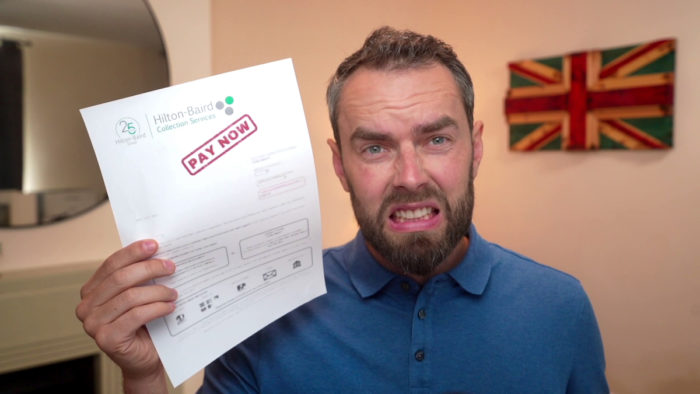

Hilton-Baird Debt Collection Services – Must You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you got a surprise letter from HiltonBaird Debt Collection Services? Are you unsure if you should pay? Don’t worry. This article will help you understand your situation and what to do next.

Every month, more than 170,000 people visit our website for advice on debt issues. So, you’re not the only one dealing with this.

In this easy-to-read guide, we’ll:

- Explain who HiltonBaird Collection Services are.

- Help you understand why you’ve received a letter from them.

- Show you how to check if the debt is really yours.

- Discuss ways to stop them from contacting you.

- Guide you on how to manage your debt, and if possible, write some off.

We know it can be scary to get a letter like this. Some of our team have been in your shoes, dealing with debt collectors.

With our expertise, we’ll help you find out more about HiltonBaird and how to handle your debt.

Why have you received a letter from them?

Your first thought when receiving a letter from Hilton-Baird is probably, ‘I’ve never done business with them before.’ Although that’s probably accurate, they may still have a good reason for contacting you.

Hilton-Baird specialises in debt collection. This means that companies will pay them to recover money when their own attempts have failed. So, if you’ve been putting off making a repayment on an unsecured debt or settling an invoice, this is likely why they’re writing to you.

Usually, a company will try everything possible to recover the money themselves. When they’re unsuccessful, they’ll pass the case onto a debt collection agency, either internally or externally. Hilton-Baird is just one such example of this type of agency.

» TAKE ACTION NOW: Fill out the short debt form

Should I ignore Hilton-Baird letters and calls?

Given that they have limited powers, it can be tempting to assume you can ignore Hilton-Baird and hope they go away. However, this is very unlikely to happen. These types of companies know every trick in the book, and they specialise in recovering money. Usually, they also work on the basis that they only get paid once the debt is recovered, so it’s in their interest to be persistent.

Ignoring their calls and letters will usually mean things escalate. Although they can’t harass you, they can certainly make sure they’re never far from your mind. They can also keep adding interest and charges to your account, meaning the debt will continue to grow.

Ultimately, ignoring debt collection agencies can eventually mean that your case gets sent to court. From here, you could face the actual bailiffs, as well as a County Court Judgement or even bankruptcy.

What should I do if Hilton-Baird Collections write to me?

Now that we’ve established exactly who Hilton-Baird Collections Service are, it’s time to look at how to deal with them. If they’ve written to you about a debt they claim you owe, here are some of the steps you should take:

Check if you owe the debt

Although it’s rare that debt collection companies get your details by mistake, it isn’t unheard of. You could have moved into an address where the previous occupant had a debt. Or you could have recently paid what you owe, but records haven’t been updated.

Either way, it’s vital that you check the full details of what Hilton-Baird is telling you. Make sure that the details on the letter match up with your own, including your name and address. Similarly, you should double–check that the original creditor and amount owed is accurate.

By gathering your own documents and records relating to the debt, you’ll be able to cross-reference whether their claim matches what you owe. This makes it far easier when dealing with the situation.

Get them to prove the debt

It’s up to the original creditor to give exact details of how much you owe, when you owe it from, and any extra charges that relate to it. From a legal standpoint, they can’t enforce the debt if they can’t prove it. This may play into your hands, and you should ask them if they’re able to prove the debt.

Not only does this buy you a bit of time, but it also means that you’ll get a clearer picture of the amount you owe. What’s more, if they can’t prove that you owe the debt, you may not have to pay it at all.

Check online for some ‘prove the debt’ templates and update them with your details. Essentially, these letters outline the FCA regulations surrounding debt repayments and the burden of proof.

Check if it’s statute-barred

Certain types of debts have a time limit when it comes to repaying them. Unsecured debts such as credit cards, store credit, overdrafts, and utility bills all fall into this category. The time limit in England is usually six years, but there are certain conditions that have to apply for it to be statute-barred:

So, if you haven’t heard about or made any action regarding the debt in the last six years, it could be statute-barred. Although this doesn’t clear the debt, it effectively means it’s unenforceable and can be written-off. As such, you should check your records to see whether this is the case for yours.

Contact them

Once you’ve got proof of the debt and made sure it isn’t statute-barred, you’ll want to contact either Hilton-Baird or your original creditor. You will have to acknowledge that the debt is yours and that you intend to pay it. Doing so will usually mean that the debt collection agency stops chasing you, and you can deal with the creditor again.

In some instances, debt collection agencies actually purchase the debt, meaning you no longer owe the creditor but instead owe the agency. If this is the case, you’ll have to contact them to settle. The letters you receive from Hilton-Baird should outline the status of your debt.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Options for paying Hilton-Bard debt

So, if you definitely owe the debt, the creditor can prove it, and it’s not statute-barred, you will have to pay it one way or another. So what are your options when it comes to clearing what you owe? It depends a little on your current situation:

Can you pay it?

If you can afford to pay the debt, you might have a few options available. Of course, the simplest is to pay what you owe in one lump sum. This will deal with the situation, and you can move on. However, that might not be feasible.

Instead, you can suggest a regular payment plan to your creditor. This could be a fixed monthly amount in line with your current financial situation. They don’t have to accept such an offer, but they’re usually likely to.

Can you write it off?

Aside from when it’s statute-barred, you might have some options to write off some of your debt. Perhaps the most feasible option is an individual voluntary arrangement (IVA). Essentially, this sees you pay a fixed amount each month for 60 months. It’s usually a smaller amount than you otherwise would pay, and anything remaining at the end of that period is written off.

Debt collection agency vs bailiffs

One common misconception is that debt collection agencies are the same as bailiffs (also known as enforcement agencies). In reality, they’re very different and have significantly different powers.

Debt collection agencies such as Hilton-Baird only have the same amount of powers as your original creditor. So, they can ask you to repay what you owe and may be more persistent, but they can’t enforce it initially.

A bailiff is usually a court-appointed individual or company that can take steps to recover money you owe. For example, they can seize your belongings and sell them to recover the cost of the debt. They can also force entry to your house in some circumstances. Hilton-Baird is not a bailiff.

Can they visit me at home?

You’ll find that, in some circumstances, debt collection agencies will visit peoples’ homes. They usually have to give at least seven days’ written notice of such an event, and even then, their powers are limited.

They can come to your door and ask you or try and persuade you to repay the debt you owe. However, you don’t have to let them in, and they have to leave when you ask them to do so. They cannot forcibly enter your property, and they can’t take or threaten to take your possessions.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Checking for Other Debt Collectors

There are a lot of ways to get into debt. In fact, it’s not uncommon to owe money to several companies at once.

Perhaps you have a mortgage, a car loan, a couple credit cards and an item or two you bought on buy-now-pay-later schemes. It’s easy to lose track.

That’s why it’s important to regularly check your credit report and bank statements to make sure you haven’t missed anything.

If a debt collector has purchased your debt, it appears on your credit report.

Some of the debt collectors you’re most likely to come across are PRA Group, Lowell and Cabot Financial.

How can I stop them from contacting/visiting me?

It’s not ideal when you have a debt collection agency on your case. They will go as far as legally possible to force you into paying your debt. On top of the stresses of everyday life, it can be an unwelcome addition, especially if you’re trying to figure things out.

One thing worth noting is that Hilton-Baird has to respect your contact preferences. So, if you feel they’re bombarding you with calls, you can request that they only contact you in writing. Similarly, if you’re disputing the debt or asking them to prove it, they cannot keep trying to reach you while it’s being reviewed.

If you’ve received a letter informing you that they’re going to visit your home, your best option is to contact them. You can tell them that you’re going to dispute it or arrange payment, and this will usually stop them from visiting you.

Hilton-Baird Debt Collection Services Contact Information

Can you get help managing your debts?

There are several options available to help if you’re struggling with debts. For example, you could consider a debt management plan, which helps you make more manageable payments towards all your debts.

Alternatively, you could contact Citizens Advice about your problems with debt. They can help you work out the best method of getting a handle on what you owe.