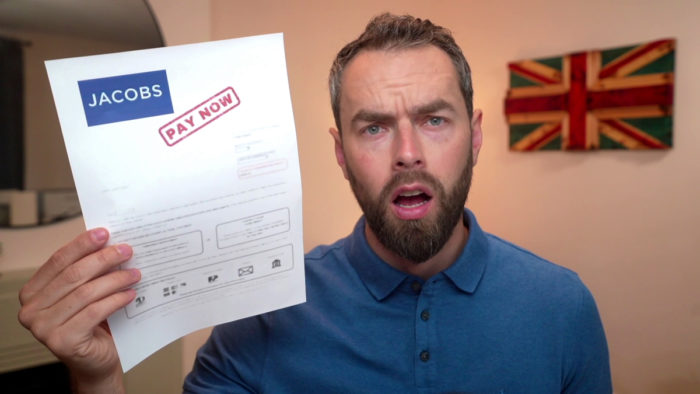

Jacobs Bailiffs Broken Arrangement – What You Should Do

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about a broken arrangement with Jacobs Bailiffs? Don’t fret. We’re here to help guide you through what to do next. Every month, over 170,000 people visit our website for advice on debt issues, and Citizens Advice estimate households have around £18.9 billion in unpaid bills like council tax and utilities1, so you’re not alone.

In this simple guide, we will explore:

- Who Jacobs Bailiffs are and how they operate.

- What steps to take if you can’t pay Jacobs.

- The ins and outs of Jacobs Bailiffs payment plans.

- Understanding debt management.

- How to negotiate with bailiffs effectively.

We understand the stress of dealing with bailiffs and the fear of losing your belongings. Our advice is backed by years of experience, and we’re here to offer you comfort and guidance.

We’ve heard from many people that Jacobs won’t accept their payment plan. It can feel hopeless, but there are options to explore. By the end of this guide, you will have a clearer understanding of your situation and how to handle it.

Remember, we’re here to help. Take a breath, and let’s delve into the world of Jacobs Bailiffs together.

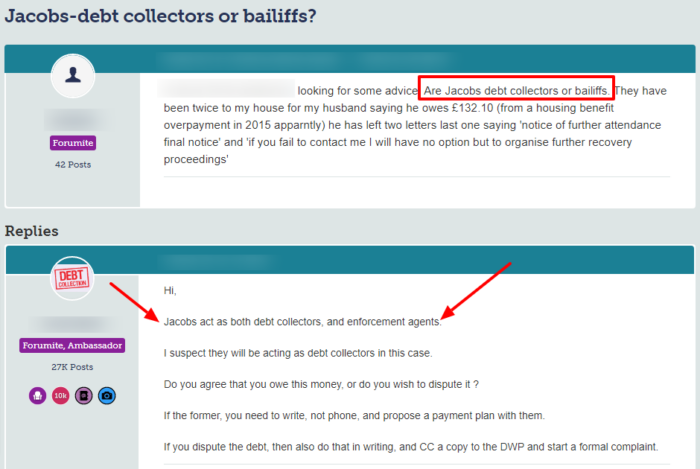

Are Jacobs High Court bailiffs?

The Jacobs Bailiffs website doesn’t suggest that they work for the High Court. Plus, they are not registered on the High Court Enforcement Officers Association website.

But they do work hand-in-hand with Wilson & Roe, the specialist High Court Enforcement Officers.

Check out this message and response posted on a popular online form.

Source: Moneysavingexpert

What happens if I don’t pay Jacobs?

Jacobs Bailiffs will first contact you by sending a letter called a Notice of Enforcement. This letter gives you with seven days to pay in full or get in touch with them to discuss a payment plan.

Our financial expert, Janine Marsh, advises: ‘If a bailiff has proven you owe money and you don’t have cash to hand, you’re within your rights to suggest a payment plan. It’s not a guarantee, but many will accept this as it’s easier than repossession.

If you don’t pay within the seven days, they will notify you of an intended visit to discuss the debt and collect a payment. This is known as a Notice of Enforcement.

Sending the Notice of Enforcement letter adds £75 to your debt. And if they have to come out to your home, you’ll pay a minimum of a further £235 per visit.

It’s best not to ignore these letters, as explained by the second reviewer in the section above.

Eventually, Jacobs Bailiffs could come to your home and take your possessions. But you could still clear the debt before they are sold at auction provided you offer to pay or set up a payment plan.

If you don’t pay, your possessions are sold at an auction to pay off the debt. Plus, there will be more fees for storing and selling your goods.

» TAKE ACTION NOW: Fill out the short debt form

Jacobs Bailiffs payment plans

Many debtors are sent Notice of Enforcement letters and cannot pay the full amount. Maybe because the amount is significant or because they’re already experiencing financial hardship.

If this sounds like your situation Jacobs Bailiffs should be willing to discuss a payment plan proposal.

Get in touch with Jacobs Bailiffs to discuss any debt repayment plans you have within the seven days to avoid being stung for further bailiff charges.

CTA Selection *

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Do bailiffs have to accept a payment plan?

Bailiffs don’t have to accept your payment plan proposal if they deem it unreasonable.

When you agree a payment plan with Jacobs Enforcement, they’ll likely ask you to sign a Controlled Goods Agreement.

A Controlled Goods Agreement is an agreement that allows bailiffs to repossess certain items if you don’t keep to the payment plan.

For example, if you stop paying, the bailiffs may have the right to take and sell your car or other assets.

Jacobs Bailiffs broken arrangement – what to do?

If you have missed a payment to Jacobs Bailiffs, it’s important to get in touch with them straight away. You should explain why you have missed the payment.

They may renegotiate your payment plan to avoid any further action but this is not guaranteed.

Jacobs Bailiffs aren’t obligated to accept a lower payment plan, and they could instead try to repossess your assets and sell them to clear the debt.

This would mean coming to your property and adding more charges to the total owed.

If you have signed a Controlled Goods Agreement, the bailiffs have the right to come to your home and take the goods listed in the agreement. However, the FCA state that a bailiff must not misrepresent their authority or legal position, and cannot suggest that an action may be taken where it legally can’t2, so be wary.

Tips for negotiating with bailiffs

I’ve included some tips on negotiating with bailiffs so the experience when you get an Enforcement Notice is, hopefully, less stressful.

Send Jacobs Bailiffs a short letter with your budget sheet, explaining the reasons why you can’t pay what’s owed in full. Dealing with bailiffs means keeping in touch with them.

Ask if you can pay either in weekly or monthly instalments.

Also, I suggest you send this information to your creditors. It may help get an offer accepted sooner as you’ve already asked Jacobs Bailiffs to collect what’s owed.

Send all letters by recorded delivery so you have proof of the correspondence. You may need these for later.

You could opt to send everything by email.

If Jacobs Bailiffs accept your payment offer, make sure you get it in writing. Also, make certain both you and the bailiffs sign the agreement.

Don’t accept a verbal acceptance from Jacobs Bailiffs.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can Jacobs bailiffs force entry?

Jacobs Bailiffs cannot force entry into your home unless they’re recovering assets listed within a Controlled Goods Agreement after you stopped paying.

They must follow Bailiffs Rights and Regulations in the UK and if they don’t, you could lodge a complaint.

In all situations except enforcing a Controlled Goods Agreement, they can only enter unlocked and open doors. They cannot climb through windows.

When they’re collecting goods listed within a Controlled Goods Agreement, they are allowed to force entry if you don’t grant them permission to enter.

But they must use a locksmith and the cost is passed on to you.

What items can Jacobs Bailiffs take?

It’s important to know your rights and what Jacobs Bailiffs can legally take and what they can’t seize.

For example. Bailiffs (enforcement agents) can take items you own or that you own jointly with another person. This includes electrical goods, jewellery, and vehicles.

That said, bailiffs can only seize items found inside your home but only if you let them in.

What items can’t bailiffs take?

Items they cannot take include:

- Goods that belong to someone else which includes children

- Guide dogs or pets

- Things you need to carry out your job, or for studying to the total value of £1,350

- Motability vehicles or vehicles with a valid Blue Badge

- Anything that’s permanently fixed or fitted to your home

- Bailiffs should not take anything if removing it causes a lot of damage

Jacobs Bailiffs can seize items you need to live which are referred to as ‘basic domestic needs’.

This includes:

- Table and chairs for everyone who lives in a home

- Beds and bedding for all the people who live in your home

- Cooker, microwave and fridge

- Washing machine

- Phone or mobile phone

- Medical equipment or medicine and anything needed for the care of a child or elderly person

Know Your Rights

Knowing your rights is key to protecting yourself against abuse of authority and bad debt collection practices. To better understand your rights and those of bailiffs, please check out the table below.

| Bailiffs Can | But They Can’t |

|---|---|

| Call and visit your home multiple times, any day of the week. | Visit your workplace (if you are not self-employed) |

| Take items from your home. These items have to be considered ‘luxury’. | Take essential items from your home. This includes beds, clothing, and work equipment. |

| Use ANPR technology and DVLA information to locate your car and take it. | Enter your home without permission unless they have a warrant to force entry for a CCJ. |

| Peacefully enter your property. | Harass or threaten you. |

| Issue notices to those who owe a debt. | Take items that belong to someone else. However, they may be able to seize jointly owned property. |

| Offer to conduct a Virtual Controlled Goods Agreement (rather than in-person). This will typically be offered to vulnerable people. | Sell goods they have seized at auction until seven clear days have passed. |

Jacobs Bailiffs reviews

There is a mixture of positive and negative experiences regarding Jacobs Bailiffs posted online.

Some people are frustrated with their payment plan offers, while others found them polite and respectful:

“Absolute shambles! They shouldn’t be allowed to collect debts for anyone!

I rang and was advised I had to pay £50 a month. I explained I couldn’t afford this but they wouldn’t budge. I asked to speak to a manager. She hung up. I Rang back and asked for a callback. Didn’t get one. Next thing a get a letter requesting £408 or they will come and take my possessions.”

- Rachel O (Google review)

“I’ve had a positive experience with Jacobs. I had a visit from them due to an old council text bill. I was honest that l got the letter, and l had ignored it, thinking it was nothing serious due to it being a small amount. He was pleasant and polite, paid my bill on the spot, and he left. Lesson learned to deal with letters of importance with urgency, then l wouldn’t have to pay extra charges.”

- Miss M (Google review)

Jacobs Bailiffs Contact Details

| Website: | https://www.jacobsenforcement.com/ |

| Phone number: | 0345 601 2692 |

| Operating hours: | Monday to Thursday 8am – 8pm Friday 8am – 7.30pm Saturday 8am – 5pm Sunday 8am – 1pm |

| Jacobs enforcement payment options: | https://www.jacobsenforcement.com/pay-now/ |

| Office address: | 6 Europa Boulevard Birkenhead, Merseyside, CH41 4PE |