Digital DRA – Who Are They?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

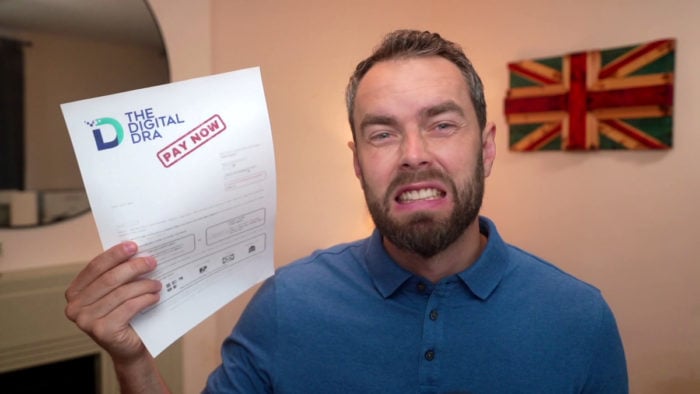

Did you get a surprise letter from Digital DRA? Don’t worry; you’re in the perfect place to learn more. Each month, over 170,000 people visit our site for advice on debt matters just like this one, so you’re not alone.

In this piece, we’ll cover:

- Understanding who Digital DRA are and what they do.

- Making sure the debt they say is yours really is.

- Knowing if you can ignore Digital DRA or not.

- Steps to stop Digital DRA from chasing you too much.

- How to set up payment plans, and even how to write off your debt.

Our team knows what it feels like to be chased by debt collectors. It can be scary, but don’t worry; we’re here to help you learn how to deal with Digital DRA.

Let’s get started!

Are Digital DRA bailiffs?

Digital DRA is not bailiffs. They’re a debt collection company that operates at the start of the debt recovery process. They use administration and communication to try and get you to pay or agree on a payment plan. If that doesn’t work, the company they’re working for may take legal action.

Only if a judge orders you to pay and you don’t can debt enforcement be used, which may include bailiffs. As Digital DRA only operate online, you’re unlikely to receive any threats that they’ll come to your home. But they aren’t allowed to do this anyway.

Received a Digital DRA debt letter or email?

You might have received a letter or more likely an email stating you owe their client money and you need to pay. The email may continue to state that if you don’t pay or contact their team to discuss a payment plan, the client might take court action against you.

» TAKE ACTION NOW: Fill out the short debt form

Can you ignore Digital DRA?

Ignoring Digital DRA might result in court action. So it’s not advised to ignore their request for payment. Some people might have ignored them in the past and not been taken to court, but this is risky and could backfire.

Should you pay Digital DRA?

If you can’t ignore them does that mean you have to pay Digital DRA? Not always. You may choose to pay them if preferred, but there are two other ways you could respond to their payment request. They could stop you from having to pay at all.

Read on for the full details.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Check your Digital DRA debt is still enforceable

Some debts in the UK become unenforceable after a set period of time passes since the debt originated or the last time you made a payment on the debt. Many debts become unenforceable after five years in Scotland and six years in England and Wales.

You should check to see if the debt Digital DRA is chasing is still enforceable. If it isn’t, which is known as a statute-barred debt, you won’t ever be asked to pay by a judge or have to face debt enforcement action. It will still exist unless paid or written off.

Ask Digital DRA to prove your debt

If your debt is still enforceable, meaning you could still be taken to court over it, you can reply to Digital DRA in another way. You can ask them to prove you owe the money. They must then send you a copy of the agreement or contract you signed, which you then defaulted on. Until they send this you’re not obligated to pay.

If they ignore the request but the client takes you to court, you must tell the judge the reason you haven’t paid is that your request for proof of the debt was ignored. This can help you avoid being subject to a court order to pay.

Should you pay if Digital DRA proves the debt?

If Digital DRA sends you evidence that you owe the money, you should think about how you’re going to clear the debt. You might want to:

- Pay in full

- Ask for a payment plan

- Make a debt settlement offer

Can Digital DRA really take me to court?

The client of Digital DRA is able to take court action to recover a debt owed. But Digital DRA won’t be the ones who take you to court.

You might want to defend yourself if the matter goes to court. If you don’t it’s likely a County Court Judgment (CCJ) will be issued and you’ll be legally obligated to pay.

Not paying at this stage is when the company could employ bailiffs to recover the money or seize your assets to clear the debt. Bailiffs add their own expensive fees to your debt.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Digital DRA Contact Information

| Registered office: | Office 32, Elsie Whiteley Innovation Centre, Hopwood Lane, Halifax, HX1 5ER |

| Contact us: | https://www.digitaldra.co.uk/contactus |

| Website: | https://www.digitaldra.co.uk/ |