Debt Management Universal Credit – What To Consider

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re dealing with Universal Credit debt, it can feel quite scary. But don’t worry; you’re not alone. Every month, over 170,000 people come to our website to get advice on debt problems just like yours.

In this article, we will:

- Explain what Universal Credit is.

- Give guidance on dealing with overpayments.

- Discuss how you might be able to write off some of your debt.

- Explain what happens when you can’t afford to repay Universal Credit overpayments.

- Offer advice on handling unaffordable debt.

We know that being in debt can make you feel worried and unsure about what to do, as some of us have been in the same boat, so we understand what you’re going through.

If you’re struggling with Universal Credit debt, stick around. We’re here to help you understand the system and find the best way to manage your situation.

Let’s dive in.

What is Universal Credit?

Universal Credit is a benefits payment that is designed for people who are either unemployed or have a very low monthly income.

If you opt for Universal Credit, it will replace some of the existing benefits which you may already be getting.

Some examples of these benefits include:

- Housing benefits

- Child tax credits

- Working tax credits

- Jobseeker’s allowance

- Income support

You might be able to apply for and claim Universal Credit successfully given that:

- You are unemployed or have a low income

- You are 18 years old or older

- You and/or your partner are under the state pension age

- You and your partner collectively have less than £16,000 in savings

- You’re a resident of the UK

There are some niche situations where you might be able to secure Universal Credit if you’re 16 or 17 years old.

Some of the situations where this could apply are:

- You are not capable or have limited capability to do work and/or are waiting for a Work Capability Assessment

- You’re taking care of a severely disabled or elderly person

- You’re solely responsible for a child or children

- You have a partner with whom you are responsible for at least one child and your partner qualifies for Universal Credit

- You’re pregnant, and it’s less than 11 weeks before you’re expected to give birth

- You’ve become a parent in the last 15 weeks

- You don’t have the support of a parent or guardian

If you’re a full-time student pursuing further education, you can also apply if:

- You don’t have support from your parents

- You have limited capability in terms of your work, and you qualify for Personal Independence Payment (PIP)

- You’re responsible for taking care of a child (or children)

- You’re part of a couple and you and your partner are responsible for at least one child and your partner is eligible for Universal Credit

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How are Universal Credit Overpayments Recovered?

If you’ve been overpaid via Universal Credit, you’ll receive a letter from HM Revenue and Customs (HMRC) detailing how much money you owe.

You can identify the letter by its name which is ‘TC1131 (UC)’.

You might receive this letter a few months after you’ve made the switch to Universal Credit.

If you’re already making payments to a ‘notice to pay’, then you should keep making those payments until you’ve received the TC1131 (UC) letter.

Once you’ve received this letter, the Department of Work and Pensions (DWP) debt management department will automatically reduce your Universal Credit payments in order to account for the money you owe.

Your Universal Credit payments will stay reduced until you’ve paid off all the money that you owe. You don’t have to set anything up on your own.

If you are required to repay Universal Credit overpayments for different years, then there’s a chance you may receive more than a single letter.

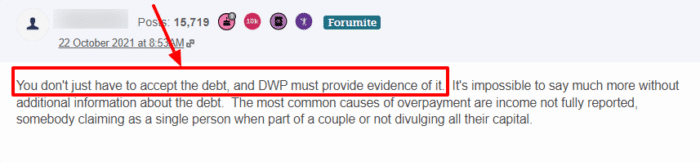

Remember, you can complain to the DWP or appeal if you disagree with the Universal Credit overpayment demand letter. You’ll need to ask for ‘mandatory reconsideration’ – this forces the DWP to look at the decision again.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What Happens if I Can’t Afford to Repay Universal Credit Overpayments?

If you can’t afford your repayments towards your benefit overpayments, it’s vital that you contact DWP immediately. They might be able to set up an affordable payment plan for you.

If you already have a repayment plan for your tax credits arrears (sometimes known as a ‘Time to Pay’ arrangement), it will be terminated once you receive the TC1131 (UC) letter from HMRC.

If you claimed tax credits as a couple and were overpaid, then the amount of money you owe will be split in half between both of you. In this case, you will both receive a TC1131 (UC) letter from HMRC detailing how much each of you owes. Both of you must pay your half of the debt individually.

Of course, if you’re both still receiving Universal Credit payments, these will be reduced in order to make up for both your debts.

If you no longer receive Universal Credit and owe money due to past overpayments, then you’re going to have to pay DWP directly.

Please note that it’s very important that you get in touch with DWP debt management and inform them of how you plan to repay them as soon as possible.

If you ignore the Universal Credit payment which you have to make for the money that you owe, legal action may be taken against you for benefit fraud.

Furthermore, if you don’t make your Universal Credit payment, DWP has the authority to make deductions from your wages to make up for the money you owe.

Not only that, but HMRC can also make deductions from other forms of benefits as well. And a court action may also be taken against you if you ignore HMRC’s letters.

» TAKE ACTION NOW: Fill out the short debt form

Repayments can be recovered from you by:

- Deductions made from benefit payments

- Deductions made from benefits owed to you in the form of arrears

- Deductions made directly from your wages

- Obtaining a court order authorising the use of bailiffs and other debt recovery tactics

| It’s important for you to note that you will never be obligated to pay more than what you can afford to pay. |

If you can’t afford repayments caused by overpayments made to you in the past, it’s crucial that you get in touch with DWP as soon as possible.

That said, it is always best to get support from an independent debt charity for advice on how to deal with overpayments from Universal Credit.

The best free debt advice organisations to contact include: