep up with repayments on the new debt.

How much does debt settlement affect your credit score?

Settling a debt for lower than its value will negatively affect your credit score.

When you repay credit, it appears on your credit history as “satisfied”. But when you settle a debt for less than what is owed, it shows up as “settled”. Banks and lenders will be able to see that you did not repay what was owed in full for the duration it remains on your file, which is six years.

This is something to keep in mind when you weigh up debt consolidation vs debt settlement.