How Long Will Debt Management Plan (DMP) Stay on Credit File?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

We understand that you may be worried about the impact of a Debt Management Plan (DMP) on your credit file and your future ability to get credit.

You’re not alone. Every month, over 170,000 people visit our website looking for guidance on debt solutions.

In this article, we’ll cover important questions including:

- How long a DMP stays on your credit file

- What a credit report is and what your credit score represents

- The effect of a DMP on your credit rating

- How to rebuild your credit score after a DMP

- If it’s possible to get a loan with a DMP

We’ve been in your shoes, so we understand your situation. We’re here to guide you through this with facts and clear advice.

Let’s start by taking a closer look at how long a DMP will stay on your credit file.

What is a Credit Report and What Does My Credit Score Represent?

Your credit report (or credit file) is a record of the financial dealings you have done in the past.

It has details regarding any debts you owe as well as what your payments have been like towards those debts.

If you happen to miss your debt repayments or pay them late, then this information gets recorded within your credit file as well.

Depending on how well you manage your finances and how punctual you are with your payments, your credit rating will either be high or low.

Your credit rating is basically an estimate of how responsible you are in your financial dealings.

Whenever you apply for credit, lenders will look up your credit file in order to get an estimate of the risk that you pose. Obviously, if your credit rating is high, you’ll have a higher chance of getting approved for credit. However, if it’s low, then you’ll have a much lower chance of getting approved.

Lenders aren’t the only ones that look up your credit file when trying to decide whether to approve you for credit or not. In fact, your credit report can come into play in many different areas of life.

For example, if you’re looking to rent a space, then your potential landlord might look up your credit file as well in order to get an estimate of how financially responsible.

Similarly, you may also be subject to a background credit check when applying for a mobile phone contract.

As you can probably imagine, having a poor credit rating can cause many difficulties for you in many different facets of your life.

» TAKE ACTION NOW: Fill out the short debt form

So, What Effect Does a DMP Have on My Credit Rating?

Most debt solutions including a DMP can have an immensely negative impact on your credit rating.

A DMP gets recorded within your credit file and it shows the fact that you’re paying less than the originally agreed amount since that’s how DMPs work.

Of course, if you’ve entered into any type of debt solution, lenders will perceive you as a high-risk candidate and thus, your chances of getting approved for any type of loan or credit will go down dramatically.

Thus, if you apply for credit while a DMP is present within your credit record, then lenders may instantly reject your application.

Even if you get approved for credit, you may be charged extremely high-interest rates and you also may not be able to get approved for as high a loan amount as you wanted.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Alternatives to a Debt Management Plan (DMP)

A debt management plan isn’t the only option you have when it comes to resolving your debts:

- IVA

- Debt Relief Order

- Bankruptcy

All of these debt solution alternatives come with different pros and cons, so make sure you know what you’re entering before agreeing to anything.

» TAKE ACTION NOW: Fill out the short debt form

How Long Will My DMP Stay on My Credit Report?

Since DMPs are an informal debt solution, they are not recorded as separate entries within your credit report but rather, they’re recorded as entries that you already had for the original debt.

Debts stay within your credit report for six years. If your debt payments last longer than six years, then the debt is removed from your file once it is paid off.

It’s important to note that while a DMP is not recorded as a separate entry, your creditors need to add a “DMP” marker alongside the debt entries that are a part of your DMP.

This will act to provide this information to anyone who is looking at your credit report and it will be clear to them that you’re making reduced payments to your debts as part of an agreed-upon plan.

Other factors might also appear on your credit report, such as late or missed payments. These could also stay on your credit report for six years. While it’s likely that a late or missed payment happened before your debt was settled, it’s worth keeping in mind that this could impact your credit score.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

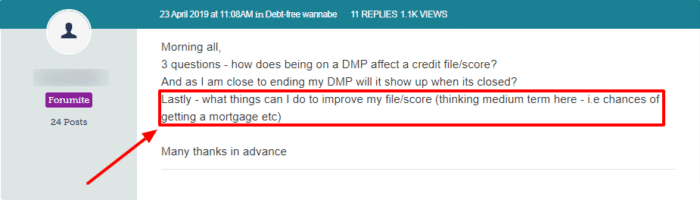

How can I rebuild my credit score after a DMP?

If you’ve decided to use a DMP then you might be wondering how you can rebuild your credit score once it’s over. I’ve come up with some easy ways to make a difference while your credit score returns to normal:

-

Register to vote. Being on the electoral roll means that when a credit check is performed against you that your details can be easily verified, and also helps show you have long-term stability.

-

Check your credit report. It’s probably the last thing you want to do right now, but checking your report could help you! Reference every mark on your report and verify it. If there’s something on there accidentally then you can ask to have it removed, which in turn will help your credit score.

This doesn’t just mean checking for bad marks on your report either – if there’s anything good missing then ask the Information Commissioner’s Office to change your report.

- Pay your bills on time. Easier said than done, I know. However, if you’ve budgeted properly for your DMP and stuck to your budget, this should be achievable. Remember if your circumstances change you will need to let your creditor(s) know.

These are some of the many ways you can improve your credit score. Keep in mind that there’s no quick solution to repair a damaged credit report. It will take time and patience to see your numbers rise as you get out of debt.