How to Stop Debt Collectors Coming to My House/ Home?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a letter from a debt collector and are unsure what to do? You’re at the right place. Each month, over 170,000 people visit our website to get advice on debt problems.

This article will give you clear and easy information on:

- Why a debt collector might visit your home

- What to do if a debt collector comes to your home

- How to stop debt collectors from visiting

- What to do if you don’t recognise the debt

- Where to get free advice if you’re struggling with debt

We understand that dealing with debt collectors can be scary and confusing. You might be wondering where the debt came from, if you should pay it, and if the debt collector is allowed to come to your home.

We’re here to help. We have lots of useful advice and examples to help you understand your rights and how to handle this.

What Should I Do if a Debt Collector Visits My Home?

The first thing you should keep in mind is not to panic. There are no debt collector visitation rights that they can rely on to force you to pay.

A debt collector is just any other citizen – they do not have any extra-legal powers or any other kind of authority over you. They are not allowed to come inside your home unless you invite them inside.

You don’t even have to open the door for them if you don’t want to. Only bailiffs can barge into your home without your permission, and even for that, they have to seek approval from the court first.

If a debt collector shows up at your doorstep and attempts to lie to you by telling you he doesn’t need your permission to get in, they would be in direct violation of guidelines authorised and regulated by the Financial Conduct Authority.

These guidelines are something that all debt collection agencies registered in England and Wales have to abide by in order to operate legally. If this happens, then tell them that you know your rights and know that they don’t have the authority to break into your home without your permission.

You can then make a complaint. I will go through this process below.

If you aren’t comfortable ignoring a debt collector on your doorstep, there are some measures that you can take to make sure that you are safe.

The very first thing you should ask when a debt collector comes knocking on your door is to ask to see their ID. All debt collectors are legally obligated to carry ID with them and show them to prove their identity when asked.

Then you should ask them which debt collection agency they are working for and make sure that it matches their ID.

You can also ask which debt they have come to inquire about. If you don’t recognize the debt they are talking about, then you have every right to end the conversation right there and go back inside your home.

Most debt collection companies do not recommend paying on the doorstep. Instead, pay online. This means that there is a good record of any payments that you have made. But if you go against this advice and pay in cash, make sure you get a receipt before they leave.

Always bear in mind that you are the one in control of this situation. If you don’t feel comfortable talking to the debt collector, you can simply ask them to leave. They are legally obligated to leave the property if you ask them to.

They are also not allowed to be abusive, aggressive or threaten you in any way. Afterwards, you can also call or write to the debt collection agency that you do not want anyone from their agency visiting you at your home ever again.

This should stop any house visits from them in the future. If a debt collector shows up at your door after you have specifically made a request to them to not do that, these are reasonable grounds for you to report them to the FCA.

As I mentioned earlier, home visits are typically quite uncommon. Coming to your home is time-consuming and also costs the debt collection agency money. This is why they typically prefer communicating with debtors through email or calls.

If a debt collector does show up at your door, it’s usually because you are missing payments or being late in paying them. If you’re struggling with paying your debts, it’s a good idea to seek debt advice from an independent charity such as Payplan or StepChange.

They will take your financial information and assess your situation to give you the best debt advice possible to help you get out of the situation you’re in. These independent charities also provide this debt advice free of charge.

» TAKE ACTION NOW: Fill out the short debt form

Why Would a Debt Collector Show Up at My Home?

If you owe money to someone, typically, they will contact you via post or phone. Even if your original creditor hires a debt collector, even he/she will typically only contact you via these two methods.

However, there do exist cases in which debt collectors will show up at your house. House visits are not part of the typical debt recovery process, but they do happen.

Typically, if a debt collector has shown up at your home, it’s not to have a run-of-the-mill discussion about your debts. Usually, a debt collector is sent to your house if you’ve missed a payment or several payments in a row. In that case, debt collectors come to ask you why that is and what your plan is regarding your debts moving forward.

Debt collectors may be working directly for your creditor or they may be working for a larger debt collection agency that your original creditor has hired.

Larger debt collection agencies have a high number of debt collectors at their disposal working all over the UK. These debt collectors are sometimes known as doorstep collectors or field agents.

From my experience, people are far too unaware of their rights in these situations.

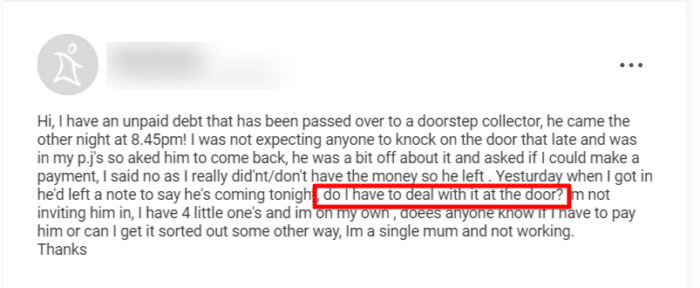

No, you never have to deal with debt collectors on your doorstep. You can ask that you are contacting via post or phone. Debt collection companies do have the right to contact you in some capacity, but that should never be in an intimidating or unreasonable way.

I’d say that knocking on the door that late in the evening is unreasonable!

What Do I Do About Debt Collector Home Visits for Debts I Don’t Recognise?

If debt collectors have been to your house for a debt that you don’t recognise, you should write to the debt collection agency they work for.

Your letter should include a request for proof that you are liable for the debt and a request that you are only contacted by post from now on. This sort of communication request is quite common and, from my experience, most debt collection companies are happy to oblige because writing to you is cheaper than sending someone knocking.

You are under no obligation to make a payment towards a debt that the company can’t prove you owe. You can use my free ‘prove it’ letter template to politely request evidence that you are liable.

Harassment During Home Visits

There is certain information you need to be aware of regarding what debt collectors are not allowed to do when they come knocking on your door.

Bear in mind that a debt collector is allowed to deal only with you. This means that if they visit your house and your roommate or spouse answers the door, they are not allowed to discuss the details of your debt with them.

All they are allowed to do is ask for you and whether they can speak to you. Divulging any sort of information regarding your debts to your housemates counts as harassment, and you can definitely report the person to the FCA or even sue them in court if you wish.

I’ve also heard accounts from debtors about debt collectors contacting their neighbours during house visits. These debt collectors will often show up at your neighbours’ doorstep before showing up at yours and divulge information regarding your debt in an attempt to embarrass you and get you to pay up. Again, this is in direct violation of FCA guidelines, and you would have every right to sue that person.

Tactics like these are malicious, ill-intended and, most importantly of all, illegal. The Financial Conduct Authority put these regulations into place to protect you, the debtor. However, if you’re not aware of your rights and are unable to identify when you’re being wronged, you will not be able to protect yourself from such practices.

Thus, it’s essential that you educate and acquaint yourself with your rights if you are in debt. It will help you navigate yourself to financial freedom with a minimal amount of stress and trauma.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How Do I Make a Complaint?

Reporting debt collector misconduct is, fortunately, a fairly straightforward process.

If you think that a debt collector has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Make your first complaint to the debt collection agency so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, the debt collection agency may be fined. You could even be owed compensation.

What Should I Do Next?

That entirely depends on why the debt collector was here in the first place.

If the person was here regarding a debt you don’t recognize and isn’t yours, I recommend writing to the company and explaining the situation. If they don’t leave you alone, you can follow the complaints procedure I have outlined above.

If it was regarding debt to which you’ve been making payments to the best of your abilities, considering what you can afford, you might need to consider your financial options. This could mean negotiating another payment plan with the debt collection agency or opting for a more formal debt solution.

If it was regarding a debt to which you’ve been missing payments or are being late with your payments, you may wish to consider a debt solution or seek legal advice. This is because a County Court Judgement (CCJ) might be around the corner. I have linked several charities that provide these services for free at the end of this page.

Whatever your situation, I recommend contacting a debt charity if you are unsure of your next steps. Their advisors will be able to walk you through all of your rights in detail and provide you with debt counselling services.

Can I Get a Debt Solution?

If you are struggling to repay your unsecured debts, you might benefit from a debt solution.

There are several different debt solution options available, depending on your financial circumstances, so I recommend speaking to a debt charity for some free advice. Their advisors will be able to walk you through your options and find the best solution for you. I have linked some of these organisations at the bottom of this page.

One of the major benefits of these debt solutions is that your creditors or debt collection companies are forbidden from contacting you for any of your debt solution-approved debts. This will put an immediate end to debt collectors on your doorstep.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.

If you have little income and no valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.