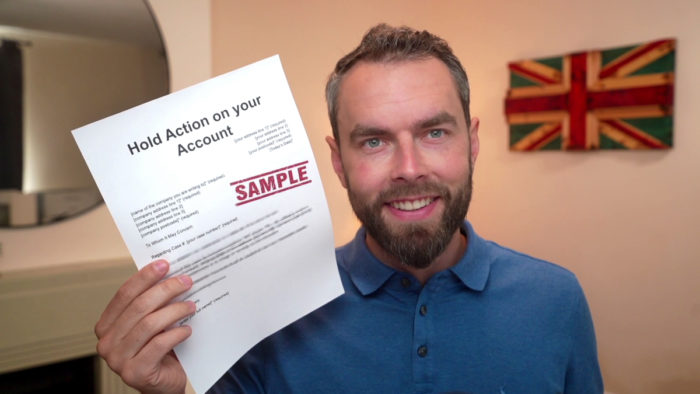

Hold Action on your Account – Sample Letter Template

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you having trouble with a debt problem and need to send a letter to hold action on your account? You’ve found the right place. Each month, over 170,000 people visit our website for guidance on debt solutions.

In this helpful article, we’ll cover:

- What it means to hold action on an account.

- The process for writing and sending this important letter.

- Details about how long creditors will usually wait before taking action.

- Ways to potentially write off some of your debt.

- Tips and advice if you’re struggling with too much debt.

We understand that dealing with debt can be tough and stressful. That’s why we’ve included a sample letter template to make things easier for you. Have a look at it below.

Letter Template

To Whom It May Concern

Regarding Case #: [your case number]* (required)

I would appreciate it if you could hold action on the above account for a period of at least 30 days to give me the breathing space I need to do a budget sheet and work out the best way to deal with my debts.

Also, if you are adding interest or other charges to the account, I would be grateful if you would freeze these during this period so that my debt does not get any bigger.

I will contact you again as soon as possible with further details of my financial situation and my proposals for repaying my creditors.

I look forward to hearing from you as soon as possible.

Yours sincerely

Downloadable Resource

The download links below take you to a Google document template where you can make a copy or save in any document format you like. Note, you may have to login to your Google account.

Download – Single (for one person)

Download – Joint (for couples)

What is holding action on your account?

Holding action on your account, also known as creditor breathing space, is when the creditor agrees to not chase you for debt repayment or start legal action while you get debt advice. It usually happens right at the start of the process when you first get asked to repay the money.

You can request that a creditor gives you some time to assess the situation, get debt advice and work out the best way to get out of debt in your situation. Holding action on your account may also mean freezing any interest accumulating on the debt.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Will creditors stop contacting me during breathing space?

When creditors give you this type of breathing space, they are not likely to contact you to ask for a payment. They may contact you on rare occasions when they are required to by law. Or you may receive a letter from them which had already been put in the post before you requested they give you breathing space.

Do creditors have to give you breathing space?

Multiple codes of conduct state that creditors should provide breathing space to new debtors. The Credit Services Association, The Lending Standards Board and the Finance and Leasing Association all state that lenders must hold the account while the debtor seeks advice and support. Members of these organisations will therefore grant breathing space.

Smaller companies that are not a member of these organisations might not grant breathing space, but it is unlikely.

You cannot get breathing space for some debts, including but not limited to court fines, council tax debts and rent arrears.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How long will a creditor hold action on my account?

Your account will typically be held for 30 days. It is crucial that you use this time effectively by getting help from a debt charity, creating a monthly budget and putting together an affordable debt repayment proposal if needed.

How do I ask my creditor for breathing space?

You should ask your creditor for breathing space in writing by using our free letter template. We have made it so easy to ask a lender to hold your account. Alternatively, you could ask a debt charity to do it for you, but this could slow down the process.