How Far Back Does Official Receiver Go?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you feeling uneasy about debt and thinking about a debt solution? You’re not alone. Each month, over 170,000 people visit our site seeking advice on handling debt.

In this easy-to-read article, we’ll explain:

- What an official receiver checks for when you’re considering a debt relief order (DRO)

- How far back an official receiver will look into your financial past

- The steps involved in the official receiver’s interview

- The possible outcomes after the interview

- The impact of a bankruptcy or DRO on your credit file

Our team is made up of people who have faced their own debt battles — we know what it feels like to be in your shoes. With our expertise, we’ll help you find out if a DRO or bankruptcy is the right choice for you.

What Does an Official Receiver Do?

When you opt for bankruptcy or a DRO, an official receiver will be assigned to your case. This is a civil servant who is an officer of the court that works within the Insolvency Service. It is their job to administer the starting steps of your bankruptcy or DRO.

The official receiver is responsible for assessing if you can afford to pay the debts you owe. They will take control over some of your property, inform your creditors of the bankruptcy and hold an investigation into your financial affairs and conduct leading up to the bankruptcy. Furthermore, the official receiver’s job is to advertise your bankruptcy.

The official receiver will go through the questionnaire you completed during the first stages of the interview. If you fail to complete the questionnaire before the interview, you must fill it out there. I recommend you take the time to complete the questionnaire to ensure all the information is correct. It will require finding paperwork and documents about your finances. This information will help the interview process go smoothly and prevent delays due to a lack of information.

The official receiver or an examiner who works with the official receiver will conduct the interview. They will ask you to detail information regarding your finances, your debts, and the circumstances that led to your bankruptcy or DRO.

This is the time to provide any paperwork or documents relating to your finances detailing transactions, assets and other requested financial information. You have the opportunity to ask questions during this time. Make a note of any questions that arise about your bankruptcy and the process. Don’t be afraid to ask anything.

A second interview might be necessary if you ask for more time or cannot provide the information you’ve been asked for.

How Long Does the Official Receiver Interview Take?

The length of the official receiver interview could be anywhere between 30 minutes and three hours. The length of the interview depends entirely on the complexity of the case. Prepare for the interview in advance to help the interview move at a good pace.

» TAKE ACTION NOW: Fill out the short debt form

What Happens After the Official Receiver Interview is Over?

Once the interview ends, the official receiver will check through all the information you provided. After checks are complete, they will create a report for the creditors detailing your debt and assets. You may be asked to attend a creditors meeting or a public examination depending on the reaction from the creditors after receiving the report.

You may be required to attend a public examination. These are requested if a minimum of half of your creditors request them. A public examination is where you’ll need to detail your financial situation under oath in an open court. Attendance is necessary as failing to attend can lead to an arrest, fine or custodial sentence.

After the interview, your assets and any money may be taken, sold and distributed to pay your debts.

Are there any other options?

Deciding how to tackle your debt is a very personal decision and you certainly can’t get the answer through a simple blog post.

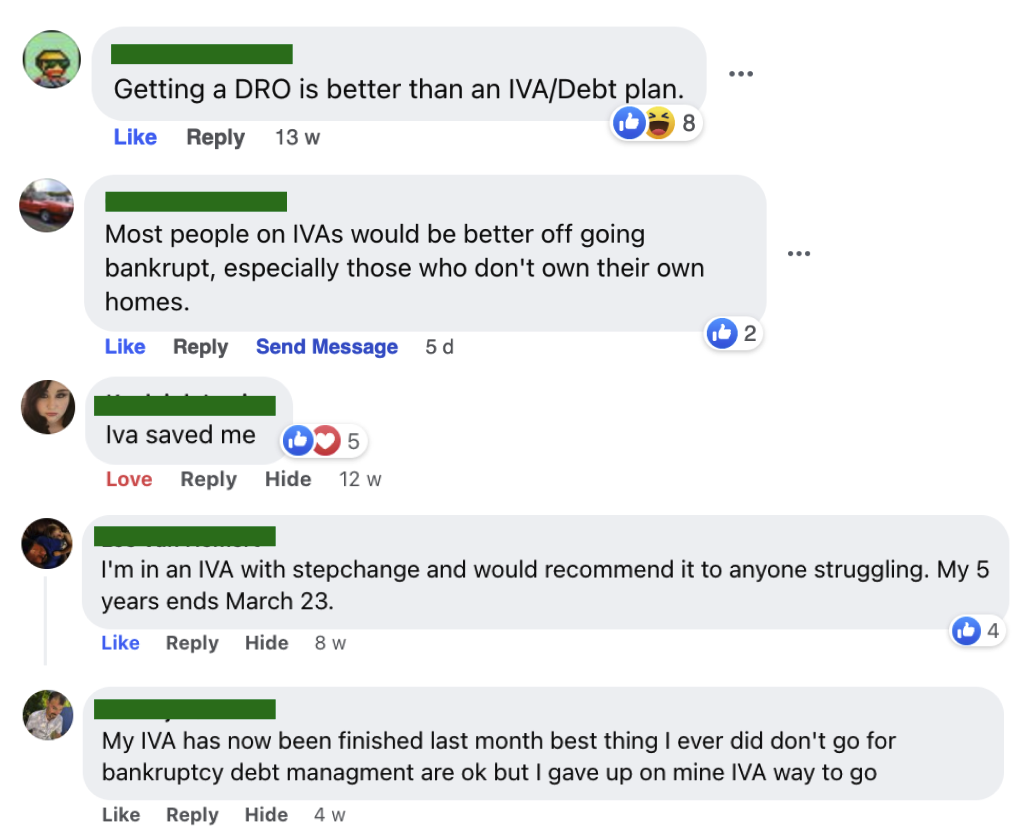

It’s made worse by the strong opinions you’ll often find online.

The best option is to get help from a debt expert to find out all your options and see which is right for you.

I’ve partnered with The Debt Advice Service and you can access their expert support by filling out the short form below.

Get help from The Debt Advice Service.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

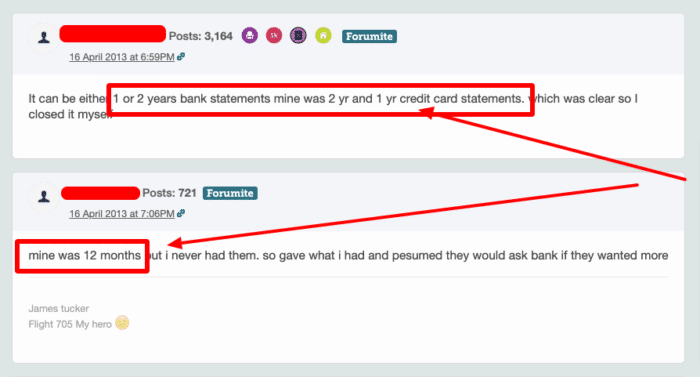

Will the Official Receiver Check Over My Bank Accounts?

The official receiver will not physically go and check your bank accounts. However, they will review your transactions and income and expenditure form to understand your finances fully, how you lost control of your debts and what happened leading up to the bankruptcy.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What Things Does an Official Receiver Check?

The purpose of the investigation carried out by the official receiver is to determine how you ended up going bankrupt. They check through the conduct leading up to the bankruptcy and your current income and spending.

An examination of your current income and expenses takes place. The examination aims to see what payments you can make towards your debts for the duration of the bankruptcy. In a DRO, the official receiver will evaluate your application and decide where it will be granted in the debt repayment plan.

How Far Back Does an Official Receiver Go?

The official receiver will investigate your financial situation up to five years before bankruptcy to see what has caused your financial hardship. These transactions include anything you sold or any assets you may have distributed. The asset investigation aims to see if you sold anything under its true value. The official receiver can reverse the sale of an undersold asset to bring the asset back into your estate and use it to pay off creditors.