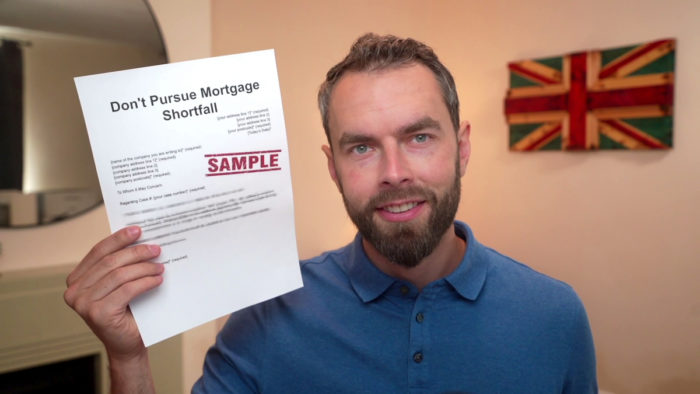

Don’t Pursue Mortgage Shortfall – Sample Letter Template

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Introduction

If your home was repossessed more than six years ago and your mortgage lender has contacted you to discuss a mortgage shortfall debt, use our free letter template to explain why you are not obligated to pay. You can use UK Finance and the Financial Conduct Authority rules to explain to your lender why you do not owe them a penny.

We have made a free template for individuals and couples requesting mortgage lenders do not pursue mortgage shortfall debt. Download the template for free, insert your details and pop it in the post. It could save you thousands!

Letter Template

To Whom It May Concern

Regarding Case #: [your case number]* (required)

You have contacted me about the account with the above reference number, which you claim I owe. I do not admit any liability for your claim.

I understand you are a member of UK Finance. As you will be aware, UK Finance has the following policy on obtaining repayments. This applies to all UK Finance members

“Lenders are committed to fair and sympathetic treatment of people who have suffered repossession, and accept that individuals should not face long delays before lenders contact them to discuss repayment of the shortfall.”

“From 11 February 2000, lenders who are members…have agreed voluntarily that they will begin all recovery action for the shortfall within the first six years following the sale of a property in repossession. Anyone whose property was taken into possession and sold more than six years ago, and who has not been contacted by their lender about recovering any outstanding debt will not now be asked to pay the shortfall.”

The property in question was sold on [insert the date.]*. (required).

Also, the first contact I had from yourselves was [by phone/in writing]* (required) on [insert the date.]* (required)

As my property was sold more than six years ago and you have not contacted me within this time, I should not be asked to pay the amount you allege I owe.

I draw your attention to the Financial Conduct Authority’s ‘Mortgages and Home Finance: Conduct of Business sourcebook’ which says that if a lender decides to recover a mortgage shortfall debt they must make sure the borrower is informed of this within six years of the date of sale.

Please confirm in writing that you will not make any further contact about the above claim and confirm that this matter is now closed.

I look forward to hearing from you.

Yours sincerely

Downloadable Resource

The download links below take you to a Google document template where you can make a copy or save in any document format you like. Note, you may have to login to your Google account.

Download – Single (for one person)

Download – Joint (for couples)

What is mortgage shortfall?

A mortgage shortfall debt is when you have handed back the keys to a property or had your home repossessed for failing to keep up with mortgage repayments. The lender must then sell the property to recover the mortgage value. However, if they do not manage to sell the property for an equal value of the mortgage, then they can legally request that you pay the difference. This difference is known as a mortgage shortfall.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How long can a mortgage debt be chased?

The Limitations Act places a time limit on how long a lender can chase someone to pay back the debt. In the case of mortgage shortfall, a lender can chase the capital for 12 years and any interest payments for six years. However, they must notify you of any shortfall quickly. Even though they have 12 years to try and recover the capital – i.e. the difference between the mortgage value and the amount the property was sold for – the lender must act much sooner.

This is how you could use the rules to ask your lender not to pursue a mortgage shortfall debt…

Mortgage lenders must notify you within six years!

Most mortgage providers in the UK are members of UK Finance, a trade association working with financial institutions. They state that their members should show compassion to people who have had their property repossessed and inform them of mortgage shortfall debt in good time. In fact, as of February 2000, all UK Finance members agreed to start to recover the mortgage shortfall debt within six years.

This aligns with the FCA’s Mortgage and Home Finance rules, which state that the mortgage lender must tell the debtor about the mortgage shortfall within six years. This is why our letter template to request your mortgage lender does not pursue the debt after six years references these sources. Download it now to fight your corner!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

When does the six-year countdown start?

The six-year time limit on notifying you of a mortgage shortfall debt will only begin once the property has sold. Therefore, if it takes one year for the mortgage lender to sell the property after it was repossessed, the lender will have seven years since the repossession to inform you of the mortgage shortfall debt.