iQor Debt Collection – Should You Really Have To Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a letter from iQor Debt Collection and you’re not sure what to do next? Don’t worry; you’re in the right place. With over 170,000 people visiting our website each month for advice on situations just like yours, you’re not alone.

In this piece, we will guide you through:

- Understanding who iQor Debt Collectors are.

- Checking if the money they say you owe is really yours.

- Learning how to deal with debt and stand up to iQor Debt Collectors.

- Exploring options to write off some iQor debt.

- Learning about the legal requirements of iQor Debt Collectors.

We know how confusing and scary it can be to get a letter from a debt collector, as some of our team members have been in the same boat. It’s important to remember that not everyone has to pay iQor Debt Collection; however, you shouldn’t ignore them because they might take more action.

We’re here to help you understand your options and guide you through this process. Let’s get started on understanding iQor Debt Collection.

Why do iQor Debt Collectors keep calling you?

If this is the first time you’ve had any dealings with debt collectors, you are probably a little confused by them. They are chasing you about debt, but how can this be if you don’t even know who they are? iQor Debt Collectors are contacting you, not because you owe them money directly, but because you have debt with another company, and the debt has been sold to them.

There are over 600 debt collection agencies in the UK, and they all pretty much have a standard way of working. When a company (the original creditor you have the debt with) gets fed up trying to chase you about the debt, they will usually turn to debt collectors to help out. The debt collectors will buy the debt from the creditor, and then begin the process of chasing you for the debt. It works for both parties, as the creditor gets rid of the day and makes a bit of money, and the debt collector gets the opportunity to make a whole lot more! Debt collectors tend to be much more persistent about getting the debt than the original company you have the debt with. This is simply because it’s all they do, and they have the resources that other organisations don’t have for credit control.

» TAKE ACTION NOW: Fill out the short debt form

Check if you really owe the money

Is the debt money you really owe? The first thing to establish is where the debt has originated and how much you really owe. It is quite likely that the original debt, if there was one, has been inflated by various charges and interest, and could be substantially more than you believe you owe.

You should write to iQor Debt Collectors and demand a copy of your original credit agreement. If they are unable to provide this you have no obligation to make any payment to them.

How to deal with debt

If you have established that everything is accurate, and you owe the money, your aim should be paying it in its entirety, as soon as possible. If you have no means of doing this, speak to iQor Debt Collectors and ask them to devise a suitable repayment plan for you. They may ask you to provide details of your income and expenditure in order to do this.

Getting out of debt

Debt problems are extremely difficult and can cause problems in every aspect of your life. No one wants to deal with debt issues, and if you are facing these problems, you should never do it alone. If you let your debt problems fester, without doing anything about them, the problem will worsen. There are many organisations out there who can help you deal with your debt problems, including:

- Citizens Advice Bureau (CAB) – an organisation that provides free help with getting out of debt. They are also able to assist with a range of other day to day issues you may be dealing with.

- Christians Against Poverty (CAP) – if you need help with your debt problems, this organisation can offer assistance in getting out of debt.

- StepChange provides free online debt advice and helps people take back control of their own finances.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Formal debt repayment

You have options for repaying your debt in a way that works for your situation. You can even write off some of your debt if you sign up to an Individual Voluntary Arrangement (IVA). With this arrangement, you can basically combine all your debt into one payment, and it saves you the hassle of dealing with multiple companies and debt collectors. After a set period, you may even be able to write off a chunk of the debt.

This isn’t the only option though. You can also come to alternative debt arrangement, including a consolidation loan that involves taking out one loan, to pay back the debt you have. It means you are only making one payment and the debt is cleared when all has been paid.

Staying On Top Of Your Debts

One of the hardest parts about being in debt is that the industry isn’t at all transparent.

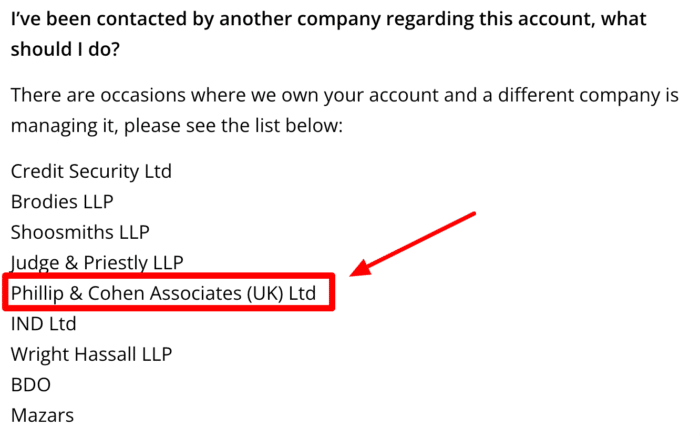

One common tactic used by Debt Collectors is contacting you under multiple names and addresses.

Sometimes, it’s for practical reasons, but even then it can be confusing and intimidating. So it’s important to try to keep a level head and research what’s going on.

Some of the biggest debt collectors in the UK operate under multiple names.

- Robinson Way will sometimes contact you under the name Hoist Finance.

- Cabot Financial Group recently bought Wescot Credit Services

- Credit Style communicate as both Credit Style and CST Law.

- Lowell Financial also owns Overdales and collects debts under both names.

In fact, in the case of PRA Group, they’ve been known to use multiple company names. As you can see in the image below.

If you’ve been contacted by a debt collector recently, it’s worth going through your post and emails to check that you haven’t missed anything, just in case they’ve started writing to you under a different name.

iQor Debt Collectors – the legal requirements

The Office for Fair Trading (OFT, 2012) put guidelines in place for debt collection agencies like iQor Debt Collectors to offer greater protection for borrowers. These regulations include:

- A responsibility to be fair to borrowers, and refrain from using any practices which could be deemed as aggressive or deceitful.

- Ensuring that all information provided to the borrower is clear, concise and does not cause confusion.

- Consideration of the debtors circumstances, and the fact that they may have financial troubles

- A responsibility to take each debtors circumstances on an individual basis, and act proportionately to these.

If iQor Debt Collectors have failed to follow any of these regulations, you would have the right to report them to the OFT. The OFT will then look into the case on your behalf, and take necessary action. When debt companies have a number of complaints from debtors to the OFT, they can end up with the license being removed.

You may be in debt, but this does not give iQor Debt Collectors or any other debt collection company the right to treat you without respect or to try and force you into making payments you clearly can’t afford. You should never stand for this behaviour.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

iQor Debt Collection Contact Details

| Phone number: | 0177 283 6078 |

| Website: | https://www.iqor.com/ |

| Address: | Iqor House 33-34 Winckley Square, Preston |

Last Thoughts

In summary of the content discussed in this article, we know how difficult it can be to deal with debt collectors such as iQor Debt Collectors. Debtors already worry and feel understandably stressed about their debt issues, and if a debt collector starts abusing or bullying them, it just adds fuel to the fire. If you are worried about your debt, you should definitely contact one of the organisations we have mentioned previously. You should never ignore debt collectors or refuse to pay them, but you should speak to them and reach an agreement both parties are happy with. You can complain and stop the behaviour of debt collectors by reporting them to the Financial Ombudsman. It is important to do this for yourself, and it might also save someone else from feeling the way you do. They could lose their licence if is deemed appropriate.