Car Leasing With IVA – Is It Possible?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you asking, “Can I lease a car with an IVA?” Well, you’re at the right spot to find your answers. This guide will help you understand:

- How car leasing companies view people with an IVA.

- Getting assistance from specialist car leasing firms.

Many people share your worries about leasing a car under an Individual Voluntary Agreement (IVA). Over 170,000 people visit our website to get guidance on debt solutions each month.

Our team understands your concerns fully, and we know what you’re going through. We’re here to offer support and clear, easy-to-understand advice.

Let’s dive in.

Is It Possible to Lease A Car with an IVA?

By now, you should have worked out that the answer is maybe. Whether you can successfully lease a car while you have an IVA in place will depend on many factors. We have listed a few below.

- How long the IVA has been in effect.

- How much you have paid back against your debt.

- Whether car finance is/was part of the original debt covered by the IVA.

- Whether you are willing to pay over-the-top interest rates to a specialist lender.

- Other financial factors, such as changes in your income level since the IVA was put into place.

Of course, your own scenario will be based on potentially several factors such as these. Best advice here might be to reach out to a few car leasing firms and explain your situation, and what you are looking for. Even if they can’t help you, they will give you some good advice, and it won’t cost you a thing. Well apart from a little of your time, of course.

How do Car Leasing Firms Look at People with an IVA?

We need to look at two possible scenarios here. Whether you either a) already have a car on a lease agreement, or b) are looking to lease a car. An IVA can have an impact on both of these situations. As explained below.

- If you already have a car lease in place – if the car finance debt (the lease) was part of the problem that has caused you to take on an IVA, then you may have a problem. The leasing firm may want you to return the car. Alternatively, they may offer you a less expensive car in exchange.

- If you are looking for a new lease – whether you can get car finance if you have an IVA in place will depend on several factors. Such as the age of the IVA, how much you have already paid back, whether you have missed any repayment, etc.

» TAKE ACTION NOW: Fill out the short debt form

How About People Who Have Cleared Off An IVA?

The situation is a little simple here. If you have already cleared down your IVA, there will still be some impact on your credit score for several years. However, having paid back your debt in full is a positive indicator for many finance firms.

An IVA that has been repaid says a lot about you. It tells car finance firms that you are a responsible person, who takes debt seriously. It also shows that you are committed to making regular monthly repayments. Therefore, contrary to what your common sense might be telling you, having a resolved IVA on your credit record is not necessarily a bad thing.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can Specialist Car Leasing Firms Help Me?

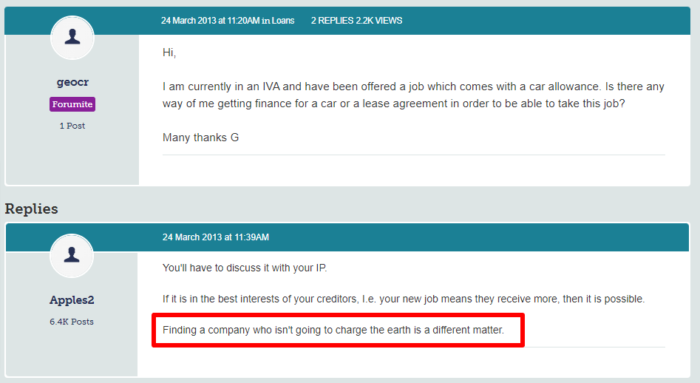

As with any financial product, there are always specialist lenders that operate in the subprime market. An IVA is set up by a firm that specialises in this kind of debt relief. Serving people who have a less than stellar credit score. Could such a lender help you lease a car if you have an IVA?

The answer here is likely yes, but with a very serious caveat. Lenders that target the subprime market are generally going to cost you more in interest and fees. This is because they are facing more risk. That being said, some specialist lenders exploit this fact, knowing that people have no other choice but to pay over-the-top interest rates. If you really want to lease a car with an IVA, a specialist lender might be able to help you, but be aware the car lease is almost certainly going to cost you more.