How does Debt Consolidation Work? In-depth Guide

How does debt consolidation work? We get this question a lot from our readers. So I’ve dedicated this post to answering how debt consolidation work and related questions.

Here’s everything you need to know about debt consolidation, its pros and cons and whether you should consider it to manage your debts.

Whether you have credit card debt or owe loan companies, we’ve got you covered.

How does debt consolidation work?

Debt consolidation is when someone with multiple sources of credit – such as personal loans and credit cards – pays off all of their debts by taking out one new form of credit, typically a debt consolidation loan.

For example, you may currently have two personal loans and a credit card owing a total of £750. To consolidate your debt, you would take out a personal loan to pay off the other loans and the credit card, leaving you with one debt and one monthly repayment.

By using one new loan to clear all existing debts, you are consolidating your debt and making repayments easier to manage through one monthly payment.

Making a single payment every month could help debtors:

- Keep track of their finances

- Prevent missed payments

- Reduce ongoing stress.

Consolidating debts may also enable you to pay a lower rate of interest and reduce ongoing fees.

Personal loan companies may offer a lower rate if you’re taking out a bigger loan which may be required to consolidate multiple debts – but not always.

If your cumulative interest was higher than the rate you pay within your new monthly payment, you’re saving money by consolidating debts. This is the main motivating reason why debtors choose to consolidate.

You can use debt consolidation to manage debts like:

- Unsecured personal loans

- Credit card debt

- Store card debts (catalogue loans)

There are different types of debt consolidation, and we discuss two of the most common further below.

The pros and cons of debt consolidation

The benefits of debt consolidation are:

- It makes budgeting for your debts easier and less stressful

- It reduces the chance of missed payments and additional fees

- It mitigates potential credit score damage

- You may be able to take advantage of loans with better interest rates

- Thus, you could be able to reduce your monthly payments and save money

The cons of debt consolidation are:

- You may have to pay higher interest or payback for longer

- It involves taking on another credit application and another credit history check

- The process can be confusing (that’s why we’re here to help!)

- You might have to pay additional fees when you consolidate debt

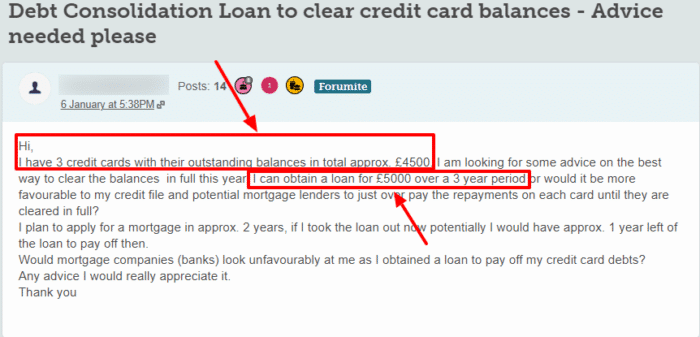

Overall, debt consolidation – taking out a new loan to pay it all off – is a good idea if you’re struggling with multiple debts like this forum poster. But it’s not always the correct answer in every situation. You may want to consider alternative debt solutions as well.

How does debt consolidation work for loans?

Debt consolidation for loans usually works in the same way as described above. The debtor will take out a loan to repay all of their other loans.

To make it worthwhile, the new loan they take out should have better repayment terms, i.e. interest rate is lower than the cumulative rate they are currently paying.

Remember that taking out a loan will require approval and a credit check from the loan provider, meaning existing debts could stop you from getting the loan.

However, to navigate this potential issue, you can take out loans specifically for the purpose of debt consolidation, aptly named debt consolidation loans.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.99% |

£218.73 |

£26,247.92 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 6.95% |

£220.40 |

£26,447.92 |

| Selina | 7.5% |

£221.35 |

£26,562.50 |

| Equifinance | 7.7% |

£221.70 |

£26,604.17 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

What is an unsecured debt consolidation loan?

An unsecured debt consolidation loan is a type of loan that is taken out for the specific purpose of consolidating debt.

Taking out a loan for a specific purpose is not uncommon. After all, you can get car loans and home loans too.

Debt consolidation loans are unsecured against your assets, as opposed to a secured loan like a mortgage that uses the property as collateral in the case of defaults.

You may be able to still get these loans when you have poor credit.

Where to search debt consolidation loans?

Scores of financial institutions like banks and building societies offer debt consolidation loans. You can also browse different consolidation loan options online, including repayment terms, APR, etc.

Lenders usually offer an online calculator so you can easily work out what your new monthly payments will be. Always consider other loan payments you may be subject to before deciding.

And before you apply, make sure to check your credit score for any mistakes that could cause your application to be rejected.

Beware of scammers and loan sharks. Only take out a loan from a lender that is authorised and regulated by the financial conduct authority.

How does debt consolidation work for credit cards?

You can also use a debt consolidation loan to pay off credit card debts, or a combination of loans and credit cards. This works in exactly the same way as explained above.

But there is another way to consolidate debt if you only want to consolidate your credit card debts, namely a balance transfer.

What is a credit card balance transfer?

A credit card balance transfer is when you take out a new credit card to pay off all your existing cards. Thus, you switch the outstanding balance from multiple cards to the new card.

The balance transfer card is similar to a debt consolidation loan because it is used for this specific purpose.

Note that some cards will not allow you to do this, and those that do will include balance transfer fees.

We’ve put together an easy guide to help you understand how to consolidate credit cards.

You may also want to get free debt advice from a debt charity like StepChange before making a decision. They can also offer support in understanding your options.

Debt consolidations loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking for a better interest rate?

- Stuck with the confusion of multiple repayment plans?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

How long does debt consolidation take?

The process of consolidation can take anywhere between a couple of days to weeks. The initial stage of taking out a new loan or credit card is usually quick as long as your credit score is good enough for approval.

What are the risks of debt consolidation?

The biggest risk of consolidating your debts is being unable to keep up with your new larger monthly repayments. You may get into unforeseen financial difficulty and fail to repay what you owe.

If this has happened to you, speak with the loan company directly and consider other debt management options.

Another risk is that you do not read the terms and conditions of any new loan you commit to, and the low interest is not worth it because of other potential fees and charges you didn’t properly understand.

How does debt consolidation affect credit scores?

When you use a consolidation loan correctly and effectively, it will not harm your score. In fact, it will remove the chances of missing further payments and, in hindsight, safeguard your credit history.

But be aware that applying for one of these loans, or any loan for that matter, will leave a search mark on your file.

Multiple marks left by irrational scattergun loan applications are bad and can cause credit score damage.

Recap – How does debt consolidation work?

Let’s recap! So, consolidating debt is an effective debt management strategy that moves multiple debts into one new debt. This can make it easier to plan for repayments and prevent the debt from increasing.

And it can make repayments cheaper if you manage to find a loan with a lower interest rate than the cumulative interest rates you are currently paying.