The Difference Between Secured and Unsecured Loan

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Are you trying to figure out the difference between secured and unsecured loans and whether they have different requirements? You’re not alone. Every month, thousands of people turn to our website for similar answers.

In this friendly guide, we’ll explain:

- The main differences between a secured and unsecured loan.

- The pros and cons of each loan type.

- Which loan type is easier to obtain.

- Which loan type you should choose.

I know the whole thing might seem overwhelming, but don’t worry. Our team has guided many people with similar questions and provided the answers they were looking for. Let’s dive in and discuss the main differences between secured and unsecured loans!

What is the difference between a secured and unsecured loan?

The difference between secured and unsecured loan agreements is that a secured loan includes assets as collateral, and unsecured loans do not. Therefore, it is easier for the lender to recover the debt if they use a secured loan, which reduces the overall risk of lending.

Some loans are always secured, such as a mortgage or a home equity loan, whereas other loans can be either a secured or unsecured loan, such as a debt consolidation loan or home improvement loan.

Any further differences between the two may be subject to the type of unsecured or secured loans in question.

What is a secured loan?

Secured loans is an umbrella term that refers to a variety of different loans which include an asset as collateral within the credit agreement.

For example, someone may take out a loan and use their car, home or home equity as security in the agreement. If the person taking out the secured loan does not repay what is owed, the lender can seize the asset and sell it to raise funds and recover the debt. Any remaining money from the sale of the asset will be given back to the debtor.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 6.34% |

£219.34 |

£26,320.83 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 7.99% |

£222.20 |

£26,664.58 |

| Selina | 8.45% |

£223.00 |

£26,760.42 |

| Equifinance | 9.95% |

£225.61 |

£27,072.92 |

| Evolution | 10.2% |

£226.04 |

£27,125.00 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

What is an unsecured loan?

Unsecured loans refer to personal loans that do not list an asset as collateral within the credit agreement. This means the lender does not have an automatic right to repossess an asset and sell it in the event that the individual or individuals have not kept up with repayments.

If someone does not repay an unsecured loan, the lender can still chase the debtor to repay, but they cannot just seize an asset straight away. They would need to go to court and get a judge to order the debtor to pay. If the debtor still does not pay, they would then have to ask the judge for permission to use enforcement action, including the possibility of bailiffs. Only then could they potentially seize some goods and sell them at auction to recover the debt.

In my experience, this can be a time-consuming and costly process.

Secured vs unsecured loan – pros and cons

Pros and cons of secured loans

The pros

- Secured loans tend to offer lower interest rates – but not exclusively. As the credit agreement is secured with an asset, you are seen as less of a lending risk, and the loan may, therefore, come with reduced interest.

- Secured loans may allow you to borrow more – for the same reasons mentioned above, you might be able to borrow more with these loans. Using a valuable asset could open the door to borrowing money way beyond the maximum unsecured personal loan of around £25,000. If you secure the agreement with a property or property equity, you might be able to borrow £100,000+

The cons

- Additional fees – there may be additional fees and charges involved when taking out a secured loan, such as valuation costs or closing costs.

- Greater risk – loans secured with a valuable asset are risking that asset if you cannot repay. Unforeseen circumstances could mean losing your job and not being able to work, which would put the asset used as collateral at risk.

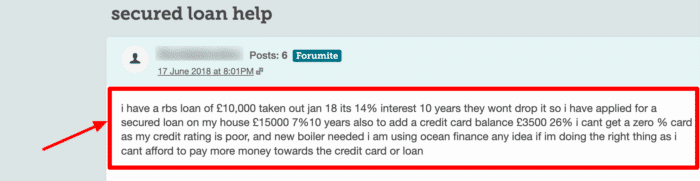

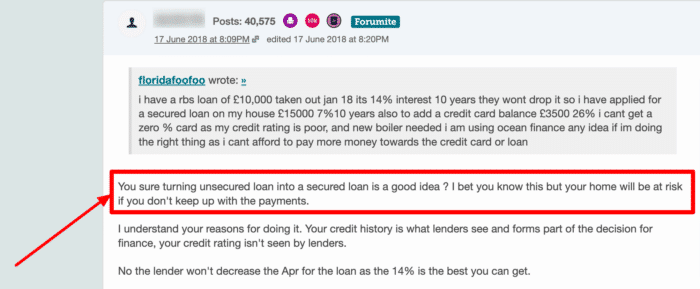

Here, you can see this forum user on MoneySavingExpert is looking for advice on whether getting a secured loan against their house is the right thing to do. Another user has advised that it might not be right for them as they will be putting their home at risk if they are unable to keep up with repayments.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

Pros and cons of unsecured loans

The pros

- You can generally borrow up to £25,000 with an unsecured loan – this is more than enough credit for most people’s loan needs.

- Low-interest rates can be secured – low-interest rates competing with secured loan rates are possible, especially if you have a good or excellent credit history.

- Less risk – no asset is at immediate risk when using an unsecured loan.

The cons

- Interest rates tend to be higher compared to secured loans – people with an equivalent credit rating are likely to be subject to a higher interest rate compared to those getting a secured loan.

- Loan amounts limited – without securing an asset in the credit agreement, the amount you can borrow through a single loan is limited, usually around £25,000.

Secured loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking to fund a home improvement project?

- Dreaming of finally taking the once-in-a-lifetime trip?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

Is a secured loan easier to get?

A secured loan is considered somewhat easier to get than an unsecured loan. The reason for this is that the lender will see you as less of a lending risk because they can more easily and efficiently recover the debt if needed due to the asset listed as collateral. However, you’ll still need to meet affordability checks and be approved for either type of loan.

Whether you apply for a secured loan or an unsecured loan, the lender will need to complete affordability checks to make sure you can afford the repayment, including the interest rate. They will assess your income and existing debts along with the proposed repayments on the loan you’re applying for.

It’s not a case of just earning more money than your debts. Your overall debt will need to be below a certain proportion of your income so you can comfortably afford all your debts along with essential living expenses. The lender will also check your credit score to see how you have managed your borrowing in the past.

Is it bad to get a secured loan?

Taking out a secured loan could be a smart way of securing credit. If you’re comfortable risking a valuable asset, possibly even your family home, then listing that asset as collateral might help you access more credit, cheaper credit – or both.

Some people consider a secured loan a bad idea because of the risk involved. However, you can mitigate this risk by not overborrowing (saving more if you have to!) and by learning how to budget accurately.

Should I consider an unsecured or secured loan?

Sometimes, a secured loan is the only way to secure the amount of credit you need. However, suppose you don’t feel comfortable securing a property or valuable asset within a loan. In that case, you may want to consider other options, such as saving more and then taking out an unsecured loan for a lesser amount later.

If the amount of credit you need is accessible through an unsecured or secured loan and you feel comfortable using an asset as collateral, you should compare all options to find the most appealing repayment terms. There is no one-size-fits-all approach. You may want to get help comparing loans through a comparison website or credit broker.

It might also be worth considering other credit options, such as credit cards, overdrafts, or Peer-to-Peer lending. But all of these options come with risks, so it’s important to do your research.