Goodwins Credit Management – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you have received a letter from Goodwins Credit Management, don’t worry. You’re not alone. Every month, over 170,000 people come to our website for advice on debt solutions.

We understand the worry you might be feeling right now. Questions may be swirling in your head. Is this debt real? Should I pay it? Can I afford to pay it?

In this article, we’ll guide you through:

- Who Goodwins Credit Management are.

- How to check if the debt they claim is yours.

- What to do if you cannot afford to pay.

- Steps to ask Goodwins Credit Management to prove the debt.

- Your options if they can indeed prove the debt.

We have a team of experts who understand what it’s like to be approached by a debt collector. We’ve been in your shoes and it’s not easy. But, with the right information and support, you can handle this.

Ready to learn more about Goodwins Credit Management? Let’s dive in!

Goodwins Credit Management debt letter

You might get contacted by Goodwins Credit Management Ltd in various ways, including calls and texts. It all depends on the contact information they have received from their client, or what they have managed to track down themselves.

The most important communication you’ll get from Goodwins Credit Management Ltd is a Letter Before Action. This is a letter that lets you know they might take you to court if you don’t pay. If you can’t pay in full they will encourage you to get in touch and discuss payment plans.

Ask Goodwins Credit Management to prove the debt

If your debt isn’t a statute barred debt, you can still reply without paying.

Your reply should ask for proof that you owe the money they say you do. You aren’t obligated to pay the debt until Goodwins Credit Management sends you evidence, which should be a copy of a signed agreement when applicable.

This is a good idea even if you think Goodwins Credit Management Ltd has made an error. It will force them to realise their own mistake and may stop them from wrongfully chasing you.

MoneyNerd has made it simple and quick to ask for proof of the debt. Download our letter template which you can use to request proof from Goodwins Credit Management.

» TAKE ACTION NOW: Fill out the short debt form

Check your debt can still be collected

The first thing you can do is check to see if the debt can be collected. Some debts become too old and cannot be taken to court. This is to prevent the courts from becoming overwhelmed with old debt cases.

Without going to court over the matter, a judge can never order you to pay and there can be no consequences if you don’t. This is because bailiffs cannot be used unless a judge has previously ordered you to pay.

These older debts are known as statute barred debts. They don’t automatically become written off, and can therefore still affect your credit score. But you don’t have to pay and can ask for it to be wiped.

What if they prove the debt?

If Goodwins Credit Management Ltd replies to your prove the debt letter with genuine proof that you owe the money, you should strongly consider paying off the debt.

If you can’t afford to pay all of the money in one go, speak to them about a payment plan. But never agree to a payment plan you know you cannot afford.

There are also alternative debt solutions which may be suitable and beneficial to you, especially if you have multiple arrears. You can learn about the most effective debt solutions at MoneyNerd.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Do you have to pay Goodwins Credit Management?

You don’t have to pay Goodwins Credit Management Ltd just because you received a Letter Before Action. At the same time, you shouldn’t ignore any letters and legal threats from them. So, if you don’t need to pay instantly and you shouldn’t ignore them, what can you do?

The best way to react to a Goodwins Credit Management debt letter depends on your situation. Below you can find two possible ways to reply to their Letter Before Action.

Are Goodwins Credit Management bailiffs?

Goodwins Credit Management Ltd are not bailiffs. They are a debt collection agency, meaning the company has no more legal powers than the original creditor. It’s simply a job of outsourcing the debt collection process.

If Goodwins Credit Management agents suggest they are bailiffs or can take your possessions, you should report them to the Financial Ombudsman. They aren’t allowed to pressure you into paying, especially using lies.

Will Goodwins Credit Management take me to court?

You might feel anxious after being told they will take you to court, but will they really take legal action? It all depends on what their client wants to do, which may come down to the amount of money you owe.

The bottom line is that you can never be sure if they will actually start legal action. Sometimes they will and other times it’s just a tactic to make you pay faster. But it’s a risk to assume you won’t be taken to court.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Will They Give Up Chasing?

After all that you might be wondering whether you can just wait it out and hope they stop chasing you.

Sadly, that’s probably not going to happen. Most debt collectors are persistent.

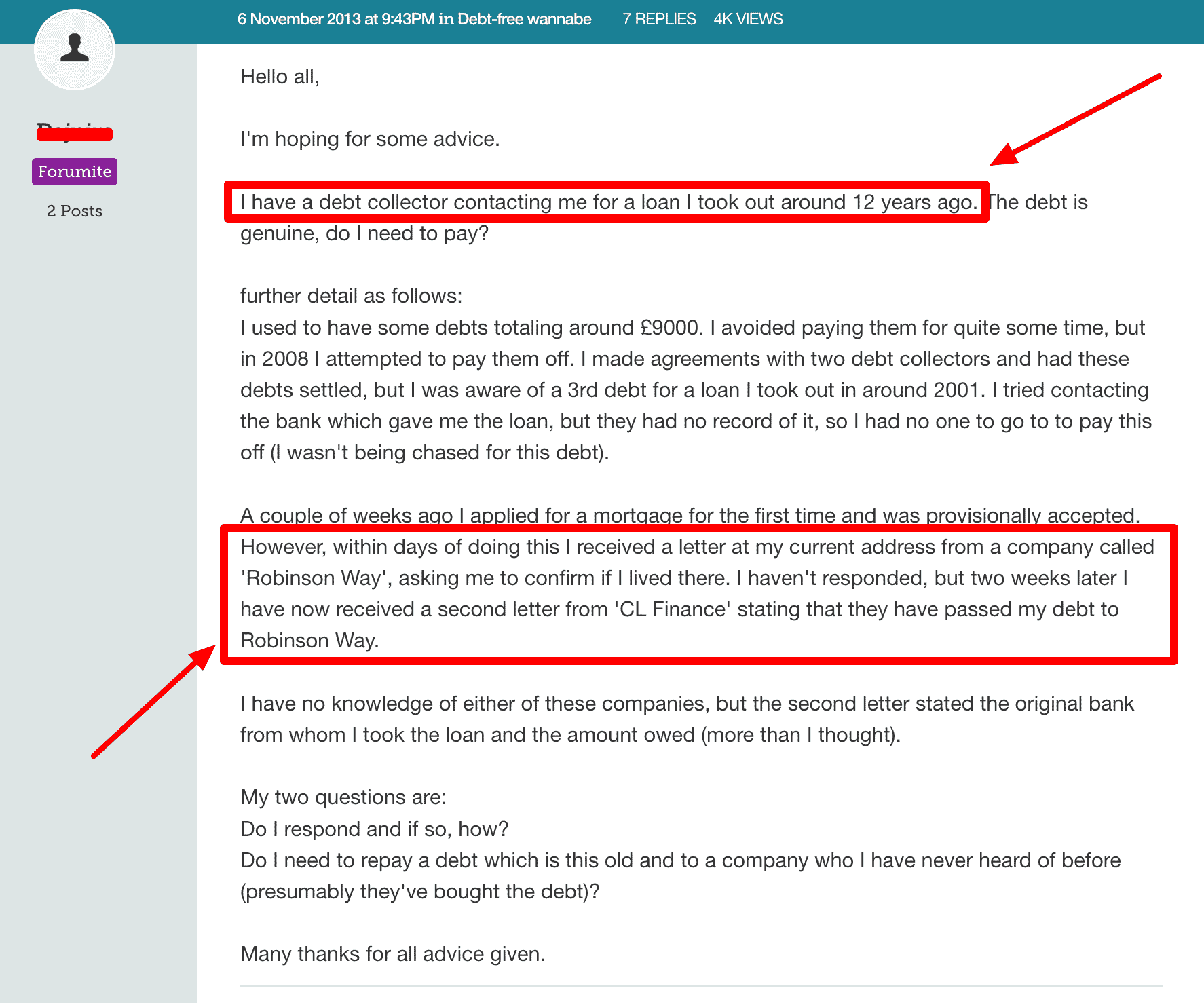

Source: Moneysavingexpert

As you can see Robinson Way starting to chase a debtor mere days after their mortgage application and a full 12 years after the debt was originally chased.

Other agencies like Lowell Group, Portfolio Recovery and Cabot Financial are constantly being accused of buying Statute Barred debts and then chasing people for payment.

Goodwins Credit Management Contact Details

| Address: | Suite 106-8 Navigation House Port Of Tyne South Shields NE34 0AB |

| Phone: | 0191 4479449 (Main Reception) 0191 9080586 (Collections) |

| Email: | [email protected] |

| Website: | https://goodwinscreditmanagement.net/ |