Debt relief order after 6 years – What You Need To Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you feeling unsure about life after a Debt Relief Order (DRO)? You’re not alone. Every month, over 170,000 people visit our website seeking advice on debt solutions.

In this article, we’ll explore:

- What a DRO is and how long it lasts

- What happens when your DRO ends

- The impact of a DRO on your long-term financial health

- Possible debt solutions and alternatives to a DRO

- Answers to frequently asked questions about DROs

We understand your worries about the long-term impact of a DRO and the uncertainty of what happens when it ends. We’re here to help you figure things out.

How long does a debt relief order last?

Debt Relief Orders are one of the alternatives to bankruptcy and normally last 12 months. If you meet the DRO eligibility criteria, there is a halt to creditor actions during your DRO to recover any debts included in your Debt Relief Order. However, creditors can still contact you to notify you how much you owe.

How long does a debt relief order stay on the credit file?

A Debt Relief Order will remain on your credit file for six years after it was made. You will likely struggle to take out any credit during the DRO duration and for a time afterwards.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What happens at the end of a debt relief order?

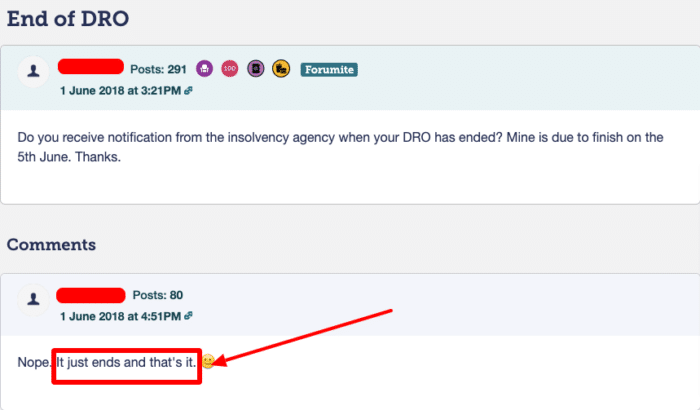

You won’t receive official notice or communication telling you of the completion of your DRO, and you are no longer held to your DRO obligations. If you can’t remember when your debt relief order was due to end, you can check up on your entry on the Insolvency Service register.

» TAKE ACTION NOW: Fill out the short debt form

How will a DRO impact me in the long run?

A direct relief order might seem like a good way of solving your debt problems. However, it’s worth noting what happens to a debt relief order after six years. A DRO will end up impacting your credit record for six years and will also affect any future credit applications you might want to make

Credit reports look back over the past six years of your borrowing history, but if you have taken out a debt relief order after six years, it will still be on your record. This will indicate to any future creditors that you have struggled to keep up repayments in the past.

It’s worth bearing this in mind, as the effects that a debt relief order after six years can be quite detrimental. For instance, you may struggle to open a new bank account because of your debt relief order or take out a mortgage after six years.

You may have to manually send the credit reference agencies a copy of an official document that states your debt relief order has ended, as occasionally, they don’t automatically update your file regarding your debt relief order after six years.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

FAQs

Here, I’ll answer a few of the more frequently asked questions about debt relief orders and what happens to your debt relief order after six years.