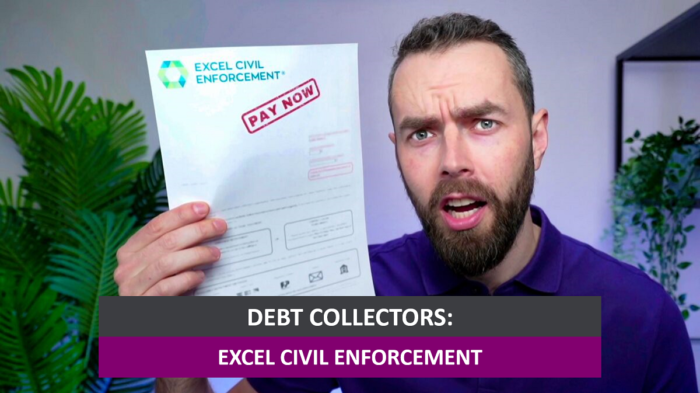

Excel Civil Enforcement Debt – Do You Have to Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a surprising letter from Excel Civil Enforcement about a debt? If you’re confused about what the debt is, or if you’re questioning whether to pay, then this article is here to help you.

Every month, our website guides over 170,000 people on debt solutions. Many have been in the same situation as you. We understand how worrying it can be to deal with unexpected debt.

In this article, we will cover:

- Who Excel Civil Enforcement Ltd are.

- How to handle Excel Civil Enforcement Debt Collectors.

- The types of debt Excel Civil Enforcement collect.

- How the debt collection process works in the UK.

- What to do if you receive an Excel Civil Enforcement notice of attendance.

Our team has faced debt collectors too. We understand how scary it can be when they come after you. This article will give you the facts you need to handle this situation. We’re here to help you take control.

Let’s dive in.

Have You Received an Excel Civil Enforcement Notice of Attendance?

» TAKE ACTION NOW: Fill out the short debt form

Will Excel Civil Enforcement Always Offer a Payment Plan Option?

Most of the time, when a law enforcement agent comes to collect a debt, they will ask for the full amount of money owed. They will then listen to your capabilities to pay a lump sum on the day and commit to a payment plan.

However, these agents may reject your offer because they see that they can repossess items around your home (or on your driveway) that will get their clients more of their money back. Making a payment arrangement with Excel Civil Enforcement can be more difficult than making a payment plan with someone else at an earlier stage of debt collection.

This is why it is crucial to reply to debt letters and never ignore them. Agreeing to a payment plan before the creditor has a court order prevents you from having to make an upfront larger payment, and it often enables you to agree on a better plan.

You should never agree to a payment plan you cannot afford!

Do I Have to Choose an Excel Civil Enforcement Payment Plan?

Before a court order is issued, you have a lot more options to escape your debt than after the order has been given. However, there are still things you can do.

Excel Civil Enforcement debt agents will try to make you simply sign up to a payment arrangement, as illustrated on their website:

“Do not be tempted to ‘consolidate’ your debts – take professional advice – or you may end up owing even more”

[Excel Civil Enforcement website]

This is not 100% correct, as professional advice can be beneficial, and it doesn’t always cost. There are free debt charities that provide professional advice and can help you understand your rights when dealing with debt collectors and law enforcement agents like Excel Civil Enforcement.

Moreover, consolidating your debts may not be the best option for everyone, but it could be an advantageous route for some. Debt solutions like IVAs and debt consolidation loans could help you save on how much you have to pay.

I go through the different debt solution options at the bottom of this page.

Keep Your Possessions with an Excel Civil Enforcement Payment Plan

The promising news is that Excel Civil Enforcement does appear to be geared towards helping debtors get through their financial troubles with payment plans. Their website even has a special section for debtors to go and make payments.

When you agree to a payment plan, it is paramount that the plan you agree fits your budget. Committing to a bigger payment, thinking you can deal with it later is not a solution. This could cause more debts to sprout up.

Always create a monthly budget before coming up with a figure you can pay each month, taking into account necessary payments such as rent, food, water and heating etc.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Contact Excel Civil Enforcement for a Payment Plan

You may want to agree on an Excel Civil Enforcement payment plan before they come calling. This will only be possible if you know they are in charge of collecting your debt via an Excel Civil Enforcement notice of attendance.

You can contact them using the contact form on their website. Or call them on 03300 081 014.

Can Excel Civil Enforcement Enter My Property?

Yes. With a court order or writ of possession, these agents working for Excel Civil Enforcement Debt Collection can enter your property. They can use force if needed but will not kick down doors or break windows.

They will try to enter the home peacefully and without aggression. They tend to stand in doorways if you leave the front door to collect papers. This is so they can gradually enter without trouble.

Excel Civil Enforcement Vs Debt Collection Agencies/Solicitors

Will Excel Civil Enforcement Take My Possessions?

With the same court order, they are able to take your possessions. These possessions are then sold at an auction to raise money and pay off the debt. Note, that the auction usually sells items under their value.

Some items cannot be taken from you, such as:

- Vehicles in other names or on finance schemes (you don’t own them!)

- Consumables

- Essential items you need to work and earn money, such as tools or a computer

Try to research and understand how far enforcement agents can go to collect debt before they arrive!

Can Excel Civil Enforcement Take My Home?

Sadly, yes. It is possible for Excel Civil Enforcement debt collection agents to repossess your home as well as vehicles, games consoles and other valuable items.

This doesn’t tend to happen in most situations because they can recover the money via other means, and because the debt would have to be of extreme significance to repossess a property.

Common Excel Civil Enforcement Complaints

If you have recently ignored a debt letter or serving papers telling you that you were being taken to court, Excel Civil Enforcement may not be in possession of the order and come calling. By reading some recent Excel Civil Enforcement complaints, they are likely to call early:

“I have had a man banging on my front door this morning at 7.15am”

“Had 2 muppets bang my door at 6.30 giving it the big one trying to threaten and intimidate my partner.”

[Yell Website Excel Civil Enforcement Reviews]

This is common practice for law enforcement officers because they want to be there before you head out. They have also been known to be quite threatening and intimidating.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Making a Complaint About Excel Civil Enforcement Debt Collection

If you think that Excel Civil Enforcement has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Civil Enforcement Association’s (CIVEA) guidelines.

Make your first complaint to Excel Civil Enforcement so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the CIVEA complaints department. They will investigate and, if your complaint is upheld, Excel Civil Enforcement may be fined. You could even be owed compensation.

Excel Civil Enforcement Contact Information

| Phone: | 03300 081 014 |

| Website: | https://www.cityoflondon.gov.uk/ |

| Registered Office: | Marine House, 2 Marine Road, Colwyn Bay, Conwy, LL29 8PH Data Protection |

| Email: | [email protected] |

Try Money Nerd for Impartial and Easy-to-Understand Debt Help

Another fantastic resource is the Money Nerd website. I provide helpful blogs and articles that discuss different debt collectors and ways to get out of debt.

All of my content is written in a simple way to make it easy to understand. Without confusing terms and jargon, I make clearing your debt easier, faster and sometimes cheaper!