How to Clear Credit Card Debt without Paying? Possible?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you feeling worried about your credit card debt? You’re not alone. Over 170,000 people visit our site every month for advice on managing their debts. We’re experts in this field, and we’re here to help you understand your options.

In this article, we’ll cover:

- How to handle your most important debts first.

- The best ways to pay off a lot of debt.

- What to do if you can’t pay off your full balance.

- When and how you can write off some of your debt.

- How much debt is too much and what it means for you.

We know dealing with debt can be tough. But remember, you’re not alone. We’ll guide you through your options and help you find the best way forward.

Deal with Priority Debt(s) First

As I mentioned earlier, the outstanding balance on your credit card is an unsecured and non-priority debt.

You should always take care of your priority debt(s) first. Examples of priority debts include:

- Mortgage payments

- Car loans

- Council tax debt

- Rent arrears

Once you’ve dealt with your priority debts, you can start worrying about the outstanding balance on your credit card.

I Can’t Pay Off My Outstanding Balance. What Should I Do?

This should be fairly obvious but I’ll state it anyway: Don’t buy any more items using your credit card.

This will prevent your outstanding balance from increasing even further, thus making it easier to repay your debt sooner.

It can definitely be worthwhile to talk to a debt professional or an adviser.

They might be able to suggest debt solutions and options which you may not have been aware of.

Please note that if you take debt advice from an agency, be sure to take it from one that does not charge you for their advice.

Of course, it would be a bad idea to go to an agency that charges you a fee for debt advice when you’re already having trouble paying back the money you owe.

This is why seeking debt advice from an independent debt charity is always the best and safest option. Some great debt charities that you can contact include Stepchange and Payplan.

What is the right of debtor?

Being in debt isn’t a crime. Plus, creditors and debt collectors must abide by the law.

In short, it’s your right to:

- Not be discriminated against

- Have your privacy protected at all times

- Seek independent debt advice

- Question the debt

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

I’ve Received a Letter About My Debt. What Should I Do?

If you’ve received a letter regarding your debt, it’s important that you don’t panic.

Ignoring the letter is also something that you should never do as that will only exacerbate the situation.

The best thing you can do in this situation is to assess your finances thoroughly and work out whether you can afford to pay your debt in any capacity at all or not.

Again, I have to stress the fact that you must maintain communication with your credit card company.

Let them know the details about what you’re doing to address the outstanding balance on your credit card.

If you don’t keep them in the loop regarding what actions you’re taking, there’s a chance that your credit card provider may pursue legal action against you.

This could be either by getting a County Court Judgment (CCJ) against you or petitioning for your bankruptcy.

Working Out How Much You Can Pay

Anyone will tell you that you should at least try to pay the minimum payment on your credit card if you can.

If you don’t do that, then your creditors might charge you an extra fee and your credit rating (credit score) may also get worse.

That being said, you should always prioritise priority debts and essential living costs over the minimum repayment on your credit card.

It’s also more important to stay in your home and avoid legal action than to pay the outstanding balances on your credit cards.

If you can afford it, try to pay the same amount towards your credit cards each month.

If you can’t afford it, you should try looking at other options to reduce the debt on your credit card.

Please note that you should keep your provider informed about what actions you’re taking to address your debt.

» TAKE ACTION NOW: Fill out the short debt form

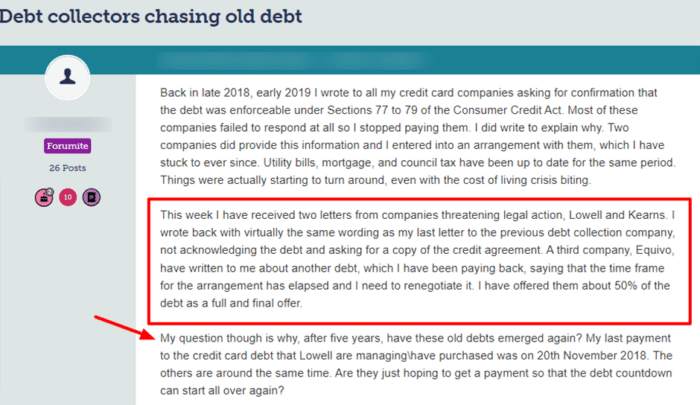

Case study: debt collectors chasing credit card debt

See the message posted by someone on a popular online forum about debt collectors chasing purchased credit card debts.

Source: Moneysavingexpert

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

The disadvantages of balance transfers

There are several disadvantages to opting for a balance transfer on credit cards which I’ve listed here:

- The possible drop in your credit rating

- Interest rates go up when the introductory offer ends

- Taking on more debt

Debt and mental health

Being in debt and struggling to pay bills can seriously impact your mental health.

You could experience the following:

- Feeling anxious all of the time

- Low mood swings

- Unable to sleep, which affects your work and relationships

If you’re not coping well because of debt, you should seek help sooner rather than later. Support is available when you need help to cope with a stressful situation.

Financial stress management is essential when you feel you’re drowning in credit card debt.