Fixed Rate Secured Loans – Complete Analysis

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Are you considering getting a fixed-rate secured loan but aren’t sure what the process to get one is or want to know more about it? You’re not alone! Every month, our site is visited by thousands of people asking themselves the same question.

In this guide, we’ll talk about:

- What a fixed-rate secured loan is.

- The advantages and disadvantages of fixed-rate secured loans.

- Examples of fixed-rate secured loans.

- How much you can borrow from this type of loan.

- Whether you can get a fixed-rate secured loan with a bad credit score.

Our team understands how to help you figure things out and can provide the best possible advice, as some of us have been through the process of securing a loan like this. Let’s get started and learn all the ins and outs of fixed-rate secured loans!

What is a fixed-rate secured loan?

A fixed-rate secured loan is a loan that uses an asset as collateral – as described above – and has a fixed rate of interest on payments that cannot change.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

Are secured loans fixed or variable?

You can get a secured loan offered with either a fixed interest rate or a variable interest rate. Some secured loans are more likely to have one or the other.

Fixed-rate interest is when the loan provider agrees to charge you a rate of interest that doesn’t change for the entirety of your monthly repayments, or a fixed interest rate for a specific duration of time within the overall repayment term, which then switches to the lender’s standard variable rate.

Variable interest means the interest you pay within your monthly repayment can change at any time. Most variable rates are made up of a fixed rate percentage and then a variable rate added on top. The fixed rate remains the same, and the variable rate changes, meaning the total interest rate changes, too. Variable rates are decided by the lender but are usually influenced by the economy or even the Bank of England base rate.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.99% |

£218.73 |

£26,247.92 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 6.95% |

£220.40 |

£26,447.92 |

| Selina | 7.5% |

£221.35 |

£26,562.50 |

| Equifinance | 7.7% |

£221.70 |

£26,604.17 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

What is the advantage of a fixed rate secured loan?

The advantage of choosing a fixed-rate secured loan over a variable-rate loan is that you know exactly what your monthly repayments will be for a set period. This makes budgeting for your loan repayments easier and straightforward.

Choosing a fixed rate can also help you avoid any inflation in interest rates that could be caused by a rise in the Bank of England’s base rate as an economic response to get people to stop spending and borrowing and to start saving more.

On the other hand, a fixed-rate secured loan could end up more expensive than variable-rate secured loans if the Bank of England base rate decreases during your repayment period.

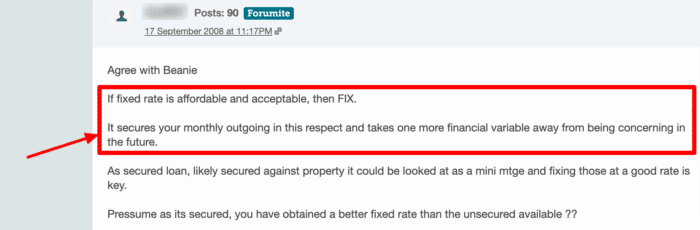

Here, this forum user on MoneySavingExpert is advising another user to choose a fixed rate secured loan as you then know what your repayments will be each month. The way I see it, though, it’s important to do your research because it may not always be the best option for your personal circumstances.

What is an example of a fixed rate secured debt?

There are many examples of fixed-rate secured loans, such as some homeowner loans (home enquiry loans), car loans, generic secured personal loans, and even some mortgages come with an initial fixed-rate period before transitioning to a variable rate mortgage.

Secured loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking to fund a home improvement project?

- Dreaming of finally taking the once-in-a-lifetime trip?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

How is the fixed rate decided?

The fixed rates offered by a lender are decided by finance and business analysts within the company. These professionals will decide on the lowest and highest fixed rates they are willing to offer, and the fixed rate you get will be between these figures, determined by your personal finances and credit score.

A wide range of metrics will decide how much of a lending risk you are – or aren’t. This includes your income, existing debts, credit score, how much you want to borrow, desired loan repayment term and others.

It is an accumulation of this information that the lender uses to decide what fixed rate they are willing to offer you. Two people applying to the same lender could be offered different fixed rate secured loans.

How much can I borrow with a fixed-rate secured loan?

Secured loans allow you to borrow more than unsecured loans on average. Whilst unsecured credit usually goes up to £25,000, secured credit goes well beyond this.

If you’re using your home or home equity to secure the loan, the amount of money you could borrow could more than quadruple this amount for some people.

The exact amount depends on personal circumstances, but you should never overborrow.

Can I get a fixed-rate secured loan with a poor credit score?

It is still possible to get a fixed or variable rate secured loan with a poor credit history. In fact, any loans secured with an asset may reduce your lending risk and increase your chances of being approved compared to unsecured credit.

Some loan providers even advertise secured loans for people with bad credit. You are likely to pay a higher interest rate.

Where can I find fixed rate secured loans?

Fixed-rate secured loans are widely available from an array of lenders. Most of these are banks, online loan companies, mortgage providers and building societies. Some loans may be easier to find with a fixed rate compared to others.

Alternatively, credit unions can sometimes be an option, particularly if you have struggled to get financial products in the past.

What is a credit union?

Credit unions (sometimes called community banks) offer an alternative to traditional banks and building societies for saving and borrowing. They are not-for-profit financial providers, owned and run by members, and are set up to be used by members with something in common. This could be living in the same area, working in the same industry, or belonging to a trade union.

It’s essential that you only try to get a secured loan from a loan provider that is authorised and regulated by the Financial Conduct Authority.

Is it easy to compare fixed rate secured loans?

Comparing fixed rate secured loans is easier than comparing secured loans with variable rates. The reason for this is because you know the interest rate won’t change and will not be subject to unforeseen changes and estimations.

To compare fixed rate secured loans, you should compare the representative example APRs advertised by each lender while also taking into account the loan amounts available and any other applicable fees. This has been made even easier with the rollout of secured loan calculators, which are found on most lenders’ websites.

But keep in mind that the representative example is only representative of 51% of successful applications. If you have a poor credit history, you’re likely to be offered a higher rate or even denied the secured loan.

Who can help me find and compare secured loans?

Comparing fixed rate secured loans can be daunting, especially if you have never taken out a loan before. You can get help searching the market and comparing loans, which could save you time or even help secure more favourable loan repayments.

Some of the ways to get help looking, searching and even applying for a secured loan are:

- Using comparison websites

- Using a credit broker

- Using money advice groups or local equivalents

- Using a professional finance advisor

Most of the above will come at a cost, and there is no guarantee that they will get your application approved or find the best deal.