How to budget

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

You can’t deal with debt unless you have a budget you can use. A budget is a tool to check income and expenditure, to see where your money is going.

With your budget you can see where your money’s being spent, and if you’re spending more than you earn and need to readjust the balance.

A budget can be as simple as a few scribbles on a scrap piece of paper. Some people budget in Microsoft Excel and others use paid-for online software. Many people get advanced budgeting tools with your bank account.

Whichever way you budget, this guide will help you make the most of your money.

» TAKE ACTION NOW: We recommend Plum, the smart money app, which help people to invest, save and manage their spending with automation (disclaimer: Capital at risk if you invest).

Why You Need a Budget

Without a budget, you simply don’t know what your financial situation is like. Most people don’t spend all their money on payday, so they’ll have a bank balance that’s constantly changing and might occasionally rise instead of fall.

Without a clear picture of your current situation, it can be hard to tell if you’re spending too much every month.

Over time, it’s clear if you’re spending too much money. At some point, you’ll need to rely on debt like an overdraft or credit card. The problem is, without a clear budget this moment can quietly creep up on you.

Even after you’ve identified that you’re spending more than you earn, without a budget it’s hard to work out where your money has gone. You might not see where you’ve been overspending, or where you can afford to cut back.

A budget makes it clear exactly what money you have coming in and going out. It should also show how that money is spent, so you’ll know if you’re spending too much on clothes or can afford to spend a bit more on groceries.

5 Bad Excuses for Not Budgeting

Budgeting isn’t that difficult, but lots of people try to avoid it because it can seem like a huge task. You might not like maths or like dealing with numbers, which could make budgeting seem boring.

Alternatively, you might avoid making a budget because you don’t want to face some harsh realities. But, without a budget in place you could struggle to ever take control of your finances.

Here are some of the most common excuses for not creating a budget:

1. ‘We usually manage OK without one…’

This is great, until one month you don’t. Those little changes to the way you spend might be small and hard to notice at first. You may not realise it until you’ve been dipping into your savings for months.

A budget can provide an early warning sign in case you ever start to go off-track.

2. ‘I’ve tried, and they don’t work for me…’

There are so many different budgeting methods, that one will surely suit your style. Perhaps you’re not the type to load an Excel spreadsheet, so why not find a separate smartphone app? Maybe you prefer to view physical money and would prefer a more low-tech system?

3. ‘My partner doesn’t want to…’

Budgets work best when the whole family’s involved, if everyone shares the household funds.

However, this doesn’t mean that you can’t attempt a budget on your own. If you have access to the bank account statements, you can see what’s coming in and going out. Create a budget so you can keep track, even if your partner doesn’t want to.

Having financial control and understanding is a very powerful thing. If you can create your own budget, you can quickly see how the household finances are looking.

If you and your partner have some separate bank accounts, you can also focus on budgeting your separate money.

4. ‘I don’t have time to budget…’

Budgeting doesn’t have to mean updating a spreadsheet every time you make a purchase. Some modern budgeting apps will do all the calculations for you. Some will even connect securely to your bank, so they can import all your transactions.

If you use certain methods, budgeting is just a task that takes five minutes on payday. Once the money’s in place according to your budget, you don’t need to do anything else.

5. ‘I just don’t have enough money!’

This is exactly what budgeting helps with! Many people think that budgeting is pointless because they spend so much more than they earn, but budgeting can highlight those problem areas and help you to find out how to fix them.

When your budget’s been created, you can see how small changes could make a big difference. A little less spending in each category could stop you from getting into more debt every time you’re paid.

Writing your budget can also highlight any spending you hadn’t even noticed, like how much the occasional coffee or meals eats into your bank balance.

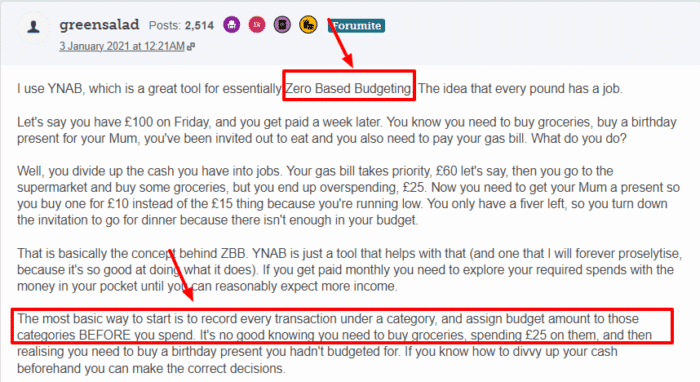

Zero-based budgeting is a concept that can help you take control of your finances and save money. it ensures that every single pound is accounted for, and not just floating around in your bank account waiting to be spent on an impulse purchase. Once you’ve assigned every pound to a category, you should arrive at £0 (ideally) and have enough money to cover all of your categories.

Look at Income, Debts, and Expenses

To start your budget, follow these five simple steps. You can use an online budgeting tool to make things easier.

1. Income

Make a note of how much money comes in. Include employment income as well as any benefits that you might receive through the month.

2. Debt

Next, make a note of any debts and how much you’re spending to repay them.

3. Bills and Commitments

List your known expenses like bills and Direct Debits. This will show what money goes out every month.

4. Other Spending

Check your bank balance and statement for any other spending. How much do you spend each week on groceries? How much on fuel for your car?

5. Long-Term Spending

Some expenses don’t happen the same every month. These could be things like your car’s MOT, dentist visits or buying Christmas gifts.

For these you’ll need to work out a yearly cost, then split it into 12 to make it monthly. Every month, set aside a fraction of what you will need. By the time the event comes around, you’ll have the money to cover it.

Make Some Changes

Many people that don’t already budget are shocked when they see the results. Budgeting can make it clear how much you’re spending, and the results can be surprising.

Now that you’ve got a working budget, you can make the necessary changes.

Even small adjustments can add up to big savings, so don’t be afraid to nudge your money around and experiment a bit with your budget. See what a difference small changes make when they add up over time.

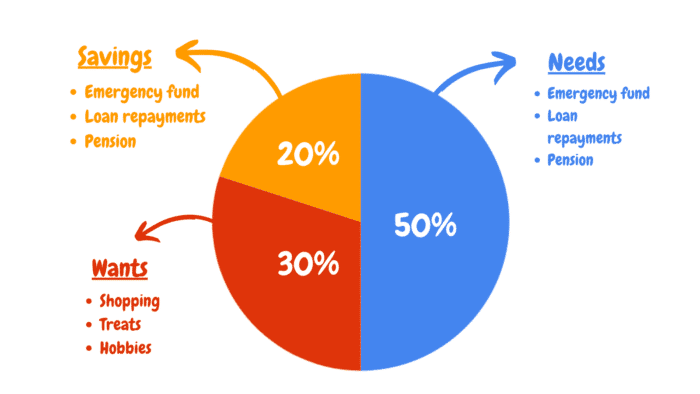

The 50/30/20 Rule

If your financial situation is relatively good, the 50/30/20 Rule could help you make more of your money.

That means using 50% of your money on needs, like bills and household essentials. 30% should go on things you want, or treats you can buy through the month. This 30% could include days out, restaurant meals, new clothes, or new books and games. The final 20% of your money should be put into long-term savings.

This method will only work if your bills are much lower than your income. If your bills steal away less than 50% of the money you bring in every month, you can use this method to make sure that you’re saving some money.

If you’re close to 50%, why not see if there are any expenses to get rid of? Could you get rid of those extra TV channels or drop down to a cheaper phone contract?

Use Budgeting Tools

There are so many different tools and methods to help you make a clear budget. Here are a few of the most popular ways to budget income and expenditure:

Budgeting Spreadsheets

Budgeting spreadsheets can be opened using free computer software. You don’t need a subscription and can check your budget on any laptop, tablet, or phone.

Budgeting spreadsheets can be as simple as a list of what goes out and comes in. Alternatively, set up more complex calculations that automate the budgeting process.

Want to get started? Our budgeting spreadsheet could help you gain control of your bank balance.

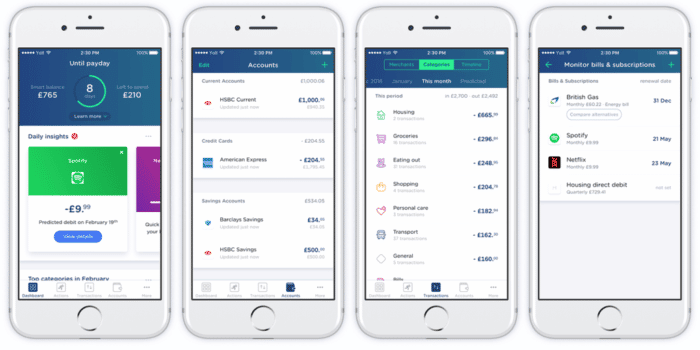

Budgeting Apps

There are so many different budgeting apps that you’ll want to look at several options. Some are free and others cost money, but different apps work for different people.

Some of the most well-known budgeting apps are Money Dashboard, Yolt, You Need a Budget, and Emma. These will provide a financial overview to highlight how you could save money.

Thanks to open banking, many budgeting apps can connect directly to your bank accounts. They’ll import balances and transactions from several different accounts, so you can clearly see at a glance how much money you’ve got overall.

Piggy Banking and the Envelope Method

A more traditional budgeting method, the Envelope Method keeps things simple. On payday, split your money into several different labelled envelopes. Each envelope holds your funds for a different category of spending.

You might have one envelope for ‘Groceries’, another for ‘Car Costs’ and one for ‘Regular Bills’. Using this budgeting method, you can clearly see how much money you have left for each type of purchase throughout the month.

If one envelope runs out, you can see where your budget has failed. Then, you can work out if you need to change your budget or cut back on your spending.

You can use as many envelopes as you need. People often find that using more envelopes can help them keep control of their spending.

If you’re partial to a morning coffee, why not make an envelope for that? Then, you can see exactly what you spend on visiting the drive-thru before work!

The envelope method was once the perfect choice for people that budgeted their cash. Now, we all do a lot more with digital funds.

There are some banks that offer what they call ‘pots’ or ‘spaces’, so you can split your balance just like you would with real envelopes. Look at Monzo, Starling, and Revolut for this app-based feature.

Keeping an Emergency Fund

Having an emergency fund will make your life a lot less stressful. It means that instead of getting into debt, you can pay up-front if your car needs repairs or the children grow out of their school uniform.

You might think that an emergency fund is something out of your reach, but with careful budgeting, you’ll be able to start setting money aside.

It’s a fact of life that everything is cheaper when you have more money. People without a lot of spare cash must pay for everything monthly, often being charged more for this payment method.

People with more money can pay up-front for things like their car insurance, with a one-off annual payment often being a lot cheaper overall.

If you have money to pay for things up-front, you don’t need to dip into debt. If you’re forced to use your overdraft or a credit card, of course, there will be interest payments added.

Just a small emergency fund can make everything easier and cheaper. Budgeting can help you get there, even if you feel like you simply don’t have any spare money.

Sticking to Your Budget

Once you’ve made your budget, the best way to stay on track is to check it several times a month. See how you’re doing and adjust your spending accordingly.

Maintaining a budget might seem like just one more thing to worry about, but trust us when we say that budgeting gets easier the longer you do it.

The hardest part is setting up the budget and finding your favourite tools to use. Once you’ve made your budget, you can adjust it as much or as little as you need to.

On your journey to clear your debt, or as you work to stay out of it, your budget will be your most valuable weapon and your best financial friend.