Fast Secured Loan – Complete Review

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

In this article, we’ll uncover the facts about fast secured loans. If you’re wondering how secured loans work, or if they could help you save money, you’re in the right place. Each month, more than 6,900 people visit us for advice on secured loans.

We understand that thinking about loans can be a bit scary. You might be concerned about getting into more debt or not being able to make the repayments, but don’t worry; we’re here to help.

Here’s what we’ll look at together:

- What a secured loan is and how it works.

- The difference between secured and unsecured loans.

- The pros and cons of secured loans.

- How quickly you can get a secured loan.

- Ways to get a secured loan.

We know that dealing with money matters can be tough. Many others are in the same boat, and we’re here to help you understand it all in a simple way. So, let’s dive in and learn more about fast secured loans.

How quickly can you get a secured loan?

The length of time it takes to get a decision on your secured loan is between two and six weeks on average.

The reason there is such a difference between the shorter and longer estimate is that some lenders will need to complete a valuation/appraisal on your asset, especially if you’re borrowing against property or home equity. This process can take time and may come at a cost.

Once the loan has been approved, you can expect it to hit your account within a couple of working days.

What is a fast secured loan?

Fast secured loans are secured loans that are advertised as quick to get a decision and fast to put the loan amount into your bank account.

Timeframes can vary but are usually below the average times advertised elsewhere – and sometimes less than two weeks. A handful of lenders promise to put the money in your account the same day as you get approved.

When most people decide that a secured loan is the best option for their credit needs, they usually want to get one approved swiftly. This may be out of convenience and anticipation, but it can also be because getting one quicker could help save money.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.99% |

£218.73 |

£26,247.92 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 6.95% |

£220.40 |

£26,447.92 |

| Selina | 7.5% |

£221.35 |

£26,562.50 |

| Equifinance | 7.7% |

£221.70 |

£26,604.17 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

How fast secured loans can save you money

Fast secured loans can help the individual save money, especially if they want to consolidate debts and are racing against the clock to save on the current high interest rates they’re paying.

Another way that a fast secured loan could save you money is if the money is earmarked for home improvements and there is currently a deal on a new kitchen, etc. By getting the money quicker, they may be able to take advantage of a limited-time offer, which otherwise they would miss out on.

Are fast secured loans a good idea?

If fast secured loans can save you money as opposed to other secured loan deals on the market, they could be considered a good idea. However, if the lender is advertising a secured loan on the basis of the speed of processing, it’s unlikely to have the best interest rates on the market. You should compare all your options meticulously.

Getting a secured loan quicker – even if it allows you to take advantage of a limited-time deal on home improvements – may not be the cheapest over the long term.

It’s also important to consider the term of a secured loan. The length of the loan will affect your monthly repayments and the overall amount you will repay. For example, a longer-term loan may result in lower monthly repayments but more interest being paid over time.

Secured loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking to fund a home improvement project?

- Dreaming of finally taking the once-in-a-lifetime trip?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

Do fast secured loans really exist?

It’s debatable whether fast secured loans really exist. Of course, some lenders will be able to assess your application and come up with a decision quicker than others. But, some secured loan applications take time, including homeowner loans where your property may need to be re-valued as part of working out how much home equity you have.

Lenders could simply be advertising fast secured loans as a way to hoover up some of the market wishing to get their loan quicker. If you read the small print on fast secured loans, you’ll likely find that the processing time can vary and may take just as long as other secured loans that are not promoted by the speed of application processing.

Are unsecured loans quicker to get?

Unsecured loans might be quicker to get approved and into your account.

Because a secured loan may require the lender to complete an appraisal of your asset to work out its accurate market value, the process can be slower. On the contrary, an unsecured loan will not require any asset appraisals and can sometimes be approved within the same day, with the money sent soon after.

Other credit options

It might also be worth considering other credit options, like credit cards, overdrafts, or Peer-to-Peer lending. All of these options come with risks, so it’s important to do your research thoroughly.

Are secured loans easier to get?

Secured loans are generally considered easier to get in comparison to unsecured loans. A secured type of loan makes it easier and less costly to recover the debt when the individual has stopped repaying.

This is why so many people with bad credit decide to consider secured loans over unsecured alternatives. But you may want to get debt advice from a UK charity before applying.

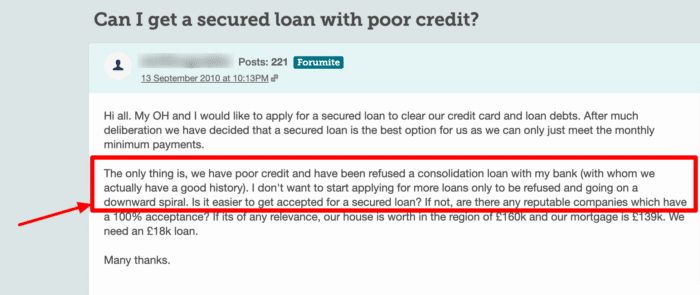

This forum user on MoneySaving Expert is looking for advice on getting a loan to clear some debt and wants to know whether a secured loan will be easier for them to get if they have poor credit.

Are fast secured loans even easier to get?

It could be argued that fast secured loans are even easier to get than any other type of secured loan – if they are genuinely a fast loan.

These quick lenders are marketing their loans as fast rather than on any other USP, such as the interest rate offered. Thus, the interest rate on fast secured loans may be considerably higher than the market average and would, therefore, be somewhat easier to get approved for. However, this is debatable and will depend on specific circumstances.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

Can you get a secured loan without a broker?

You can get a secured loan independently without using any credit broker or commercial service. You will have to search the market yourself, which has been made easier to understand thanks to online loan calculators.

These calculators enable you to enter the amount you want to borrow and your preferred repayment term. They’ll then provide you with a quote based on the representative APR – which may not be entirely accurate.

Fast secured loans from rogue lenders

Moreover, there could be some rogue lenders operating illegally, offering fast secured loans, or even doorstep lenders promising the same. Some warning signs could be high upfront fees, aggressive marketing tactics, or any promises they make that seem too good to be true.

No matter how swiftly they promise to approve your application, you should only consider using a lender that is legal, meaning they are authorised and regulated by the Financial Conduct Authority.

It’s so important when applying for any type of loan that you do your research first. You need to be aware of any extra fees, such as early repayment fees and admin costs; make sure you check all of the terms thoroughly and know exactly how much you will have to repay.