Equity Release Criteria – Who Qualifies?

Our preferred equity release adviser is Age Partnership. For free and impartial money advice you can visit MoneyHelper.

Our preferred equity release adviser is Age Partnership. For free and impartial money advice you can visit MoneyHelper.

Are you trying to understand all about equity release? Wondering who qualifies and what the criteria are? You’re in the right place. Each month, over 7,000 visitors find our website helpful in guiding them about equity release.

In this article, we’ll cover:

- What equity release means.

- How to get a fair quote.

- The basic rules of equity release.

- Who can and can’t get equity release.

- Factors that can affect your chance to get equity release.

We all know that equity release can be a bit tricky. It’s not always easy to understand all the rules, but don’t worry; we’re here to make it simple for you. We have lots of useful tips to help you understand the process better.

Let’s dive in.

What are the basics of equity release?

Equity release schemes are simply a way for senior homeowners to borrow against the value of their homes. Many senior homeowners cannot access loans due to their age. Equity release plans provide a unique way for them to still borrow money. They are a particularly popular method of retirement financing.

The two methods of equity release are lifetime mortgages and the less common home reversion schemes.

Who qualifies for equity release?

To qualify for a lifetime mortgage, you need to be at least 55 years old. If there are two homeowners taking out a lifetime mortgage together, both individuals will need to be at least 55 years old.

To qualify for a home reversion plan, you may need to be older than 55. Many lenders require all homeowners to be at least 65 years old to take out a home reversion plan.

How equity release could help

More than 2 million people have used Age Partnership to release equity since 2004.

How your money is up to you, but here’s what their customers do…

Find out how much equity you could release by clicking the button below.

In partnership with Age Partnership.

Who doesn’t fit the equity release criteria?

Homeowners who are younger than 55 years old and/or don’t own their residential property outright don’t meet the standard equity release criteria.

Can you be refused equity release?

Yes, you will be refused a lifetime mortgage or home reversion scheme if you don’t meet the lender’s equity release criteria or if your property doesn’t meet specific standards.

Equity release companies don’t have the exact same criteria all of the time. A broker or an equity release advisor might be able to help you find a company that will offer you an equity release.

Join thousands of others who release equity

Age Partnership have helped over 2 million people release equity from their home.

Mrs Wareham

“I am more than pleased to have taken out Equity Release with Age Partnership.”

Reviews shown are for Age Partnership. Search powered by Age Partnership.

Equity Release Fees

There are a number of costs and fees associated with equity release, such as:

- Arrangement Fees

- Valuation Fees

- Legal Fees

- Advice Fees

- Transfer Fees

These fees will vary depending on your personal circumstances and your provider.

» TAKE ACTION NOW: Find out how much equity you could release

Can you get equity release on all types of property?

Equity release plans can normally only be taken out on your residential property where you habitually live in the UK. However, there may be some lenders that offer equity release plans on investment properties or holiday homes.

The property itself must meet specific standards that allow the lender to easily re-sell the property on the open market in the future. Many properties can be excluded from an equity release plan if they are located in flood zones or above commercial premises.

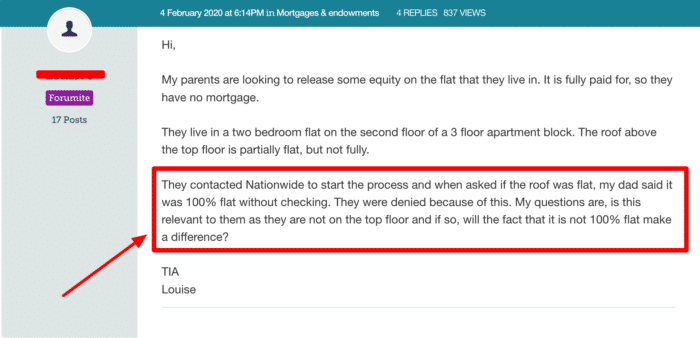

They can also be excluded if they are too remote or if there are issues with the way the property has been built, including a flat roof or if unauthorised building work has taken place. A flat roof is a common issue, as this forum user experienced:

Park homes, retirement homes (age-restricted purchases), and boathouses don’t qualify for equity release either.

How does the condition of your property affect equity release?

The condition of your residential property can affect an equity release application. Equity release companies will only provide a lifetime mortgage or home reversion plan on liveable properties.

So if your home needs major renovations and improvements, you could be denied equity release.

If issues arise during a valuation, the timescale on your equity release application could be extended.

Does the value of your property matter?

Yes, the value of your property does matter when applying for a lifetime mortgage or home reversion plan. Lenders might not approve equity releases on properties that are valued below a certain amount.

The minimum property value can change between lenders, but it’s usually around £100,000 – give or take a little. Property valuation is an important part of applying for an equity release scheme.

Is equity release based on affordability?

No, equity release plans aren’t approved or declined based on affordability. This is because you don’t have to make monthly repayments on the debt, so affordability doesn’t need to be considered.

Do you have to have a good credit score to get equity release?

No, you don’t need a good credit score to qualify for equity release.

Lenders usually look at your credit score to see how you have managed debt repayments in the past, but as there are no monthly repayments on equity release, your credit score doesn’t need to be considered.

Some people use equity release to pay off multiple other debts and arrears which have caused their credit score to decrease significantly.

» TAKE ACTION NOW: Find out how much equity you could release

Pros and Cons of Equity Release

Before releasing equity, it is important to consider the pros and cons.

Pros of Equity Release

- You get tax-free money to spend on what you wish.

- You never owe more than the value of your house (thanks to the No Negative Equity Guarantee)

- You don’t have to make monthly repayments.

- You still own your house.

- You can remain in your house.

Cons of Equity Release

- Your debt could increase significantly due to interest.

- There are sometimes early exit fees or early repayment charges.

- It might affect any benefits you receive.

- You can’t usually take out any other loans on your house.

Alternatives to Equity Release

Based on my experience, whilst equity release is a good option for many borrowers, it definitely doesn’t suit everyone. If equity release isn’t appropriate for your circumstances, there are some alternatives. For example:

- Downsize your home

- Rent a room in your home

- Remortgage

- Use savings

- Take out an unsecured personal loan