Debt Relief Order – What Happens After a Year?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you unsure what happens after 12 months of a Debt Relief Order (DRO)? Don’t worry; you’re in the right place. This article aims to answer your questions and ease your worries about the final stages of a DRO.

Each month, over 170,000 people visit our website seeking advice on debt solutions. You’re not alone in this.

Our team truly understands your situation, as some of us have also dealt with debt solutions. That’s why we’ve prepared this guide that will give you the knowledge you need to decide if a DRO is the right choice for you.

What Happens After a Year on a Debt Relief Order?

At the end of the Debt Relief Order, if your income has not increased, any debts covered by the Debt Relief Order will be wiped, meaning you won’t have to pay and become free from debt. This means a Debt Relief Order can get you out of debt much faster than a Debt Management Plan (DMP) in some cases.

But that shouldn’t be the only consideration when choosing between a DRO and a DMP.

Will I Be Told My Moratorium Has Ended?

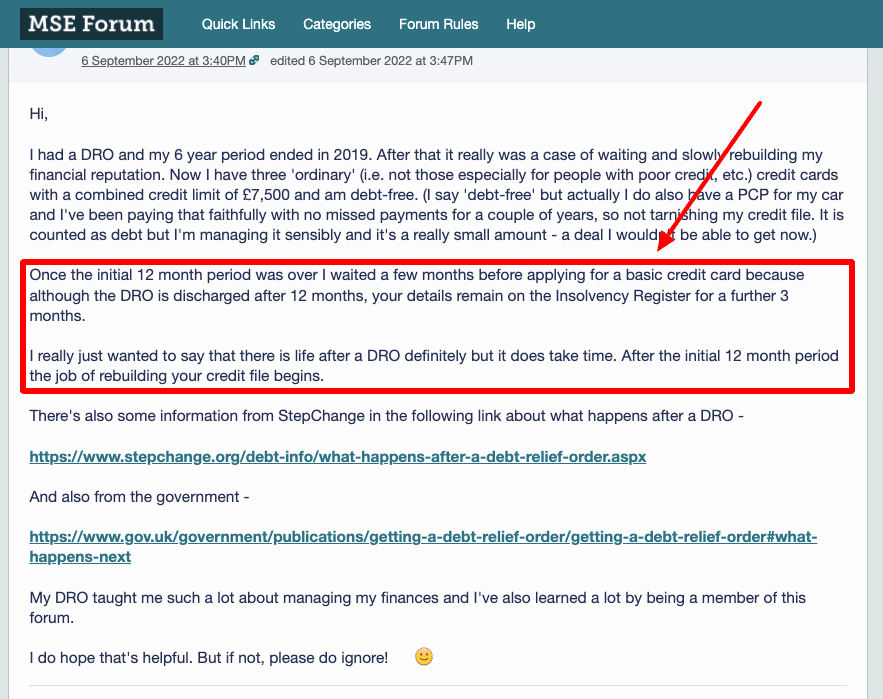

No, you do not receive any letter or notification to state that the year has ended. Instead, your details will have been recorded in the Insolvency Service’s Register. The entry into the register will remain there for three months before being removed again.

This means you must print out a confirmation of the Debt Relief Order and the end of the Moratorium within these three months. You could need this proof for various applications if creditors wrongfully start asking for their money again.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Is a debt relief order a good idea?

You don’t need to pay for most sorts of debt regarding your DRO, and your creditors can’t ask you to take care of the debts. A DRO ends after 12 months, except if your circumstance improves.

At the end of the DRO, the greater part of your debts will be discounted.

You’ll have to find a DRO counsellor who will help you fill in an application to the official collector. The counsellor can’t charge you for their time, but there’s a £90 fee to make a DRO application.

Notification of the end of the DRO period

You won’t get any official notification or correspondence to disclose that the DRO period has finished.

If you can’t recollect when your DRO closes, you can check your entrance in the Insolvency Service’s register. This will show the end date of the DRO period.

What If My Income Increases During the Debt Relief Order?

You have an obligation to inform the Official Receiver about income increases during the DRO period. You could earn money through inheritance or a new job with better pay. Increased disposable income could affect the Debt Relief Order and your right to relief.

If your income decreases, there are no penalties or changes.

» TAKE ACTION NOW: Fill out the short debt form

In the case you would want proof that your DRO has finished

On the off chance that you need to have the option to demonstrate that your DRO has finished, you can print off a duplicate of your entrance in the Insolvency Service register, which will show the end date of the DRO period.

You have three months to print off your duplicate of the section after the DRO has finished. After this time, you may not be able to access it.

What happens if your Creditor Doesn’t Accept that your DRO Has Ended?

On the off chance that a bank attempts to gather a debt that was recorded in your DRO after the DRO period has finished, you can challenge them and don’t need to pay. Approach your DRO debt adviser or credit reference agencies for information about this.

The bank can not acknowledge or accept that your DRO has finished. Send them a duplicate of your entrance from the Insolvency Register if you have one.

If you don’t have a duplicate and it is past the point where it is possible to print it off, request that your creditors contact the Insolvency Service s DRO Team.

The financial conduct authority will have the option to affirm to your bank that your DRO has finished and that they can’t make any move against you over it.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

When are Creditors Permitted to Reach You?

While your creditors for debts recorded in your DRO can’t, for the most part, move against you during the DRO period, there are a few circumstances where they may keep reaching you. These include:

- to give you data about your authorised and regulated records

- to observe the guidelines of the Consumer Credit Act

- to pursue payments for debts excluded from the DRO

- you are behind on your rent and the landlord needs you to pay your arrears

Wrapping it Up

This guide was meant to help you learn more about a DRO and what happens once it ends. A DRO can be complicated if you don’t know what you’re doing.

If you need more debt advice, feel free to reach out.