Does Klarna Affect Credit Score If You Don’t Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re worried about your credit score and how to manage your debt, you’re not alone. Every month, over 170,000 people visit our website seeking guidance on these key points.

We understand how important it is to keep your credit score in good shape. That’s why, in this article, we’ll help you understand:

- What Klarna is and how it works.

- The meaning of a credit score and why it’s important.

- How not paying Klarna might harm your credit score.

- Ways to handle unaffordable debt.

- Where to get help with your debts.

- Ways to possibly write off some of your debt legally.

We know dealing with debt can be tough, but understanding your credit score and knowing how to handle your debt are important steps towards financial stability.

We’re here to provide guidance and support to help you on this journey.

How Does Klarna Work?

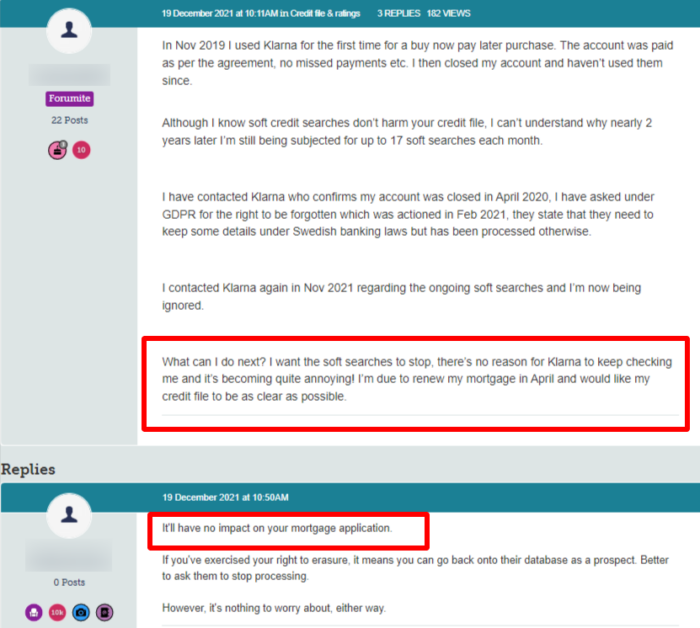

When you first sign up for Klarna, the company will do a soft search on your credit file. It has been known for Klarna to do this repeatedly, and this may be some kind of bug with the application process itself. Once you have created an account and downloaded the app, you can log in and use the Purchase Power section of the app. Here, you will find out what your BNPL spending limit is. Klarna offers three ways to pay, as defined below.

- Traditional BNPL, in the form of repaying the purchase cost across 4 equal instalments, each of which is two weeks apart.

- Purchase goods using Klarna, and pay the cost back within 30 days. However, if you order goods and want to return them within the 30 days, then you don’t pay anything at all.

- Monthly credit payments. This is traditional style credit, and Klarna would perform a hard searching your credit file before offering you this service.

Klarna doesn’t charge interest on the first two of these options. If you are late making a payment, a £7 fee is levied. The third option is a standard credit agreement, which works in a similar fashion to a store card. You need to be aware that the interest rate for using this service can be quite high, as much as 25% APR.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can Klarna Damage Your Credit Score?

As a BNPL credit scheme, Klarna can and will have an impact on your credit score. Initially, when you set up your BNPL credit with Klarna, the new agreement will appear on your credit file. As long as you keep up regular repayments, the impact on your credit score might be quite positive. However, if you miss payments or are late paying, this will have a negative impact on your credit score.

We also need to talk about the third credit option that Klarna offers. Namely the standard credit agreement. A hard search will be done on your credit file when you apply for this. Too many hard searches in a short period of time can have a serious impact on your credit score.

Furthermore, if you fail to keep up repayments with Klarna, they may pass your debt on to a collection agency such as PRA Group or Cabot Financial. When this happens, it will be noted on your credit file that a credit account is in collection due to non-payment. It should come as no surprise that this will damage your credit score. If the collection agency seeks a CCJ against you and it is granted, this will have an even greater negative impact on your credit score.

» TAKE ACTION NOW: Fill out the short debt form

Why Your Credit Score is Important

As we previously mentioned, your credit score is a measure of your general level of creditworthiness. The higher your credit score, the more chance there is of you being accepted when you apply for new credit. This applies to all credit products, such as:

- Credit cards

- Personal loans

- Mortgages

- Buy now pay later credit

- Overdraft facilities

- In-store finance

- Car loans and hire purchase

If you have a low credit score, it is less likely that credit applications would be successful. Traditional lenders would see you as too high risk. There are specialist subprime lenders that may be willing to offer you credit if you have a low credit score. However, these can be costly. In general, subprime lenders charge higher interest rates. They are also quite likely to charge heavy late or non-payment fees.