Halifax Debt Consolidation Loan Reviews & In-depth Info

If you’re thinking about getting a Halifax debt consolidation loan, our article is here to help. We aim to answer common questions like:

- What is a Halifax debt consolidation loan?

- How to know if you can get one?

- How much it might cost?

- How to apply for one?

- What do other people say about these loans?

We understand that sorting out your money can be a bit tricky. Maybe you have too many bills to pay. Maybe the interest rates are too high. We know it can be tough, but you’re not alone. Every month, over 170,000 people come to our website for advice on money matters.

So let’s get started and learn more about Halifax debt consolidation loans.

What Is a Halifax Debt Consolidation Loan?

Halifax offers its own personal loan, which can be used to consolidate debts.

Unlike many other well-known banks in the UK, Halifax even advertises this personal loan as a debt consolidation loan. This is rather unique because many competing banks advertise “personal loans” only and state they can be used to consolidate debt.

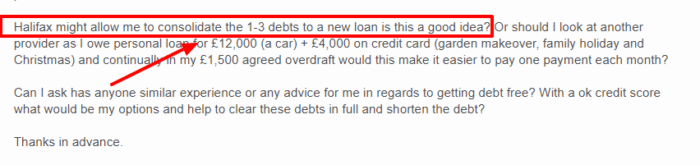

The Halifax debt consolidation loan comes with different APR rates and amounts you can borrow depending on your circumstances – and if you are already a Halifax customer.

Who Can Apply for a Halifax Debt Consolidation Loan?

Both UK residents with and without a Halifax account can apply for a debt consolidation loan of up to £25,000.

This is also the policy that Santander has adopted, but it is not the same as Nationwide, where you must already have a Nationwide account.

You can borrow a further £10,000 (up to £35,000) if you are a Halifax customer. But if you do need to borrow such significant sums to consolidate debt, you probably shouldn’t be using a debt consolidation loan.

More favourable debt solutions exist in these situations, such as an IVA, which could wipe out most of your debt.

The best thing about being a Halifax customer and applying for their debt consolidation loan is that they do not do a credit search. This could make a big difference.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

Further Criteria to Get a Halifax Personal Loan

But there will be other criteria that applicants must meet to be considered for their personal loans. To apply, you must:

- Be 18 and live in the UK

- Have regular income (usually employment)

- Not a full-time student

- Not had credit applications rejected in the last 30 days

- You must not have bad credit or have been declared bankrupt

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 6.34% |

£219.34 |

£26,320.83 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 7.99% |

£222.20 |

£26,664.58 |

| Selina | 8.45% |

£223.00 |

£26,760.42 |

| Equifinance | 9.95% |

£225.61 |

£27,072.92 |

| Evolution | 10.2% |

£226.04 |

£27,125.00 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

What Are the Halifax Personal Loan Interest Rates?

The best APR rate you can get on a Halifax debt consolidation loan is 6.3% (representative rate).

However, this is only available to loans between £7,500 and £25,000, which you must repay within five years. The exact APR rate you receive will depend on your personal debt and finances. The maximum that Halifax will charge is 29.9% APR.

Is There a Halifax Debt Consolidation Loan Calculator Online?

Yes, there is a Halifax personal loan calculator to help you figure out what type of repayment plan you could get. But it is essential that you use the calculator as a guide only.

On many occasions, potential customers see lower APR rates calculated but are then offered less appealing loan terms.

How to Apply for a Halifax Debt Consolidation Loan

If you have a Halifax account already and use internet banking, you can apply for a loan on your account, and it is said to take one minute.

A decision will be made almost instantly, and the credit can be in your Halifax account in a few moments after that.

You can also apply online if you don’t have a Halifax account, but this will take slightly longer. If successful, the credit may take up to five working days to hit your external bank account.

Halifax Debt Consolidation Loan Repayment Periods

Halifax is able to match the loan repayment period of Nationwide by offering some repayment plans up to seven years.

This is slightly better than those offered by Santander, which are usually capped at five years.

Halifax Debt Consolidation Loan Reviews

It is not uncommon for the big banks to have bad reviews online.

Although you shouldn’t just accept this, you need to be aware that most people will review something bad over something good when it comes to a sensitive topic like finances.

Halifax’s current Trustpilot reviews give them a rating of 1.7 out of 5.

Some recent reviewers have been saying:

“Excellent, refunded me when my holiday was cancelled, very nice and polite customer service.”

[Trustpilot]

“Very disappointed in this bank. Leaving a father of 4 children with no money at this time of year, how does this bank think I can live with no money they took my full wages I am very upset.”

[Trustpilot]

Unfortunately, there are currently no reviews that specifically mention personal loans.

Debt consolidations loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking for a better interest rate?

- Stuck with the confusion of multiple repayment plans?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

Halifax Debt Consolidation Contact Details

| Website: | Debt consolidation link |

| Phone number: |

https://www.halifax.co.uk/contactus/contactushome.html Scan and download the app |

| Contact us: |

https://www.halifax.co.uk/contactus/contactushome.html scan and download the app |

The MoneyNerd Verdict on Halifax Debt Consolidation Loans

The rates available at Halifax are not as appealing as those offered by other big-name banks, but they do come up with repayment periods lasting up to seven years. The lack of a credit check on existing customers is a massive bonus.

That said, if you are not already with Halifax, they probably aren’t your best option.