FCA Auto Services Debt – Should You Really Have To Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you got a letter from FCA Auto Services about a debt? Are you not sure if you should pay or not?

You’re not alone. Each month, over 170,000 people come to our website for help with debt problems.

In this guide, we’ll explain:

- How to check if the debt is really yours.

- If FCA Auto Services debt letters are real or a scam.

- What to do if you can’t afford to pay.

- How to stop FCA Auto Services from contacting you all the time.

- Ways you might be able to get some of the debt written off.

We understand how scary it can be to get a letter about a debt you didn’t know about. Our team has been there too.

Don’t worry, we’re here to help. By the end of this article, you will have a better idea of what you can do about your FCA Auto Services debt.

Are FCA Automotive Services Debt Letters a Scam?

No, FCA Automotive Services is a legitimate company governed by the Financial Conduct Authority (FCA). They provide financial services in the vehicle industry. Some people use FCA Automotive Services Ltd to buy cars over time, while others protect their already owned cars with other services.

Keep in mind that the FCA was partly set up to maintain fair debt collection practices. This means that FCA Automotive is a legitimate company with a minimum standard for behaviour and conduct.

The bottom line is that FCA Automotive Services is a financing company in the automotive industry. Many customers use FCA Automotive Services to buy FIAT cars, Jeeps, Alfa Romero vehicles, Maserati cars and more.

All of their services are listed on the FCA Automotive Services website, where you can also find the FCA Automotive Services Login portal for current customers and their contact information.

» TAKE ACTION NOW: Fill out the short debt form

But You Can Get FCA Automotive Services to Prove the Debt

If you disagree with the debt/payment that FCA Automotive Services claim you owe, you may want to dispute the debt. Alternatively, you can ask them to prove the debt. This means they would have to supply a signed agreement between you and them, such as a car financing agreement.

By supplying the agreement, they have proof of the money you owe, but you could use the content of that agreement to dispute any payments.

For example, FCA Automotive Services may have not given you your consumer rights or they may have not abided by the agreement themselves.

If they claim you have debt, it is best to use a prove the debt letter template which stipulates your rights in these circumstances. Citizens Advice could help with consumer disputes and tell you what to do next.

What If FCA Automotive Services Do Prove the Debt?

If FCA Automotive Services prove that you owe them money and there is no disputing the payment on your end, you will need to make provisions to pay off the debt.

Sometimes FCA Automotive Services debt can be smaller payments and payable in one lump sum for people with a regular income. If you can afford to pay the debt, then it is worth doing to avoid interest payments or further action.

Could FCA Automotive Services Have Made a Mistake?

When someone receives a letter stating they owe money or debt, these letters usually come from solicitors of debt collection agencies. Solicitors usually do their due diligence and send the letter to the right people, whereas debt collection agencies usually send out lots of letters to similar addresses or people with identical names to hopefully find the right person.

FCA Automotive Services is neither a law firm or a debt collection agency, but they are a financial company in the automotive industry who may have to recover debts. They are not as likely to send out debt letters by mistake as they rely on signed agreements and customer details on file.

But it is not impossible that FCA Automotive Services have contacted you by mistake.

Even if they have got the right person, that doesn’t mean you owe the debt because they could have made a mistake regarding your account or you may dispute their fees.

What Could FCA Automotive Services Do to Me?

FCA Automotive Services is regulated by the FCA. If they fail to adhere to financial conduct regulations, they could be heavily punished. This means FCA Automotive Services cannot claim to have powers that they do not.

They are not allowed to tell you that they can repossess your items or your home when they cannot.

Only law enforcement officers could do this when a CCJ has been issued. However, be aware that they could try and get a CCJ if the debt is legitimate and you do not pay.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Should I Just Ignore FCA Automotive Services Debt Letters?

If you recently received an FCA Automotive Services debt letter and disagree with their claims or cannot afford to pay, it is natural to want to bin the letter and not give them another thought.

Unfortunately, binning the letter will not make FCA Automotive Services go away and it could cause your debt to grow. Ignoring it will also have a huge negative credit score impact.

They could employ one of the aforementioned debt collection agencies to collect your debt and threaten to get a CCJ to collect the money.

A County Court Judgement (CCJ) is an order from a judge that states you have to pay the debt. This means that the court agrees with your creditor, and you owe the money.

Your judgement will include the following:

- How much you owe

- How you should pay

- Who you should pay

- Your deadline to pay.

Unless you pay within one month of the CCJ being issued, it will be recorded in the Register of Judgements, Orders and Fines for 6 years. If you pay off your debt within these 6 years, you can request that your judgement is marked as ‘satisfied’ on the register.

To do this, write to the court with proof that you have paid off the debt in full.

If you manage to pay within one month of the CCJ being issued, the judgement will not be recorded in the register. You will need to write to the court explaining that you have paid and provide proof.

CCJs are also visible on your credit file for 6 years. This will make it almost impossible for you to get credit during this time.

This is because companies use your credit file to see if you are a ‘high-risk’ customer – someone who might have difficulty paying their bills on time. If you have a CCJ, you have had such trouble paying back your debt that someone had to go to court about it.

Understandably, companies are going to be reluctant to give you credit!

After 6 years, it is no longer visible on your credit report and you should find it easier to get credit again.

I Cannot Afford to Pay My FCA Automotive Service Payment Plan

If you can’t afford to pay for an FCA Automotive Services repayment plan, or if you have other unsecured debts that you are struggling to manage, you may benefit from a debt solution.

There are several different debt solutions available in the UK, so I recommend speaking to a debt charity as soon as possible. Their advisors will be able to look at your finances in detail and help you work out which debt solution will work best for you, or suggest alternative debt management strategies.

The following organisations offer these debt advisory services for free:

Debt Management Plan (DMP)

A DMP is an informal debt solution that lets you pay off your debts via a single monthly payment.

Because it is informal, it is not legally binding so you are not tied into a DMP for a minimum number of payments.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.If you have little income and no valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.

I Cannot Afford to Pay My FCA Automotive Services Debt…

Not everyone can afford to pay their FCA Automotive Services debt in one payment, especially if the person owing the money does not have a large income or they are currently out of work.

In these situations, it is still pivotal that you do not ignore FCA Automotive Services debt letters.

One way of approaching this situation is to communicate with FCA Automotive Services and agree to a new payment plan to pay off the debt without causing yourself financial hardship. To do this, you will need to calculate how much you can afford to pay towards the debt each month.

Make sure your calculations account for all your necessities, such as rent, utility payments, groceries and commuting to work if applicable. Do not overcommit to payments, as this could result in missed bill payments and new debts being created with other companies.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

When You Never Have to Pay Your FCA Automotive Services Debt

There may be a situation where any debt owed to FCA Automotive Services does not have to be paid. This would be when the debt is an old debt and classed as statute barred.

What Is a Statute Barred Debt?

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is now classed as a statute-barred debt in the UK.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window it will be enforceable for the duration of the CCJ.

If your debt is statute-barred, you can use my free letter template to write to FCA Automotive and explain the situation.

If you are unsure about the status of your debt, you can contact a debt charity for some advice. Their advisors will be able to look at the debt in question, determine its status, and advise you on your next steps.

If you are unsure of the status of your debt, I don’t recommend writing about it until the status is confirmed. Stick to phone calls. You might accidentally restart the statute-barred debt timer and your debt will be enforceable for several years again!

Why Do I Not Have to Pay?

You do not have to pay statute barred debt because the debt cannot be enforced in the courts, i.e. FCA Automotive Services cannot get a CCJ for the debt. It is important to realise that the debt does not get wiped, it is simply not enforceable by FCA Automotive Services or any legal firm or debt agency.

The reason this loophole exists is because the courts get overwhelmed with old debt cases which puts pressure on their ability to deal with other – and newer – cases. To save the courts’ resources and time, they have issued an end date on old debts to be legally enforced.

Other Ways to Escape FCA Automotive Services Debt

Working out a payment plan with FCA Automotive Services UK is one way to get rid of your debt in time. But it doesn’t have to be the only way. Debt solutions are not always the same for every person. Some people can pay less money on their debt or pay off their debts quicker by choosing other options.

The number of debt solutions are extensive and can make us off wanting to research what will help us the most. Yet, lots of (see the end of this guide) are able to help. And you can find detailed information on debt solutions made simple on MoneyNerd.

You don’t have to be a financial guru to understand your options!

Some examples include:

- An IVA to pay off debt over five years and wipe away any unpaid debts

- Debt management Plans (similar to payment plans)

- Debt Relief Orders for those without a home

Can I Stop All Calls and Letters from FCA Automotive Services?

You will not be able to stop all contact from FCA Automotive Services because the debt could be genuine, and they need a way to communicate with you regarding the debt.

How Do I Make a Complaint Against FCA Automotive Services?

If you think that FCA Automotive Services has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Fortunately, the FCA complaints procedure is quite straightforward.

Make your first complaint to FCA Automotive Services so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, FCA Automotive may be fined. You could even be owed compensation.

Will They Give Up Chasing?

After all that you might be wondering whether you can just wait it out and hope they stop chasing you.

Sadly, that’s probably not going to happen. Most debt collectors are persistent.

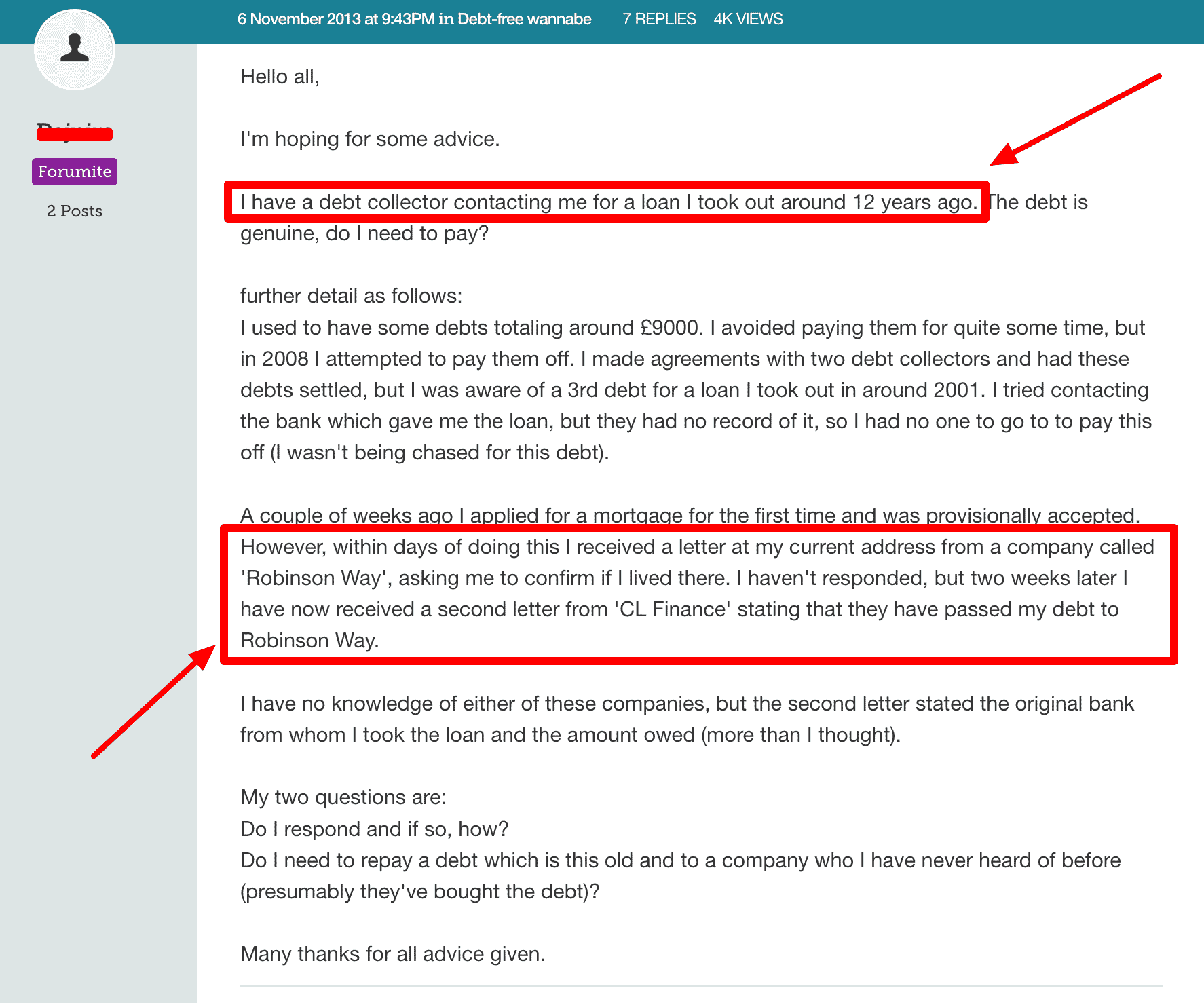

Source: Moneysavingexpert

As you can see Robinson Way starting to chase a debtor mere days after their mortgage application and a full 12 years after the debt was originally chased.

Other agencies like Lowell Group, Portfolio Recovery and Cabot Financial are constantly being accused of buying Statute Barred debts and then chasing people for payment.

FCA Automotive Services Contact Information

| Phone: | 0344 561 4738 Monday – Friday: 9.00am to 6.00pm Saturday: 9.00am to 1.00pm |

| Mail: | FCA Automotive Services UK Ltd, PO Box 4465, Slough, Berkshire, SL1 4DX |

| Email: | [email protected] |

| Website: | https://www.fcaautomotiveservices.co.uk/ |