How Much Debt Do I Need to Enter into a Trust Deed?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you wondering how much debt you need to enter into a trust deed? You’re not alone! Every month, our website is visited by over 170,000 people who are looking for guidance on similar matters.

In this easy-to-understand guide, we’ll address the following questions:

- What is the minimum amount of debt required to enter a trust deed?

- How much debt do you need on average to enter a trust deed?

- What amount of income do you need for a trust deed?

- What type of debts can you include in your trust deed?

Our team has lots of experience dealing with trust deeds and debt. We know the stress it can cause, and we’re here to give you the facts you need in a simple way you can understand.

Let’s dive in!

What is the minimum amount of debt required to enter a trust deed?

How much debt do I need on average to enter a trust deed?

What amount of income do I need for a trust deed?

» TAKE ACTION NOW: Fill out the short debt form

Am I expected to disclose my entire income?

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can I include my Payment Protection Insurance in my trust deed?

What type of debts can I include in my trust deed?

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

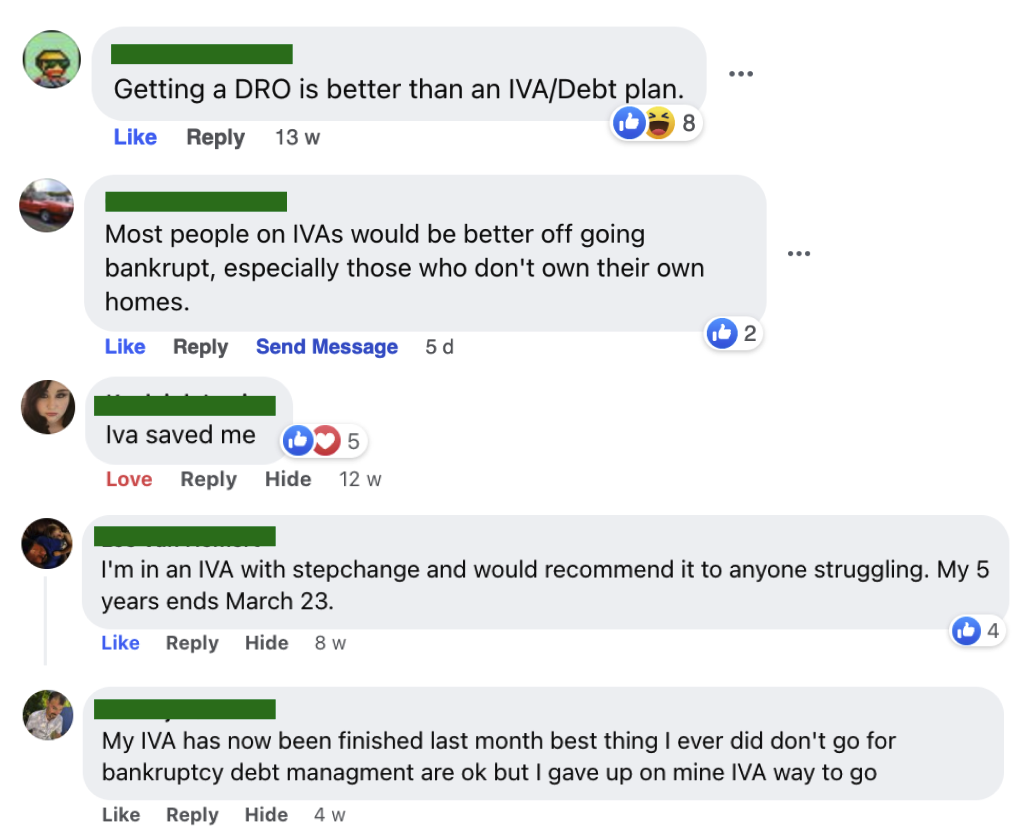

Are there any other options?

Deciding how to tackle your debt is a very personal decision and you certainly can’t get the answer through a simple blog post.

It’s made worse by the strong opinions you’ll often find online.

The best option is to get help from a debt expert to find out all your options and see which is right for you.

I’ve partnered with The Debt Advice Service and you can access their expert support by filling out the short form below.

Get help from The Debt Advice Service.